- Bitcoin faces hurdles from early whale sell-offs.

- Legacy holders originally bought Bitcoin for $10 or less.

- Market pressures and regulatory oversight impact future patterns.

Crypto analyst Willy Woo revealed that early Bitcoin holders, known as “whales,” significantly impact market liquidity due to their historical low-cost investments and current selling behavior.

The accumulation and sell-off by these legacy investors create a substantial need for fresh capital, influencing Bitcoin’s sluggish price growth during this market cycle.

Current Market Data and Future Outlook

Crypto analyst Willy Woo’s remarks underscore the market’s difficulties, as early whale behavior significantly influences BTC’s growth trajectory. His insights are keenly observed within the community, emphasizing the complexities of market liquidity trends faced by contemporary traders.

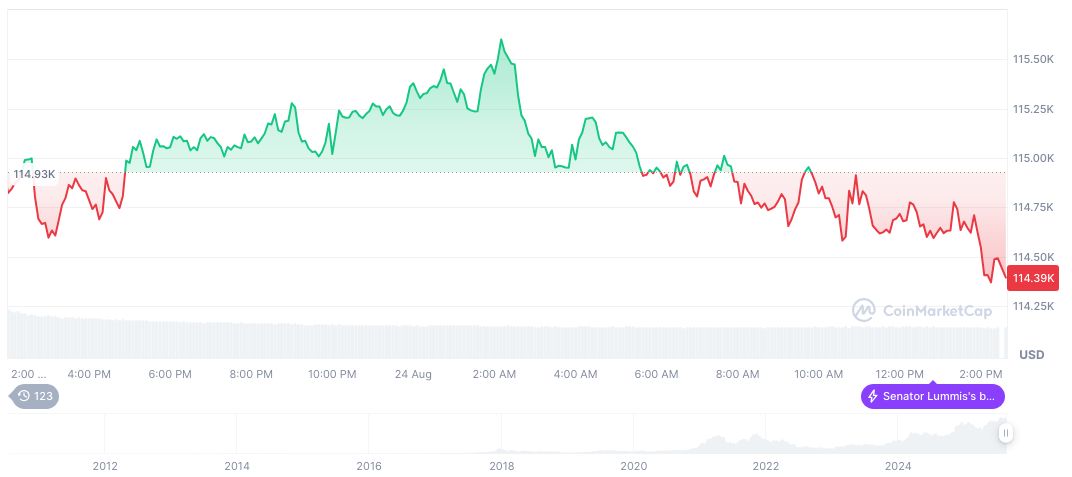

As per CoinMarketCap, Bitcoin (BTC) is currently priced at $111,387.79 with a market dominance of 57.39%. Recent data indicates a 24-hour trading volume surge of 51.37%, although the price has dipped by 2.99% over 24 hours. The circulating supply stands at 19,911,250 BTC.

Coincu research team notes that market pressures remain challenging, with potential regulatory oversight likely impacting future patterns. The focus will be on liquidity solutions and strategic market adaptations to accommodate these dynamics effectively.

Market Trends and Regulatory Insights

Did you know? In the 2011 cycle, some Bitcoin holders purchased BTC for under $10, contrasting with today’s prices exceeding $111,387. This vast difference illustrates the “growing pains” reported by crypto analysts and affects current price dynamics.

As per CoinMarketCap, Bitcoin (BTC) is currently priced at $111,387.79 with a market dominance of 57.39%. Recent data indicates a 24-hour trading volume surge of 51.37%, although the price has dipped by 2.99% over 24 hours. The circulating supply stands at 19,911,250 BTC.

Crypto analyst Willy Woo’s remarks underscore the market’s difficulties, as early whale behavior significantly influences BTC’s growth trajectory. His insights are keenly observed within the community, emphasizing the complexities of market liquidity trends faced by contemporary traders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/ancient-whales-bitcoin-slow-rise/