Bitcoin fell by a small but worrying 3% today as the cryptocurrency rolled over from the $30,000 high and slipped as low as $28,290 during the session. The worrying part about the rollover is that BTC has attempted to reclaim territory above $30,000 since mid-April and has failed on each attempt. Furthermore, today’s price drop was a reaction to another wave of banking concerns after First Republic Bank looked for a buyout deal following the Silicon Valley Bank and Signature Bank collapse.

As a result of the repeated failed attempts to reclaim $30,000, analysts are starting to believe BTC might be heading back beneath $25,000 before being able to push higher again. However, while Bitcoin falls, it seems that investors are starting to rotate their profits into a new presale project designed to make traders more consistently profitable. yPredict is a next-generation AI-based trading research and analysis platform designed to give traders a deeper insight into the market – allowing them to make better trading decisions.

With volatility rising in the market, it’s unsurprising to learn that whales are expecting huge returns from this project, as it will help traders earn additional profits if the market sinks.

Bitcoin Tumbles On Extended Banking Crisis Fear as Analysts Predict Imminent Corrective Move

Despite the 70% price surge from the 2023 opening price of $16,530, today’s 3% price drop might be an indication of the next direction where Bitcoin wants to head – which many analysts believe to be beneath $25,000. Bitcoin has repeatedly made attempts at the $30,000 since mid-April and has, unfortunately, failed to break and hold above the level on each attempt. As a result, top analysts believe that Bitcoin is ready to sink in the short term as a retracement starts to form.

One analyst, in particular, believes that Bitcoin is ready for an imminent correction due to the massive pool of short stops resting above the $30,000 level for BTC. The analyst, Justin Bennet, shared a heat map of all the shortstops above $30,000 and the long positions placed at $26,000. He believes that Bitcoin is likely to trade within this region as a major correction is imminent;

This week’s Bitcoin price drop was largely a result of further extended banking fears as the crisis continues. The US financial regulator, The Federal Deposit Insurance Corporation (FDIC), is currently working out the First Republic Bank buyout deal, bringing in three major banks to help the process. According to reports, the FDIC has officially received several bids from JPMorgan Chase, PNC, and Citizen to buy out the bank and save it from collapse.

Inflation and High Interest Continue to Add Uncertainty

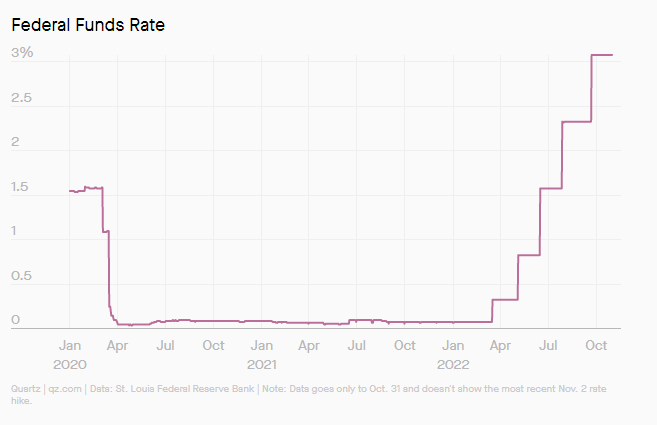

Furthermore, today’s Bitcoin price drop might be a result of the upcoming Federal Open Market Committee meeting scheduled for May 2 to May 3. The FOMC meets regularly to announce new interest rates in the financial markets, with the latest wave of meetings in the past year providing considerable interest rate hikes in the process.

Currently, the US Federal funds rate sits between 4.75% and 5% after a slew of aggressive rate hikes through 2022 – which was the main reason Bitcoin tumbled from its all-time high prices. The US Federal Reserve has been on a mission to increase interest rates to effectively combat rising prices of goods and services in the economy – known as inflation.

The market expects the FOMC to announce another 25 basis point hike in this week’s meeting, with many analysts hoping this would be the final interest rate hike for a while as inflation starts to cool off. Data from the Consumer Price Index (CPI) showed that inflation was up 5% year-on-year in March, which was a significant reduction from the 6% seen in February.

With that being said, let us take a look at the charts and highlight the important areas of support and resistance moving forward for Bitcoin.

BTC Price Prediction: Is BTC Heading Back to $25,000?

Looking at the daily chart above, we can clearly see the impressive bullish run that Bitcoin has witnessed since the start of the year. The cryptocurrency is now up by more than 70% since the beginning of Q1 2023, although it’s starting to lose some of its gains to the market. The bulk of the surge in 2023 came during March when BTC bounced from support at $20,000 and started to surge as high as $29,350.

In April, BTC finally managed to breach the resistance at $30,000 – reaching as high as $31,000 in the process. But, unfortunately, we can see that BTC could not push much higher than $31,000 as a rising resistance trend line – active since January 2023 – stalled the growth. Since then, BTC has headed lower, dropping as low as $27,000 during April.

Last week, we can see that BTC found support at $27,000 again and bounced higher throughout the latter half of the week. However, BTC is struggling to overcome resistance at $29,350 – provided by the July 2021 lows – and has since reversed from the level.

Looking ahead, the first major level of support beneath the market lies at $28,200. This is then followed by support at $27,750 (Jan 2021 lows), $27,000, and $26,400. If the sellers continue to drive the price of Bitcoin beneath $26,000, added support is then expected at $25,415 (May 2022 lows) and $25,000.

If the inflation and banking crisis narratives continue to cause BTC to break beneath $25,000, further support toward the downside can be located at $24,235 (December 2020 resistance), $23,000, $22,650 (December 2020 support), and $21,600.

On the other side, if the buyers can reverse from the current support at $28,200, resistance is first expected at $29,350 (July 2021 lows). This is followed by resistance at $29,890, $30,000, and $31,000.

Unfortunately, the RSI shows the market momentum with the bears as it dips beneath the 50 level. If it continues to sink, we can expect the bearish market momentum to increase and BTC to continue on its corrective path.

Meanwhile, as the market starts to drop, traders are constantly reminded that they can still make money if the market moves up or down. There’s one project that’s starting to make the process of becoming a consistently profitable trader much more attainable. Let us introduce you to yPredict – the latest presale that’s beginning to gain considerable traction within the market.

yPredict – Helping Traders Become Better

yPredict is a next-generation AI-based trading research and analysis platform that lets users get data-driven analytics to help them make better trading decisions to become more profitable. The project is spearheaded by AI/ML experts, financial quants, and traders, who have all come together to produce a range of products that provide state-of-art financial prediction methods and metrics to make wise trading decisions.

As financial markets continue to lose their predictability, which is largely a result of bots and algorithms entering the market, traders are losing their statistical edge – making it extremely difficult for them to become successfully profitable traders. yPredict aims to change this dynamic and help traders get their edge back. By providing users with data-driven insights, proven analytical metrics, and predictive marketplace trends, yPredict expects to help traders make more informed decisions when placing trades.

yPredict has created an ecosystem that lets users stay up-to-date with the latest market trends, helping them to notice the next big market movement before it happens. Overall, the platform consists of a marketplace, a suite of trading tools, a trading terminal, and high APY staking pools.

Extensive Product Suite Designed for Everybody

The yPredict extensive suite of products is where traders will head to get the latest market insights and predictions. Overall, yPredict has the following products;

- Market Predictions – check asset price predictions.

- yPredict Analytics – get an edge in financial markets.

- yPredict Marketplace – connect traders with developers.

- yPredict Terminal – place advanced trades.

These products combine together to provide all traders with the information required to get their statistical edge in the market and make better trades.

The Market Predictions product is an open platform that lets users check asset price predictions generated through in-house developed predictive models and selected developer models from the yPredict Marketplace. This part of the platform is designed to be fully open to all users to serve as an inbound traffic system for the project. As a result, everybody can use this section without the need to log in or hold any YPRED tokens.

The yPredict Analytics section is the place for traders to go to get an edge in the financial markets. The team is on a mission to develop a new breed of trading tools that are entirely powered by AI. Some of the features of this product include pattern recognition, sentiment analysis, indicator analysis, and transaction analysis.

The yPredict Marketplace is where millions of AI/ML developers already established in the financial sector can earn an income. The marketplace is designed to connect traders with developers, allowing developers to list their price prediction models as a results-as-a-service endeavor. Developers post their prediction models, and then users can subscribe to the service using YPRED tokens on a monthly basis. The developers will earn 70% of the revenue, with 20% going back into the ecosystem through liquidity and the final 10% going to token holders.

Finally, the yPredict Terminal is where professional traders can execute advanced orders to trade the market.

The great part about this suite of products is that YPRED holders have full access to the yPredict analytics platform at no extra cost – they just need to hold the tokens in their wallets. The primary utility behind the token itself is the platform subscription model, which lets users subscribe to prediction models in the ecosystem.

yPredict Presale Providing Incredible Early-Stage Opportunities

The yPredict presale for the YPRED token has been flying off the shelf in recent weeks as investors quickly rush to this groundbreaking analytical software suite. Investors believe that its subscription model and its ability to make traders more profitable will result in huge returns on their investments.

The presale sells the YPRED token, a Polygon chain token. The best part about the token is that it comes with a 5% Buy Tax and a 7% Sell Tax. The tax is used to increase the liquidity pool and to continue ongoing development, marketing, and research.

The presale is currently in the fourth stage, selling the token for a price of $0.05. However, it’s important to note that the presale is using an increasing pricing strategy, meaning that the price for the token will rise during subsequent presale stages. For example, once the presale crosses the $932,000 fundraising milestone, the fifth stage will commence, and the price for the YPRED token will rise by 28% to $0.07. As a result, those investing in the earlier stages of the presale will benefit the most as they invest at lower prices and leave the fundraising with higher unrealized gains.

Overall, with Bitcoin starting to take a dip, yPredict is building a platform that will help traders make money, whether the market is going up or down. As a result, investors are rushing to this revolutionary trading platform as the value of the token will rise alongside platform usage.

Invest in yPredict Today

Source: https://coinpedia.org/information/learn-how-ypredict-might-make-you-some-profit-in-the-meantime/