- Bitcoin experienced a notable surge at press time compared to previous day’s close.

- Are traders capitalizing on the recent pullback or awaiting a further price drop?

Bitcoin [BTC] surged notably in the past 24 hours, yet a full price correction remains elusive as it continues to trade below the critical $60K mark.

In addition, tracking stablecoin movements is a crucial barometer for gauging overall investor sentiment toward BTC.

With this in mind, AMBCrypto analyzed a recent post by CryptoQuant, which indicated a decline in stablecoin influx.

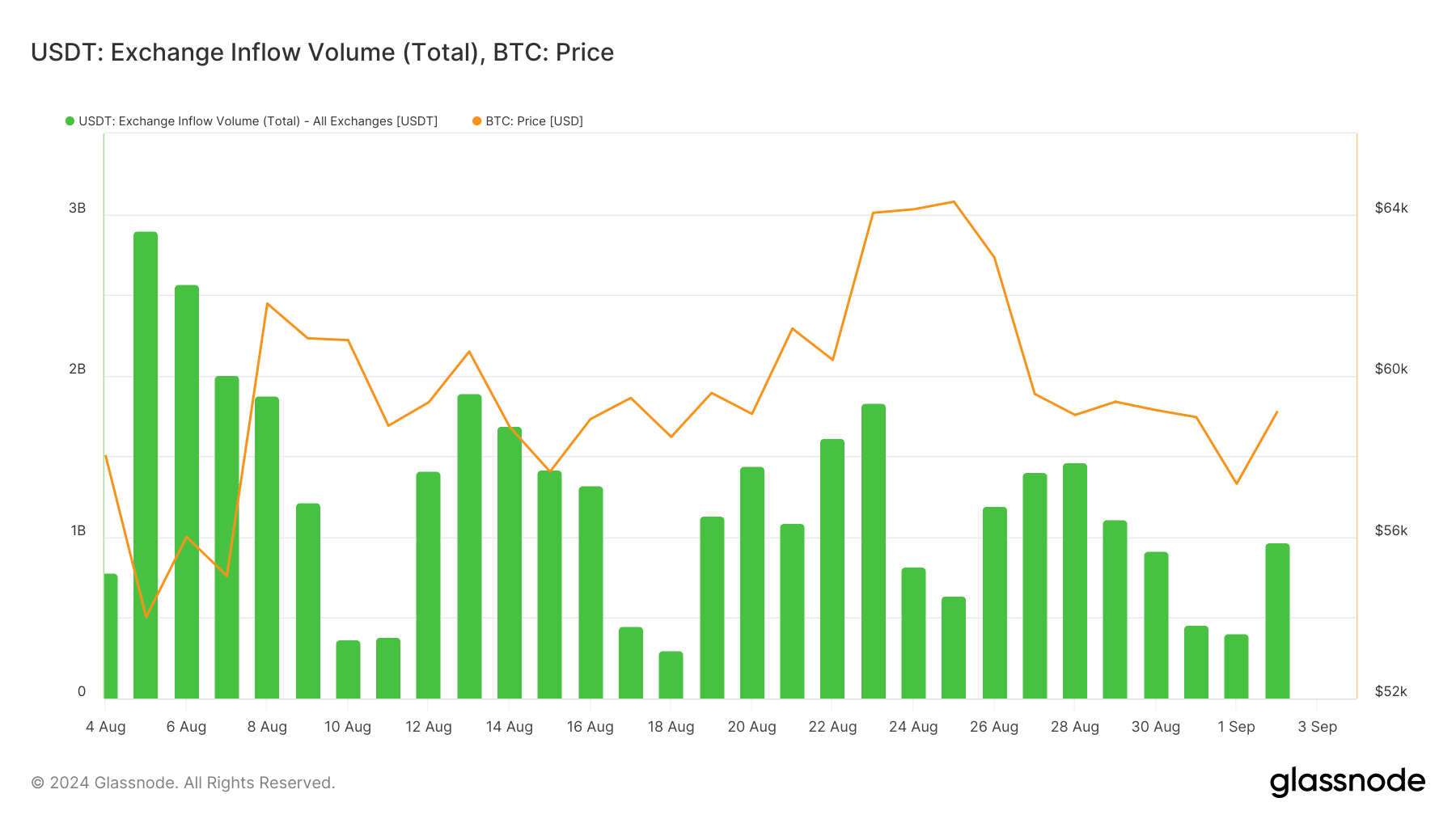

USDT influx in contrast with BTC’s muted rise

It is no surprise, USDT holds a 70% dominance in the stablecoin market. Consequently, AMBCrypto analyzed recent investor behavior regarding this token.

Source : Glassnode

On the daily price chart, Bitcoin started September on a bearish note, falling about 3% to $57,300 from the previous day. However, a significant upward swing the following day brought Bitcoin close to the $60K threshold.

Surprisingly, the upward swing coincided with USDT inflows doubling from $402 million to $970 million.

According to AMBCrypto’s analysis, this indicated renewed optimism among stakeholders, as evidenced by the rise in USDT deposits into exchanges.

Moreover, this influx may have driven the recent upward swing, prompting day traders to buy the dip.

Typically seen as a bullish signal, this revelation contrasts sharply with the post mentioned earlier.

Consequently, AMBCrypto dug deeper, noting that Bitcoin, despite the USDT surge, remained just 0.21% above the previous close of $59,129 at press time.

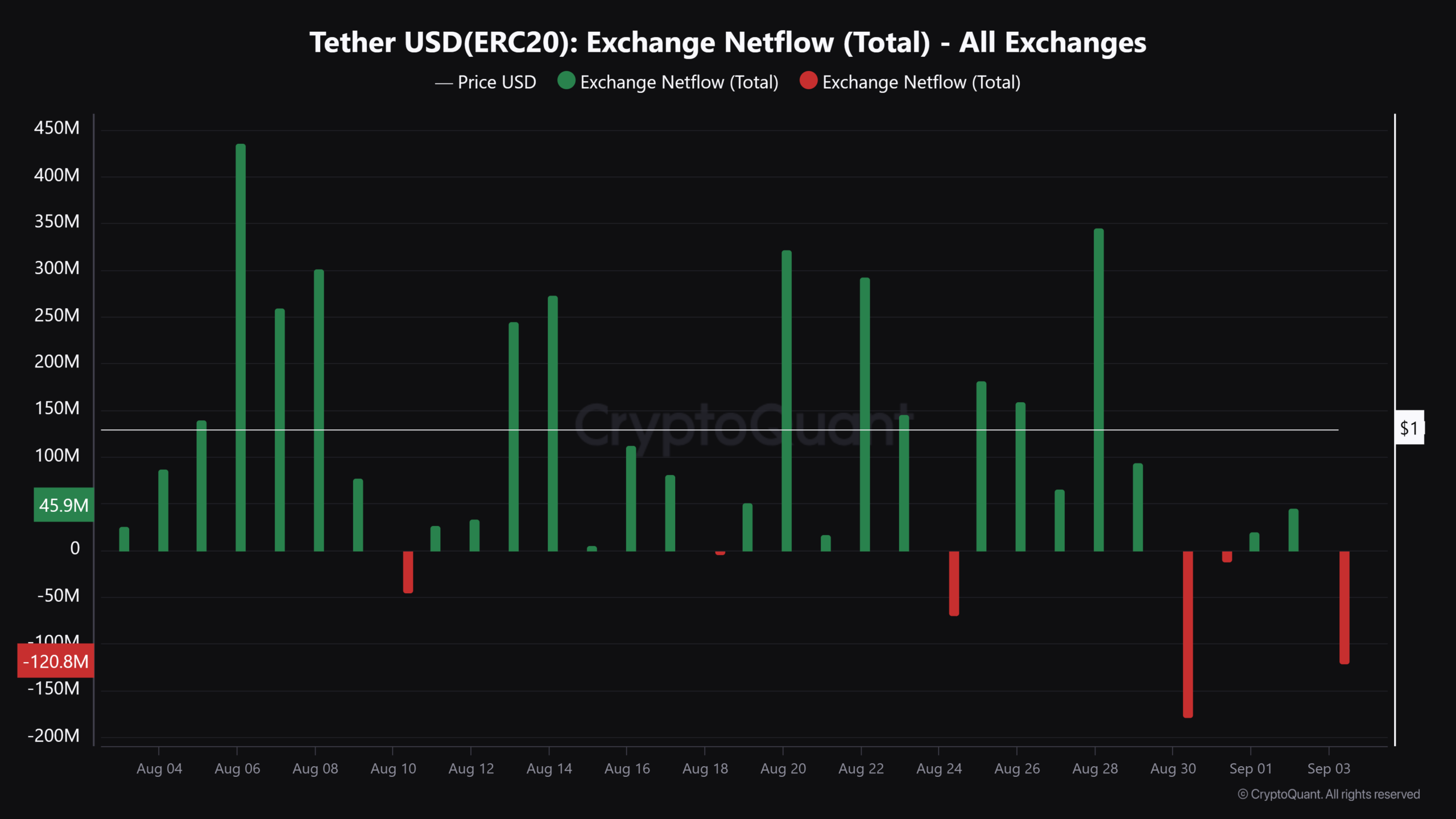

Market caution evident in net flows

Examining net flows will offer better insight. Currently, USDT net flow is negative at $120.8 million, with the trading day still unfolding.

Certainly, this significant net outflow suggested growing caution among stakeholders.

Source : CryptoQuant

According to AMBCrypto’ analysis of the chart above, four days ago, a substantial $180 million outflow of Tether from exchanges occurred.

Following this, Bitcoin experienced a sharp bearish downturn, with its price closing at $57,700 – the day’ lowest.

These negative flows don’t necessarily signal outright selling pressure on Bitcoin but do indicate caution among traders, who might be using USDT to lock in profits or waiting for a dip to buy – So, which one is it?

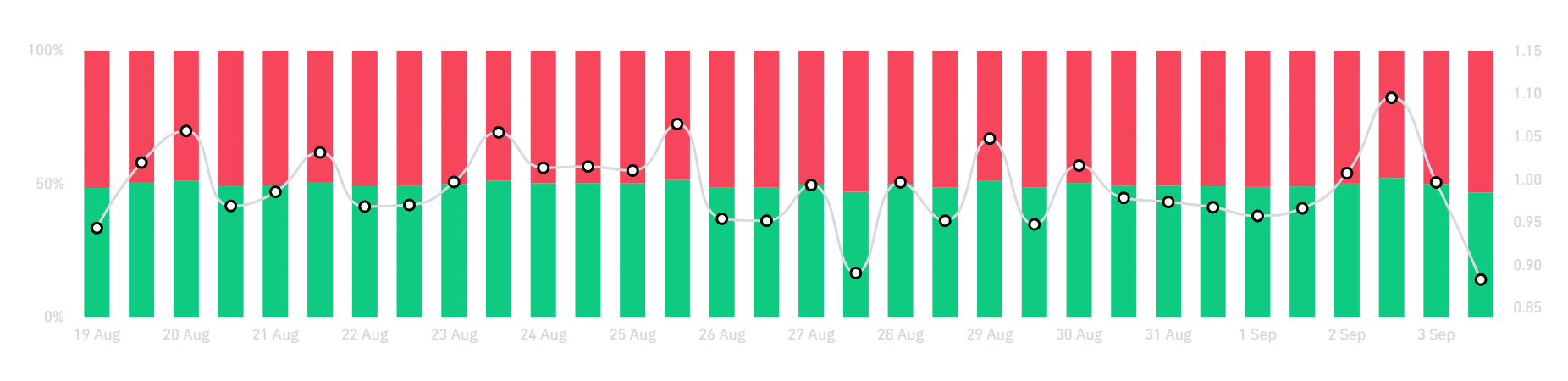

Traders brace for a deeper drop amid rising BTC caution

AMBCrypto analyzed the chart below to determine if traders are primarily positioning for a potential decline or holding out for more profit.

Source : Coinglass

On the 12-hour chart, a sharp plunge shows 46% long versus 54% short positions.

Simply put, the dominance of short positions indicates traders are awaiting a deeper price drop before considering new longs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Interestingly, if the bulls failed to intervene, Bitcoin might retrace back to its earlier support, somewhere around $57K, before expecting a price correction.

However, if the market turns out to be more resilient or if there is unexpected bullish news, this could lead to short squeezes, where short sellers are forced to buy back their positions, potentially driving Bitcoin past the $60K ceiling.

Source: https://ambcrypto.com/bitcoin-below-60k-checking-usdts-role-in-btcs-next-move/