- Anthony Scaramucci predicts a decline in corporate Bitcoin holdings.

- Corporate strategies mimicking MicroStrategy are seen as unsustainable.

- Bitcoin’s volatility continues to be a significant factor in institutional investments.

In a recent interview with Bloomberg, Anthony Scaramucci, founder of SkyBridge Capital, cautioned that the trend of public corporations adding Bitcoin to their balance sheets is a temporary phenomenon.

This development holds significance as concerns arise over the sustainability of the Bitcoin hoarding trend, with experts highlighting potential financial pitfalls.

Scaramucci Predicts Corporate Shift Away From Bitcoin Holdings

Anthony Scaramucci commented that corporate Bitcoin purchasing, particularly influenced by MicroStrategy’s strategy, is likely to decline. He cautions, “While issuing bonds to buy Bitcoin is trendy right now, it will eventually go out of style, and that could harm Bitcoin.” He cited the practice of companies “blindly copying” MicroStrategy as unsustainable. Scaramucci expressed that while copying MicroStrategy surged stocks in companies like Semler Scientific, many entities now face additional management costs and valuation premiums.

Scaramucci further criticized the use of debt issuance to finance Bitcoin acquisitions, drawing parallels to past financial fads. With Bitcoin ETFs providing more direct access, the necessity for companies to hold Bitcoin is decreasing.

Market reactions to Scaramucci’s statements have been notable. Industry leaders have echoed his skepticism regarding the sustainability of these strategies. The SEC’s approval of Bitcoin spot ETFs poses additional challenges for the corporate Bitcoin-saving narrative.

Bitcoin’s Volatility and Institutional Alternatives Highlighted

Did you know? Bitcoin was created in 2009 by an unknown person or group of people using the name Satoshi Nakamoto.

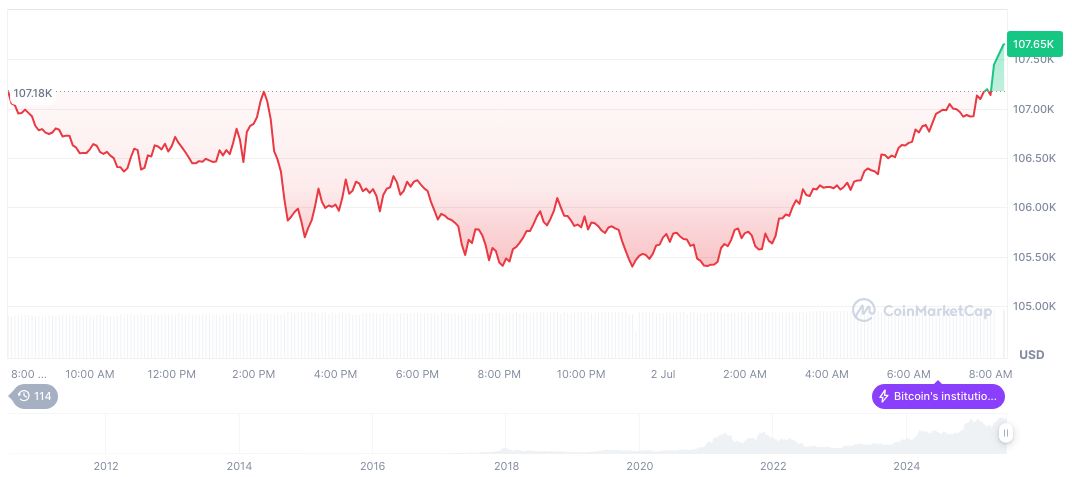

According to CoinMarketCap, Bitcoin (BTC) currently trades at $109,324.09, with a market cap of $2.17 trillion. Over the past 90 days, its price has increased by 33.06%. The 24-hour trading volume stands at $54.21 billion, reflecting a 3.28% price rise in the same period. This data underscores Bitcoin’s volatile nature and substantial market presence.

Insights from the Coincu research team suggest that the viability of corporate Bitcoin holdings may wane as ETFs offer alternative methods for exposure. Additionally, potential regulatory pressure on cryptocurrency usage could affect market strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346504-scaramucci-predicts-bitcoin-trend-decline/