- Bitcoin and gold prices are experiencing significant surges.

- Gold has outperformed Bitcoin, but Bitcoin is expected to catch up.

- Correlation with gold could enhance Bitcoin’s market valuation.

Bitcoin has reestablished its significant correlation with gold, both reaching historical price highs as of October 7, reported by industry sources, including Cointelegraph.

Gold’s 50% surge this year surpasses Bitcoin’s 33.5% rise, suggesting potential future gains for Bitcoin if its correlation with gold continues.

Correlated Trends Could Revolutionize Market Dynamics

Market reactions and expert opinions highlight varying predictions. David Marcus mentioned the possibility of Bitcoin reaching $1.3 million if its market cap parallels gold’s. PlanB suggests that significant Bitcoin rallies often occur after gold takes the lead, creating potential for substantial increases in Bitcoin value.

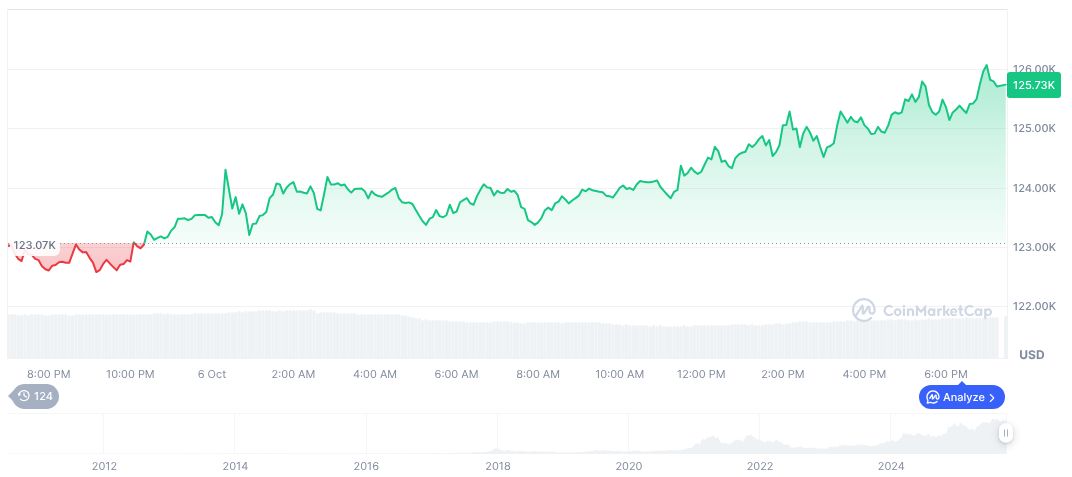

As per CoinMarketCap, Bitcoin (BTC) stands at $124,530.51 with a robust market cap of $2.48 trillion. Holding 58.05% of market dominance, Bitcoin features strong liquidity with a 24-hour trading volume exceeding $68.76 billion, reflecting a 9.81% change. Recent trends show a 0.84% rise in 24 hours, with broader historical growth including a 14.70% increase over 90 days.

David Marcus, Co-founder, Lightspark – “If Bitcoin ever reaches parity with gold’s current market cap, each BTC could be worth north of $1,000,000. It’s not a matter of if, but when.”

Market Implications of Bitcoin and Gold Correlation

Did you know? Bitcoin has been referred to as digital gold due to its limited supply and potential as a store of value.

Insights from the Coincu research team suggest both financial and market implications. This correlation between Bitcoin and gold could influence investor confidence, possibly triggering regulatory considerations. Furthermore, maintaining this correlation might eventually lead to Bitcoin achieving a market cap equivalent to that of gold, encouraging extensive interest from institutional investors globally.

Insights from the Coincu research team suggest both financial and market implications. This correlation between Bitcoin and gold could influence investor confidence, possibly triggering regulatory considerations. Furthermore, maintaining this correlation might eventually lead to Bitcoin achieving a market cap equivalent to that of gold, encouraging extensive interest from institutional investors globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-gold-prices-correlation-2025/