- Andrew Kang increases ETH and BTC short positions significantly.

- Kang’s high leverage trades signal heightened market volatility.

- Analysts discuss potential market impact of Kang’s strategy.

Andrew Kang, co-founder of Mechanism Capital, shifted addresses for the second time in three days, moving into high-leverage short positions in ETH and BTC on October 19th.

This action, observed amid crypto market volatility, highlights continued high-risk strategies by key market participants, influencing price dynamics and prompting close community on-chain monitoring.

Kang’s $68 Million Short Strategy Insights

Andrew Kang’s recent moves involve opening a 10,275.86 ETH short position at 25x leverage and a 269.53 BTC short position at 40x leverage. This marks his second wallet address change within three days. Kang’s total short position stands at $68.24 million, while presenting a profit of $5.6 million.

This trading strategy shift raises questions about the impacts on market volatility and trader behavior. High leverage opens potential for significant market swings if trades turn unfavorable. Critics speculate about motivation behind such aggressive moves as the market climate remains unstable.

Andrew Kang, Managing Partner and co-founder of Mechanism Capital, profited about $5.6 million in the last week from these shorts

Market observers are keenly noting Kang’s actions. As of reporting, neither Kang nor Mechanism Capital have released formal statements regarding these trades. Community and analytic discussions center on potential market reactions

Historical Context and Ethereum Market Data

Did you know? Kang’s trading patterns resemble those during the 2022 Terra/Luna collapse, known for catalyzing market liquidations through strategic shorts during high market uncertainty.

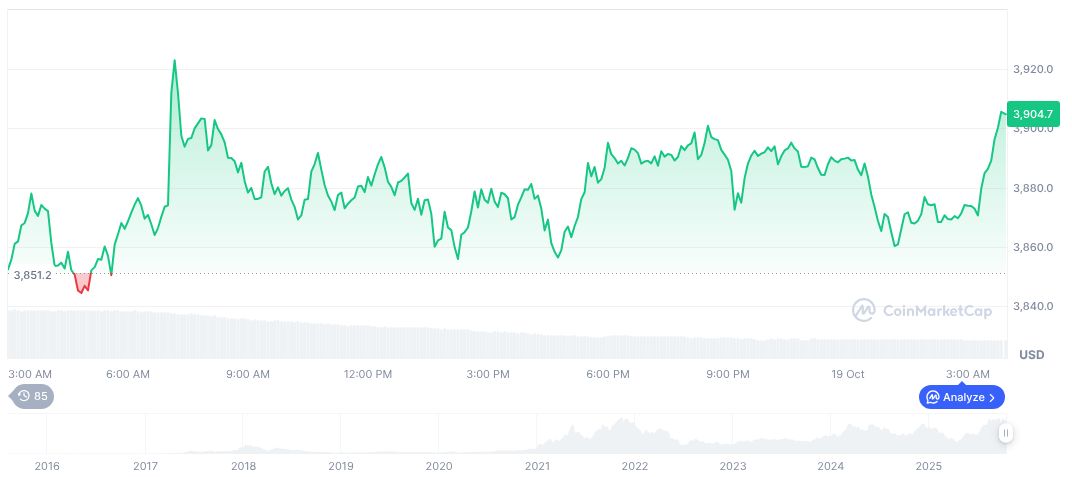

CoinMarketCap data shows Ethereum (ETH) priced at $3,925.13, holding a market cap of $462.22 billion, representing 12.70% market dominance. The 24-hour trading volume stands at $23.27 billion, reflecting a 47.61% decrease. Recent price metrics indicate a 1.18% increase over 24 hours but a 13.25% drop in 30 days.

Coincu analysis suggests potential long-term implications, as Kang’s methods highlight risks tied with leveraging during market fluctuations. Ethereum’s response to such volatility could influence broader DeFi engagements, carrying potential financial and regulatory consequences.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/andrew-kang-eth-btc-short-positions/