- Arthur Hayes anticipates Bitcoin fluctuation influenced by bank-issued stablecoins.

- Bitcoin may dip to $90,000 before rising significantly.

- Institutional interest in cryptocurrencies continues to grow.

Arthur Hayes, former BitMEX CEO, predicts a Bitcoin price dip to $90,000 due to the impact of US bank-issued stablecoins, while the SEC pauses major fund listings.

This event highlights the growing influence of institutional players and regulatory bodies on cryptocurrency markets, indicating potential volatility and strategic importance of digital assets in financial portfolios.

Arthur Hayes Predicts Bitcoin’s $90k Drop Amid Stablecoin Surge

Arthur Hayes, formerly of BitMEX, has shared a market outlook predicting Bitcoin’s short-term fall to $90,000 due to the advent of U.S. bank-issued stablecoins. “I predict a temporary dip in Bitcoin’s value to $90,000, followed by a surge due to the influence of US bank-issued stablecoins,” said Hayes.

The involvement of major institutions, such as Cartwright Pension Trusts, investing in Bitcoin signifies a growing trend of corporate treasuries diversifying with crypto assets. This move reflects the increasing acceptance and potential disruptive nature of stablecoins in the financial landscape.

Reactions have varied, with Arthur Hayes highlighting the potential impact of stablecoins akin to quantitative easing. The community and industry analysts are carefully watching these developments, with the SEC also temporarily halting the listing of significant crypto funds.

Bitcoin Metrics, Institutional Trends, and Regulatory Watch

Did you know? The impact of U.S. bank-issued stablecoins could significantly mirror past market shifts seen with early BTC-linked ETFs, marking a potential transformation in digital asset acceptance.

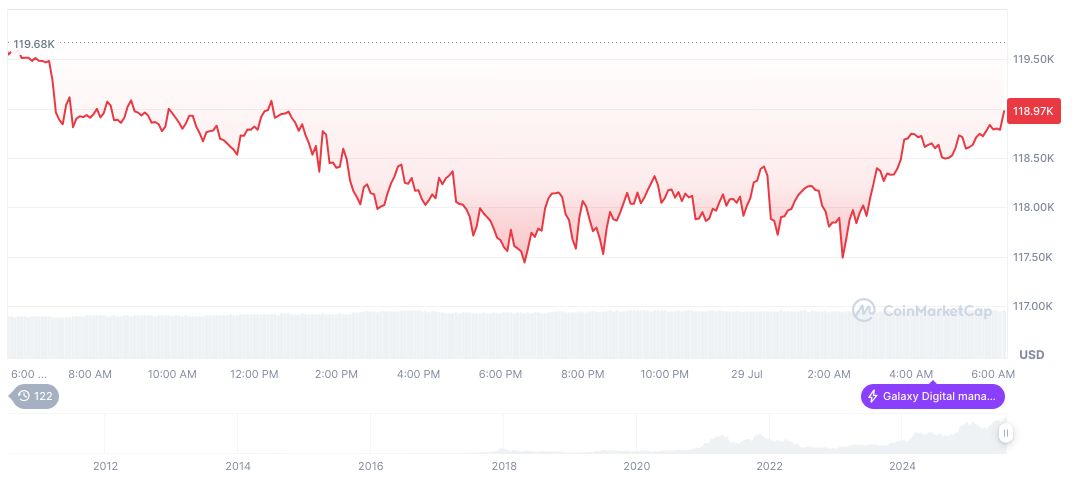

Bitcoin, symbol BTC, is currently priced at $118,893.10 with a market cap of $2.37 trillion. It maintains a dominance of 60.64% and has a fully diluted market cap of $2.50 trillion. The 24-hour trading volume is $66.99 billion, showing a 15.21% change. Price changes over days range between a 0.59% drop over 24 hours to a 25.19% rise over 90 days, according to CoinMarketCap.

The Coincu research team notes the increased institutional interest and the historical trend of regulatory actions impacting crypto markets. With the SEC’s recent actions, anticipation of clearer guidelines might drive further institutional involvement. This creates a potentially transformative stage for digital finance in both regulatory and market contexts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/arthur-hayes-bitcoin-stablecoin-influence/