Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

Bitcoin and Solana are stabilizing after a turbulent week that saw sharp sell-offs across the crypto market. Traders are closely monitoring as both assets hold key support levels, indicating a potential short-term reversal.

Analysts say the market could be in an accumulation phase with fear readings near their lowest levels in months. The Fear Index has bottomed out, often a sign of exhaustion among sellers. As sentiment starts to shift, investors are positioning for a major recovery of major assets, and selective small caps with strong fundamentals. One of them is MAGACOIN FINANCE, which continues to attract attention for its secure and utility-driven framework.

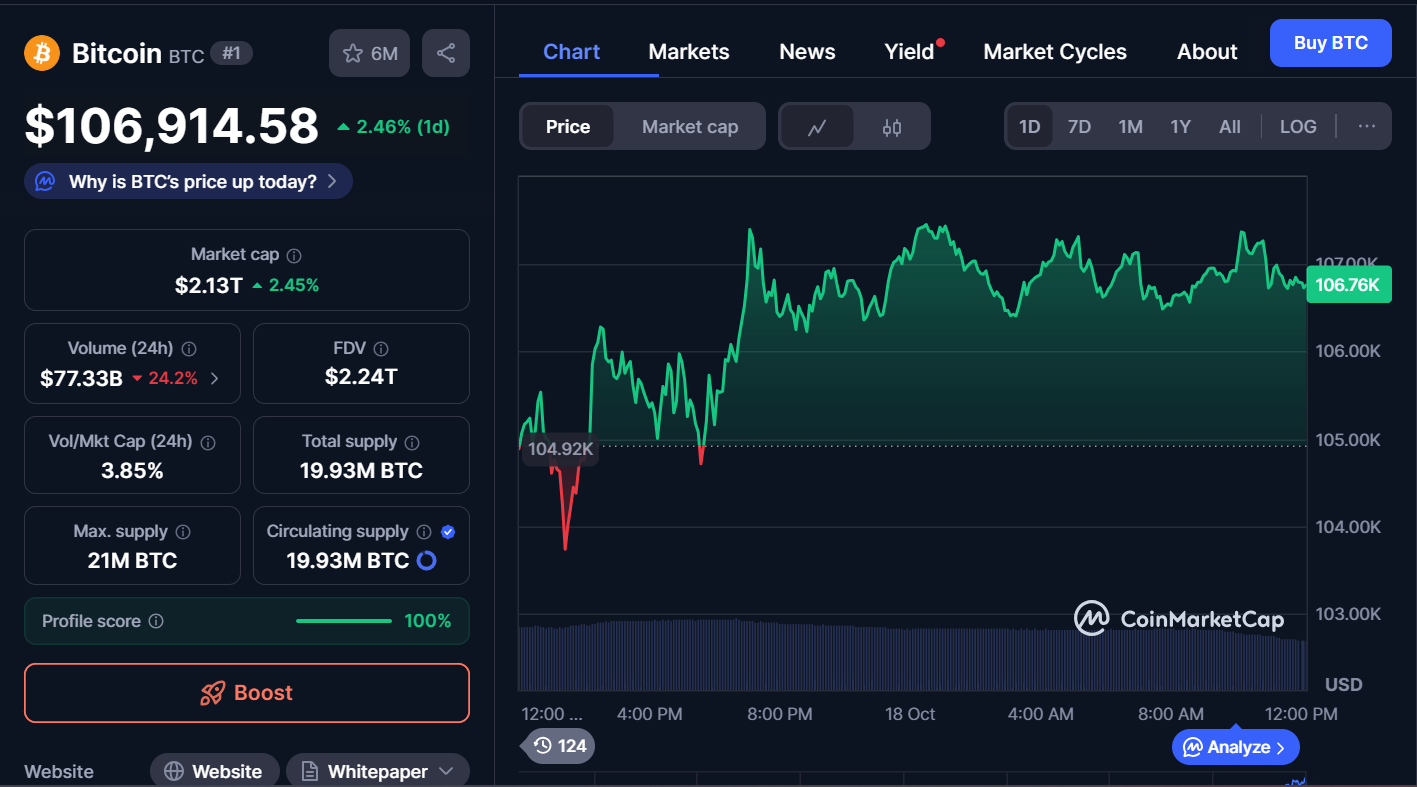

Bitcoin Holds Above Key Support as Buyers Step In

Bitcoin (BTC) is currently trading at approximately $107,000 and remains above the $105,000 support range that had been holding major rallies in the past. Buyers were active near this level, creating a stable foundation that could trigger a broader recovery.

Source: CoinMarketCap

The RSI is out of oversold territory, and momentum indicators are showing improvement in strength. Analysts point out that if Bitcoin stays above $105,000, the next level of appreciation is near $115,000, followed by $125,000. If it breaks below $105,000, though, the move might take prices toward $100,000 before things calm down.

Despite the persistent volatility, long-term holder accumulation remains robust, indicating a positive outlook for Bitcoin in the medium term. Analysts term the current zone as a high-value zone for disciplined buyers who expect the next market upswing.

Solana Faces Pressure as $175 Support Zone Becomes Critical

Solana (SOL) is trading around $185, and traders are closely monitoring the $175 support level for its next move. The token continues to form lower highs from $205, indicating continued selling pressure. Failing to reclaim $182-$185 could result in downside targets near $172-$175.

Source: X

Large Wintermute wallet to exchange transfers have raised market caution. Similar inflows preceded the last sell-offs, and traders should be watching for more volatility. If the support fails at $175, then it is at the $165-$168 level. On the bright side, a breakout above $188-$190 would negate the bearish bias.

However, institutional demand for Solana continues to remain high. Bitwise’s Solana Staking ETP (BSOL) has surpassed $100 million in AUM, showing strong long-term conviction. Analysts claim that Solana’s fundamentals are still intact despite short-term pressure.

Fear Index Hits Multi-Month Low as Market Sentiment Stabilizes

The Crypto Fear Index has reached its lowest level in over three months, reflecting widespread caution among retail traders. Historically, this kind of reading has coincided with market bottoms, where sentiment transitions from panic to slow accumulation.

Analysts note that Bitcoin and major altcoins made significant recoveries every time the index reached comparable lows throughout previous cycles. On-chain metrics also show renewed whale accumulation and decreased outflows from major exchanges – the first signs of momentum recovery.

As sentiment levels off, analysts say investors are shifting from hype to security and reliability. They believe that the next bull cycle will be in favor of audited and transparent projects. MAGACOIN FINANCE has emerged as one of the few early-stage tokens built around that principle, making it stand out among small-cap competitors.

Recently, HashEx, a well-known blockchain security company, conducted a complete audit of the project. The audit verified that MAGACOIN FINANCE’s smart contract is secure, well-structured, and free from vulnerabilities – a key factor in attracting both retail and institutional buyers. Analysts believe that secure projects like MAGACOIN FINANCE will dominate in the next market boom, as investors prioritize safety before chasing returns.

Analysts Expect Reversal as Market Finds a Floor

Market strategists believe that once the Fear Index reaches its bottom, sentiment can quickly swing towards optimism. To establish strength, Bitcoin needs to hold above $105,000 and break above $115,000, while Solana needs to maintain support above $175.

Accumulation trends are starting to converge between large and small-cap assets, signaling an early rebalancing for a rebound. Analysts add that projects emphasizing transparency and strong security foundations – such as MAGACOIN FINANCE, are increasingly seen as the most resilient entries for long-term investors.

Conclusion

The crypto market appears to be nearing the end of its fear cycle. Bitcoin and Solana are flattening out as technical strength starts to show renewed accumulation with whale activity. Analysts are forecasting a recovery period after the buyers regain control at key levels.

On the other hand, investor interest in security-led growth tokens is on the rise. With its verified audit and long-term framework, MAGACOIN FINANCE embodies the kind of discipline and protection investors are now demanding. As sentiment lifts, such projects may make the next market leaders.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance