Leading cryptocurrency Bitcoin (BTC) has continued to decline in recent days, and has started the week in which critical US data will be announced with a decline.

BTC fell to the $80,000 level in the morning hours, but then recovered to $82,000.

As Bitcoin continues to exhibit volatile movements and investors try to predict which direction BTC will move, the latest data from cryptocurrency tracking platform Coinglass has arrived.

Bitcoin’s price action is set to trigger major liquidation events on mainstream cryptocurrency exchanges (CEX), according to the latest data from Coinglass.

“At this point, if the Bitcoin price drops below $80,000, $648 million worth of long positions will be liquidated.

In contrast, $970 million worth of BTC short positions on CEXs will be liquidated if Bitcoin rises above $84,000.”

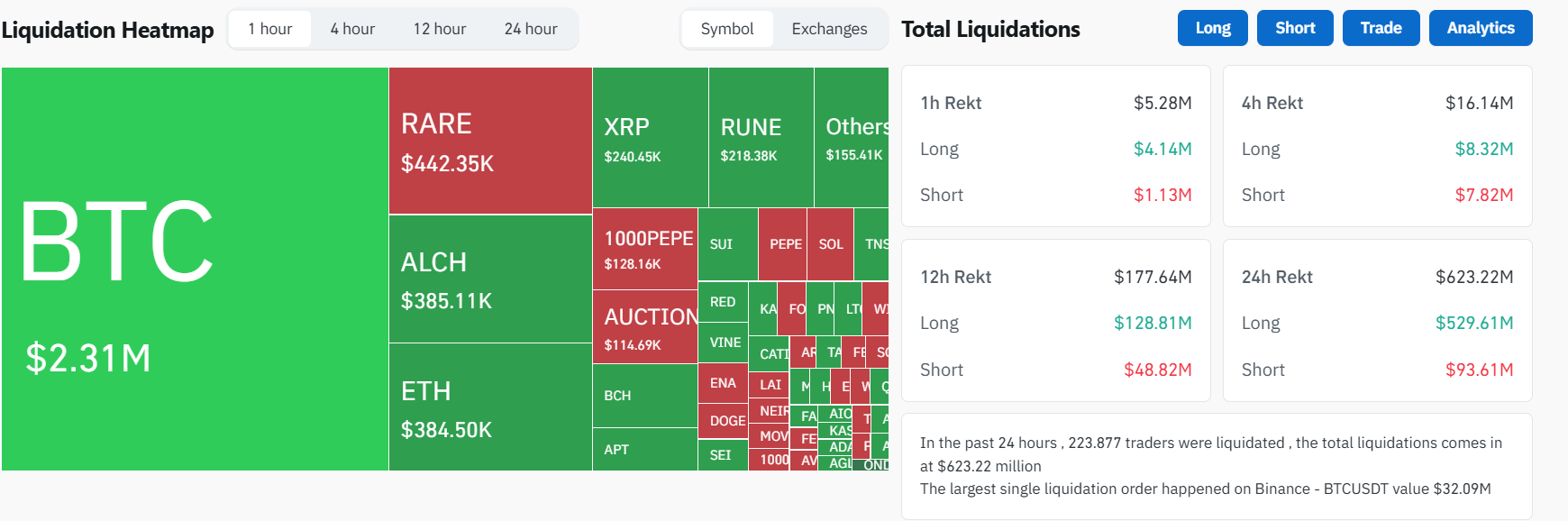

According to current data, in the last 24 hours, $623 million worth of leveraged transactions were liquid, while $529.5 million worth of long positions and $93.4 million worth of short positions were liquid.

Again, while 223,778 traders were liquidated in the last 24 hours, the largest liquidation occurred in a BTC/USD transaction on Binance.

*This is not investment advice.

Source: https://en.bitcoinsistemi.com/bitcoin-btc-investors-attention-these-two-levels-are-very-critical-there-is-a-risk-of-1-6-billion/