- Bitcoin tested a critical $84,640 level, with potential for a new all-time high or deeper correction.

- A breakdown could lead to a correction to $64,700 or $60K, but also precede a major rebound.

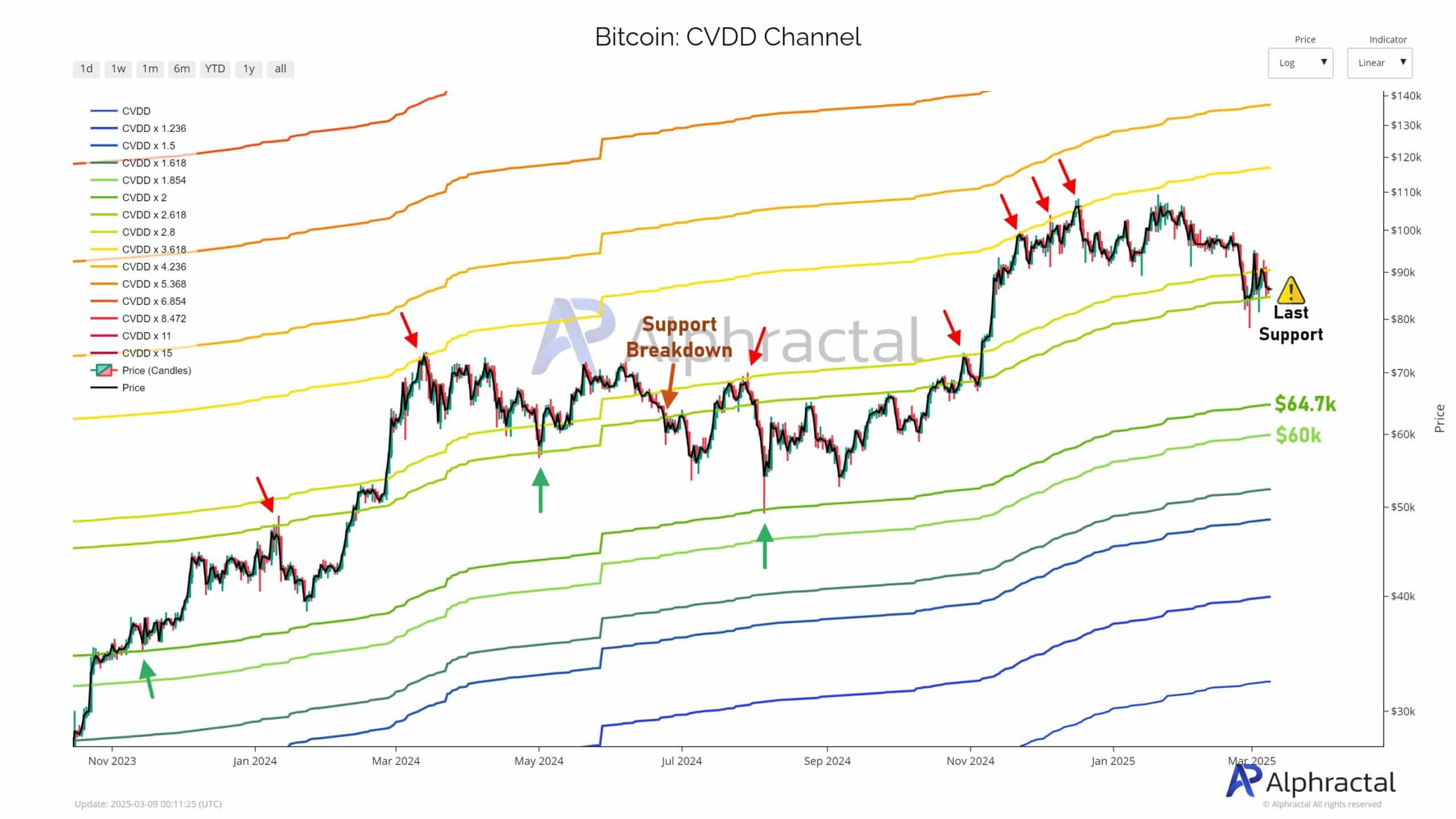

Bitcoin [BTC] is currently sitting on a razor’s edge. According to the CVDD channel — a historically reliable on-chain indicator — the $84,640 level is a make-or-break zone.

If Bitcoin consolidates above this line, a new all-time high could be in sight. But if it falters, a steeper correction toward $64,700 or even $60K may follow.

Despite the looming risks, past breakdowns have often led to major rallies.

The significance of the CVDD channel

The CVDD (Cumulative Value Days Destroyed) Channel tracks long-term investor behavior by measuring the value of coins moved relative to their age. It’s one of the most accurate tools for identifying cycle bottoms.

By layering Fibonacci multiples of the CVDD, this channel creates dynamic support and resistance bands that Bitcoin has historically respected.

These lines offer a forward-looking framework to identify structural shifts in price, with each breakdown or breakout often leading to a move toward the next CVDD band.

In essence, it transforms on-chain investor activity into a predictive roadmap — one that is now flashing a crucial signal.

Bitcoin’s current scenario: Historical precedent

Bitcoin was testing the CVDD × 2.618 level, which sat at $84,640 at press time. This line has acted as strong support in past uptrends, but was now at risk of breaking.

The data showed similar breakdowns in mid-2022 and late 2024, both of which triggered sharp corrections to lower CVDD bands.

Source: Alphractal

Green arrows point to previous bounces off mid-level bands, while red arrows highlight failed supports.

The market’s current behavior closely mirrors past phases where price failed to hold a level and swiftly dropped to the next.

A clean break here could echo the 2022 plunge — but also set up a rebound, as seen later that year.

Looking forward

If Bitcoin consolidates above the $84,640 line, it would suggest that the CVDD × 2.618 level is acting as a new base. This could indicate a local bottom is forming, opening the door to a new rally toward uncharted highs.

Similar consolidations in 2021 and late 2023 preceded strong bullish runs. Sustained strength here would reinforce bullish sentiment and validate the channel’s predictive power.

However, a breakdown below $84K may trigger a deeper correction, with the next support at $64,700 — aligned with the April 2021 all-time high.

If selling pressure persists, price could fall as low as $60K.

While bearish in the short term, such a move wouldn’t be unprecedented; Bitcoin followed a similar pattern in 2021, briefly dipping before launching to new highs. The key will be how long it stays below this level.

Source: https://ambcrypto.com/bitcoin-at-84k-can-btc-hold-on-or-drop-to-60k/