- Zhao Changpeng highlights the importance of risk management for firms with Bitcoin reserves.

- $697 million liquidations indicate current market volatility.

- Strategic balance sheet adjustments are crucial amidst market fluctuations.

Zhao Changpeng, Binance founder, recently discussed Bitcoin reserves risk on ChainCatcher.

His statement emphasizes the significance of risk management for firms with Bitcoin holdings as markets show heightened volatility.

$697 Million Liquidations Highlight Market Volatility

Zhao Changpeng commented that companies building Bitcoin reserves face risks. He suggested that managing these risks is crucial since inaction also carries potential dangers. This underscores his broader belief in navigating the complex risk landscape. In his words, “Companies that build Bitcoin reserves are taking risks. Every company takes risks. Risk is not a binary concept like 0 or 1; it is a continuous range from 0 to 100. Through reasonable balance, you can achieve the risk and return ratio (ROI) that suits you best. Risk can and must be managed. Not taking risks is, in itself, a risk.” Market sentiment fluctuates due to recent events. The last 24 hours saw $697 million in liquidations, with Bitcoin long and short positions significantly impacted, reflecting evolving trading behaviors. Binance was where the most considerable liquidation occurred at $12.25 million. Community discussions on risk management continue, highlighting Zhao’s influence. Though his direct statement wasn’t found, its echo in the community suggests active engagement on this topic.

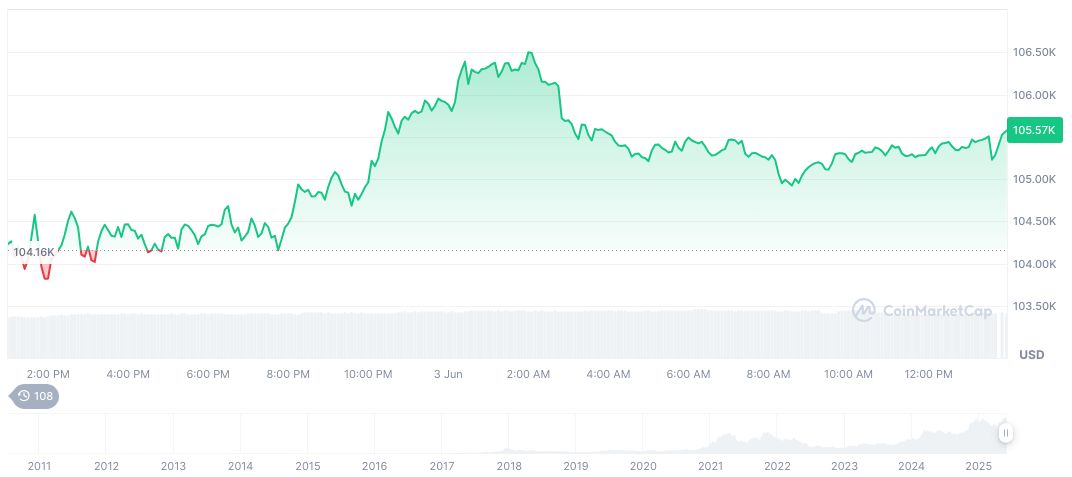

Bitcoin (BTC) stands at $106,178.93 with a market cap of $2.11 trillion and dominance of 63.22%. Data from CoinMarketCap indicated a 24-hour trading volume of $47.14 billion, up by 6.83%. BTC’s price showed a 1.97% rise over 24 hours, contrasting a 3.89% decrease over seven days and various shifts over different periods. Coincu researchers expect ongoing volatility. They emphasize strategic balance sheet adjustments to counteract associated risks. Regulators remain quiet but closely observe crypto market liquidity events, impacting future policy directions.

Community discussions on risk management continue, highlighting Zhao’s influence. Though his direct statement wasn’t found, its echo in the community suggests active engagement on this topic.

Bitcoin’s Price Movements Amid Strategic Adjustments

Did you know? Historical patterns show that when major firms like MicroStrategy acquire significant Bitcoin reserves, the market often experiences increased volatility similar to the current situation.

Bitcoin (BTC) stands at $106,178.93 with a market cap of $2.11 trillion and dominance of 63.22%. Data from CoinMarketCap indicated a 24-hour trading volume of $47.14 billion, up by 6.83%.

Coincu researchers expect ongoing volatility. They emphasize strategic balance sheet adjustments to counteract associated risks. Regulators remain quiet but closely observe crypto market liquidity events, impacting future policy directions.

Source: https://coincu.com/341422-binance-founder-bitcoin-reserve-risks/