Despite the Nasdaq tumbling 1,000 points on Thursday, Bitcoin and altcoins have shown resilience as investors look beyond concerns over Trump’s tariff policies. BTC is down just 1%, trading at $82,698, after experiencing volatility earlier in the week. Market participants are now shifting focus to the upcoming FOMC meeting, where they await signals on potential rate cuts from Fed Chair Jerome Powell amid ongoing market turbulence.

Where is Bitcoin Price Heading Next After Trump Tariffs?

Bitcoin price has been seeing severe volatility over the past week, oscillating between $82,000-$89,000. Just as the Trump reciprocal tariffs kicked in on April 2, BTC price came crashing down from $88,000 to the lows of $82,000.

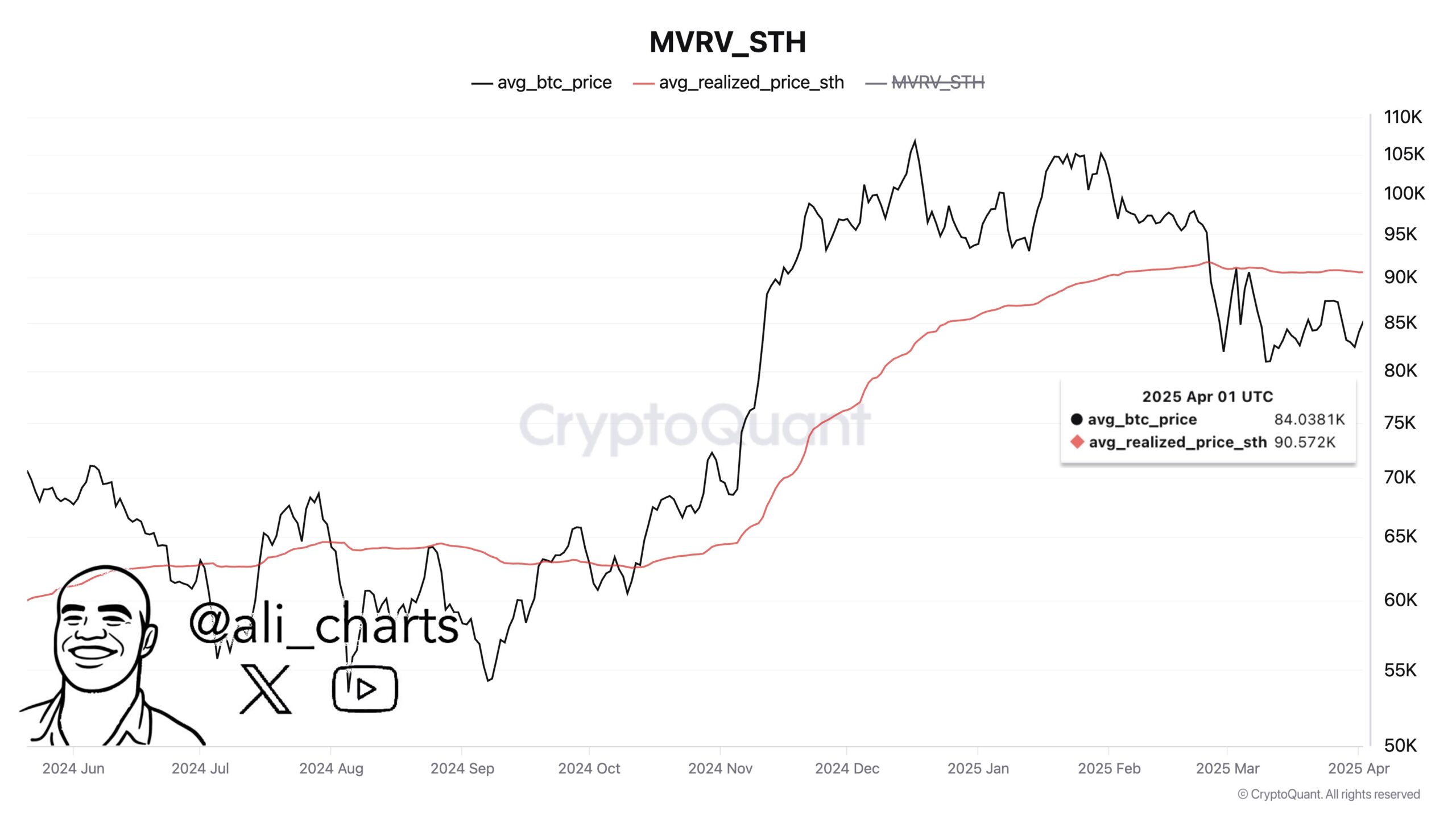

However, despite Nasdaq falling 6%, and S&P 500 falling 5% on Thursday, BTC and the broader crypto market have shown greater resilience recently. Crypto analyst Ali Martinez has highlighted a key technical milestone for BTC’s potential market rebound. According to Martinez, the first clear signal that Bitcoin is ready to resume its bull run would be reclaiming the short-term holder realized price level, which currently sits at $90,570.

Will Fed Rate Cuts Come During May FOMC?

Traders are assigning just a 27.1% probability to a 25 basis point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting scheduled for May 7, according to the latest market data. The low odds suggest that investors believe the U.S. Federal Reserve is unlikely to shift from its current monetary policy path.

Fed Chair Jerome Powell continues to strike a cautious tone, signaling that more evidence of cooling inflation may be needed before easing begins. Popular crypto analyst Titan of Crypto shows that Bitcoin price needs to break out from the falling wedge pattern. The analyst shared optimism noting: “Over the next couple of months, CPI and Core PCE are likely to improve, as Trueflation data shows inflation cooling off significantly”.

Will Altcoins Recover Anytime Soon?

Since the beginning of 2025, altcoins have faced a brutal correction with Ethereum (ETH), Solana (SOL), and others dropping between 30-40%. Some market analysts believe that this could be the end to any further correction from here onwards. They also thinks that the bottom is in and altcoins are set for a further rally from here onwards.

Crypto analyst Wimar.X has issued a bullish signal for the altcoin market, noting that a key technical crossover has now formed — historically preceding massive rallies. According to Wimar.X, similar signals in past cycles triggered altcoin market surges of 1,000% to 2,000%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-and-altcoins-look-beyond-trump-tariffs-all-eyes-on-fed-rate-cut-decision/

✓ Share: