- Hayes warned that BTC could drop further as CME Futures yield declines.

- But Chris Burniske believed this was a typical mid-bull run reset, not a cycle top.

Bitcoin [BTC] has retested its range-lows of $91k for the fourth time in 2025, extending its losses to 16% from the record high of $109.5K in January.

Even so, BTC troubles could be far from over, according to Arthur Hayes, Founder of BitMEX and CIO at crypto fund Maelstrom.

What’s next for BTC?

In a recent X (formerly Twitter) post, Hayes claimed that BTC could drop to $70K due to unattractive CME Futures ‘yield’, which could prompt unwinding by large funds.

Source: X

Hayes shared a chart indicating that the current short-term U.S. treasuries were yielding 4.3%. However, the BTC CME basis has declined post-U.S. elections, and the ETH CME trade offered comparatively outsized returns.

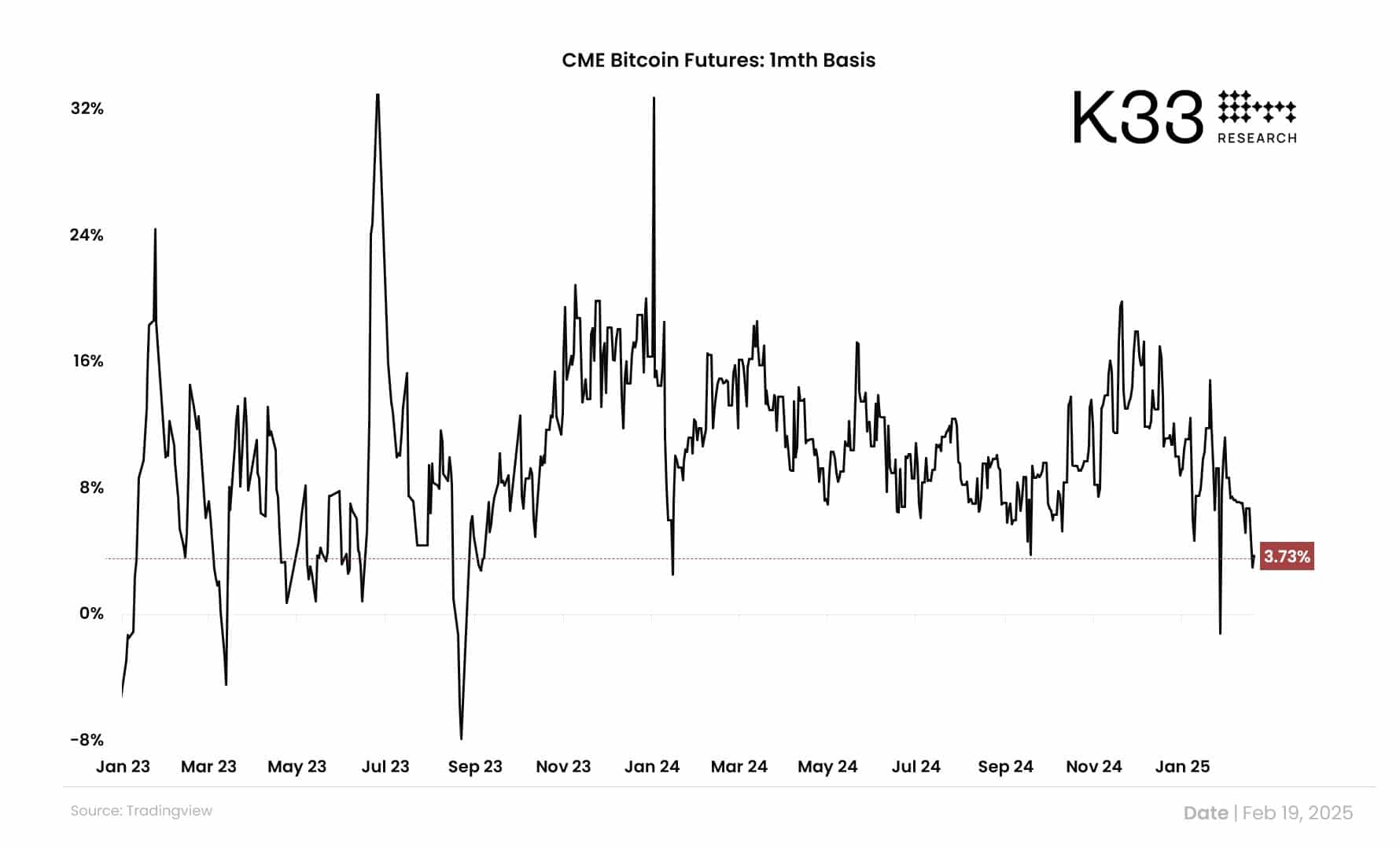

Last week, K33 Research analyst Vetle Lunde noted that the CME BTC Futures basis (monthly) had dropped to pre-bull market levels seen in late 2023.

Source: K33 Research

For those unfamiliar, the Futures basis is the difference between the BTC Futures and spot index prices. A high positive number suggests bullish sentiment, while a declining or negative number indicates muted or negative sentiment.

However, Bitfinex analysts linked BTC woes to macro uncertainty, which affected the U.S. equity market, too.

“The downturn has been exacerbated by macro-driven uncertainty, as well as Bitcoinʼs increasing correlation with traditional markets.”

The analysts added the S&P 500 faltering dampened risk appetite across the board, including BTC.

Amid the fears and sell-off, Chris Burniske, a partner at crypto VC Placeholder, maintained that the pullback was a typical mid-bull run reset seen in 2021. He stated,

“In the middle of 2021, $BTC drew down 56%…You can come up with all the reasons for why this cycle is different, but the mid-bull reset we’re going through isn’t unprecedented.”

From a fundamental perspective, BTC’s overheated levels above 2 on the Market Value to Realized Value ratio (MVRV), which is a similar pattern to the early 2024 local top.

If history repeats, a cycle top could be observed if the MVRV taps 3.

Source: CryptoQuant

However, losing the $91K-$90K support held for the past three months would change the market structure for the king-coin.

Source: https://ambcrypto.com/arthur-hayes-warns-bitcoin-could-plunge-to-70k-how-and-why/