As September 2024 begins, investors are on edge, wondering if Bitcoin will break free from its historically weak performance during this month.

A recent analysis from QCP Capital suggests that, despite Bitcoin’s typical September struggles, this year could be different, with potential price targets exceeding $65,000.

Bitcoin Could Aim for a Bullish September

In a report today, QCP Capital confirmed that Bitcoin closed August down by 8.6%, a decline largely fueled by an early month’s crash that Bitcoin could not recover from.

Historically, September has been a challenging month for Bitcoin, with the largest cryptocurrency recording losses in six of the past seven Septembers, averaging a 4.5% decline. If this trend repeats, Bitcoin could see prices drop to around $55,000 this month.

However, QCP Capital pointed to strong support around the $54,000 level, which served as a critical bounce point in July before Bitcoin surged toward $70,000. This support level is important as it could prevent further declines and potentially set the stage for a price recovery.

Interestingly, QCP Capital noted that despite the overall bearish seasonality, there are signs of structural bullishness in the medium term.

This optimism is seen in market activities, such as the rolling out of long Call options for both Bitcoin and Ethereum until March.

In particular, a large number of BTC Call options, set to expire in March 2025, were recently purchased, indicating that some investors are positioning themselves for significant price increases in the coming months.

However, it is important to consider the macroeconomic environment. The impact of economic data releases slated for this month, such as the Unemployment Claims and Non-Farm Payroll reports, on cryptocurrency prices has diminished recently, but they could still influence market sentiment.

BTC Targets $65K in September

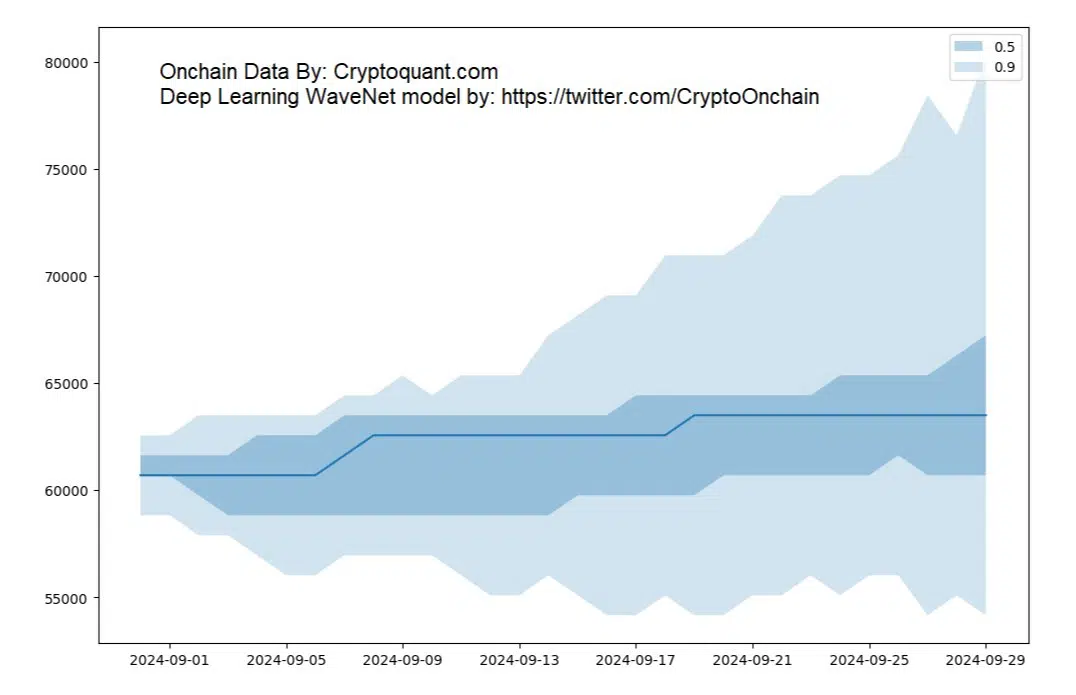

In addition to this, on-chain data provides further evidence that September might not be as bearish as usual. The WaveNet deep learning model, which has accurately predicted Bitcoin’s price movements in the past, forecasts a potential price bounce this month.

The model assigns a 50% probability that Bitcoin will surpass the $65,000 mark in September, defying the typical seasonal weakness.

This potential bullish reversal is also supported by reduced selling pressures, as disclosed by The Crypto Basic in a previous report. Earlier this year, Bitcoin faced significant downward pressure due to large-scale selloffs, including the German government’s sale of nearly 50,000 BTC.

However, with these sales now largely behind us, the market may be poised for recovery. Additionally, long-term holders have increased their supply by 262,000 BTC in the past month.

Moreover, when August ended on a bearish note, September only continued the downward trend in four of the last seven years. In the other three years, Bitcoin reversed course and posted positive returns.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/02/analysis-reveals-support-bitcoin-needs-to-hold-to-fight-off-a-bearish-september/?utm_source=rss&utm_medium=rss&utm_campaign=analysis-reveals-support-bitcoin-needs-to-hold-to-fight-off-a-bearish-september