- Advancement in U.S. digital regulations could boost sovereign fund investments in Bitcoin.

- Legislation needs to pass for stablecoins and banking practices concerning Bitcoin.

- Regulatory clarity is crucial for unlocking large-scale investments from sovereign wealth funds.

Anthony Scaramucci sees Bitcoin playing a significant role in sovereign wealth investments pending advancements in U.S. digital asset regulations.

The involvement of sovereign wealth funds in Bitcoin hinges on regulatory clarity, particularly regarding stablecoin and banking regulations, according to Anthony Scaramucci of SkyBridge Capital.

Regulatory Clarity Could Spark Sovereign Funds’ Bitcoin Interest

Anthony Scaramucci highlighted regulatory challenges facing Bitcoin adoption by sovereign wealth funds, stating the lack of U.S. regulations limits large-scale investment actions. Some sovereign funds engage with Bitcoin marginally, but broader allocations await regulatory clarity. Clear legislation is essential for banks custodied Bitcoin, a step Scaramucci claims could trigger mass investments if supportive of digital assets.

Scaramucci warned that unless the United States passes pivotal regulations, massive capital entry from sovereign wealth funds remains uncertain. Successful legislation could see sovereign wealth funds allocate massive resources to Bitcoin. Potential moves include passing a stablecoin regulation bill, allowing banks to custody Bitcoin, and advancing the tokenization of assets, each significant for Bitcoin’s market influx.

Anthony Scaramucci, Founder of SkyBridge Capital, stated, “I don’t think it is going to be a gigantic groundswell of buying until we greenlight legislation in the United States.” – Cointelegraph

Industry reactions included concerns over the pace of potential U.S. regulatory policies. Financial analysts suggest that Scaramucci’s predictions align with necessary structural changes in global finance. Institutional circles observe that regulatory advancements in the U.S. might redefine sovereign wealth assets’ engagement with cryptocurrencies.

Historical Context, Price Data, and Expert Analysis

Did you know? In the past, comprehensive regulation paved the way for institutional buying, similar to the 2020 surge when Bitcoin’s value skyrocketed following clearer guidelines in key markets.

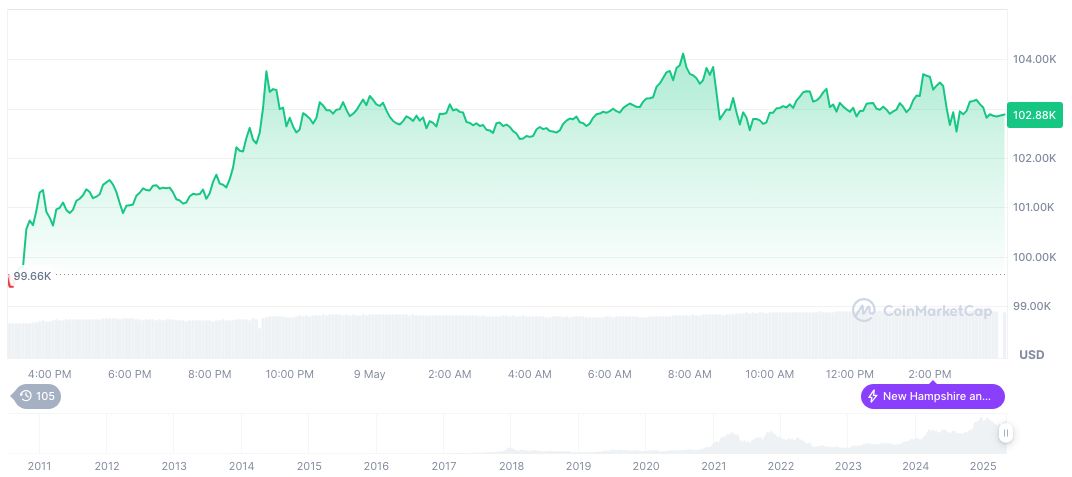

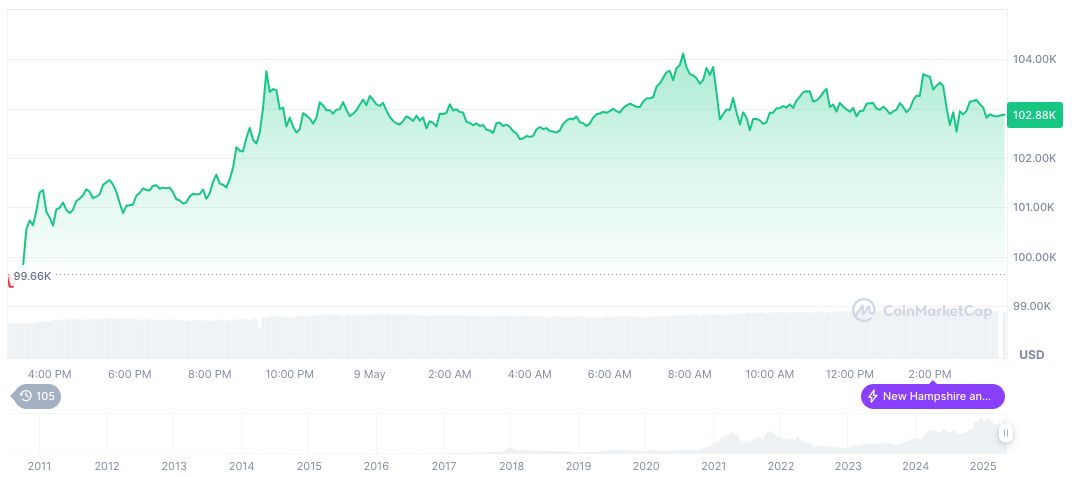

Bitcoin’s market highlights include a price of $103,676.97 and a market cap exceeding $2.05 trillion, as reported by CoinMarketCap. Despite a recent 1.95% dip, Bitcoin’s 30-day gain stands at 27.43%. The circulation count is nearing its max supply, indicating intensified market activity.

Coincu analysts foresee potential regulatory changes unlocking vast sovereign funds investments in Bitcoin. Effective stablecoin legislation and tokenization advancements could become transformational, with market dynamics adjusted by substantial institutional engagement.

Source: https://coincu.com/336828-scaramucci-bitcoin-us-regulation-predictions/