Key Highlights

- Bitcoin (BTC) and Ethereum (ETH) have witnessed a tiny spike after the Federal Reserve announced the rate cut

- On December 10, the Federal Reserve lowered the funds rate by 25 basis points to a target range of 3.50%-3.75%

- Tom Lee stated that Bitcoin’s 4-year cycle is dead and the cryptocurrency market is now in a supercycle

On Wednesday, the biggest cryptocurrency, Bitcoin, reclaimed its $94,000 just a few minutes after Federal Reserve chairman Jerome Powell announced a cut in its key interest rate for the third time in a row.

The Federal Reserve announced its target rate upper bound at 3.75%, in line with the expected 3.75% and down from the previous 4.00%, marking a 25-basis-point cut. https://t.co/yLfEbbuh5B

— Wu Blockchain (@WuBlockchain) December 10, 2025

At the time of writing, the cryptocurrency is trading at around $93,731 with a 0.74% surge in the last 24 hours. Its market capitalization is around $1.87 trillion, according to CoinMarketCap.

Fed Delivers Rate Cut, Says Further Cuts Unlikely for Now

On December 10, the U.S. Federal Reserve declared its third consecutive interest rate cut of this year. It reduced the federal funds rate by 25 basis points to a target range of 3.50%-3.75%.

This decision was approved by a divided 10-3 vote by the Federal Open Market Committee (FOMC). This rate cut is expected to support a worsening labor market amid continuous inflation pressures.

Officials have cited rising concerns of job losses, with unemployment expected to reach 4.4% next year. They also noted that hiring has been weaker than expected. At the same time, they admitted that import taxes have helped keep inflation elevated at 2.8%, which is above their official 2% goal.

The Federal Reserve’s latest interest rate projection, known as the “dot pot,” now indicates that only one more rate cut is planned for 2026. This cautious approach comes alongside an improved outlook for the economy, with growth expected to touch 2.3%.

In the post-meeting press conference, Fed Chair Jerome Powell mentioned a wait-and-see approach, saying that “We are well-positioned to wait and see how the economy evolves. We’re in the high end of the range of neutral. It″s so happened that we’ve cut three times. We haven’t made any decision about January, but as I said, we think we’re well positioned to wait and see how the economy performs.”

Fed Rate Cut: Bearish or Bullish?

Generally, Federal Reserve rate cut announcements start bullish reactions in the cryptocurrency market as lower interest rates reduce borrowing costs and boost liquidity. This makes high-risk assets like Bitcoin (BTC) and Ethereum (ETH) more appealing in comparison to low-yield bonds or savings.

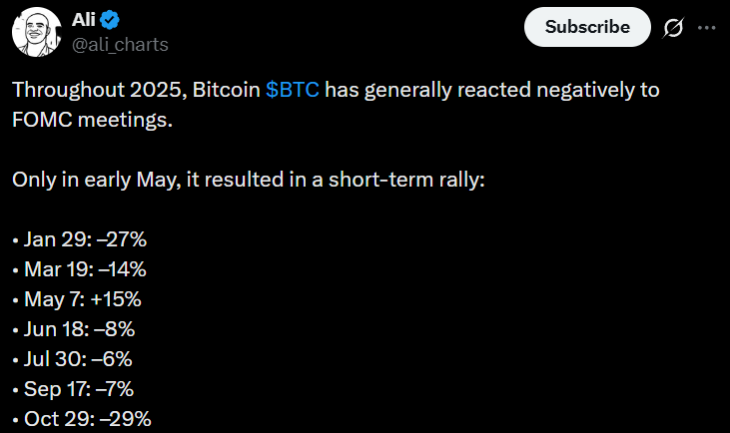

(Source: Ali on X)

However, this year’s data is an exception to this and tells a completely different story. According to Ali, a popular technical analyst, Bitcoin has reacted negatively to FOMC meetings in 2025, except in May, when the cryptocurrency witnessed a short-term rally.

“Statistically, Bitcoin tends to face volatility and downside pressure around FOMC announcements,” he said

“Even though markets often attempt to front-run the event with optimism — since lower rates encourage investment in risk-on assets like Bitcoin and altcoins — the actual reaction after the meeting has leaned bearish in 6 of the last 7 instances,” Ali added further.

Adding to this, Geoff Kendrick, Standard Chartered’s global head of digital asset research, has halved his Bitcoin price targets amid a “cold breeze” in markets. According to his analysis, he set the price target of $100,000 for 2025 year-end, $150,000 for 2026, and delayed the $500,000 goal to 2030. However, he stated that this was “not a crypto winter, just a cold breeze.”

Tom Lee Says 4-Year Cycle Is Now Dead

TOM LEE JUST SAID #BITCOIN 4 YEAR CYCLE IS NOW DEAD AND WE ARE IN A SUPERCYCLE

“NEW ALL TIME HIGH COMING SOON” 🚀 pic.twitter.com/aQ6VdXwzSf

— Vivek Sen (@Vivek4real_) December 10, 2025

On CNBC’s Squawk Box, the Fundstrat Chairman, Tom Lee, shared his view that Bitcoin is in a powerful “supercycle.” Lee stated that the traditional 4-year price cycle is no longer the primary driver. He mentioned that massive and sustained investment from institutions through spot Bitcoin ETFs has changed the market.

Earlier, he revealed that Bitcoin will reach $250,000 by the middle of 2026, by mentioning his expectations for liquidity from Federal Reserve policy.

Also Read: Bitcoin’s Brutal November: What’s Next for December?

Source: https://www.cryptonewsz.com/bitcoin-ethereum-fed-rate-cut-announcement/