- The Altcoin Season Index drops to 46, a 4-point decrease.

- Bitcoin gains capital as altcoin performance wanes.

- Ethereum sees major whale investors shifting assets.

According to CoinMarketCap, the Altcoin Season Index fell to 46, indicating fewer altcoins are currently outperforming Bitcoin, as tracked on August 24.

This decline suggests a shift in market sentiment towards Bitcoin, supported by notable whale behaviors and significant on-chain activity impacts.

Altcoin Season Index Drops 4 Points: Bitcoin Takes Lead

CoinMarketCap reported that its Altcoin Season Index dropped to 46, highlighting a shift in market performance. Over the past 90 days, fewer altcoins outpaced Bitcoin in terms of price increases. This metric underscores changes in investor sentiment and market dynamics.

Altcoin performance is softening, leading to more investment in Bitcoin, with large BTC whale transactions being redirected to Ethereum. This highlights significant capital flow adjustments, evident through notable industry actions and allocations. Recent whale activity, including a reallocation from Bitcoin to Ethereum, emphasizes the ongoing strategic shifts.

There have been no official comments from major industry leaders or key opinion leaders about this specific index adjustment. However, whale analysts and cryptocurrency forums have been actively discussing the implications of capital moves and how they might influence the broader market.

“In the past 3 hours, a certain Bitcoin OG whale once again swapped 1,276 BTC for ETH, valued at $1.4709 billion. Now the OG whale holds 221,600 ETH, valued at $1.06 billion.” – Whale Analyst

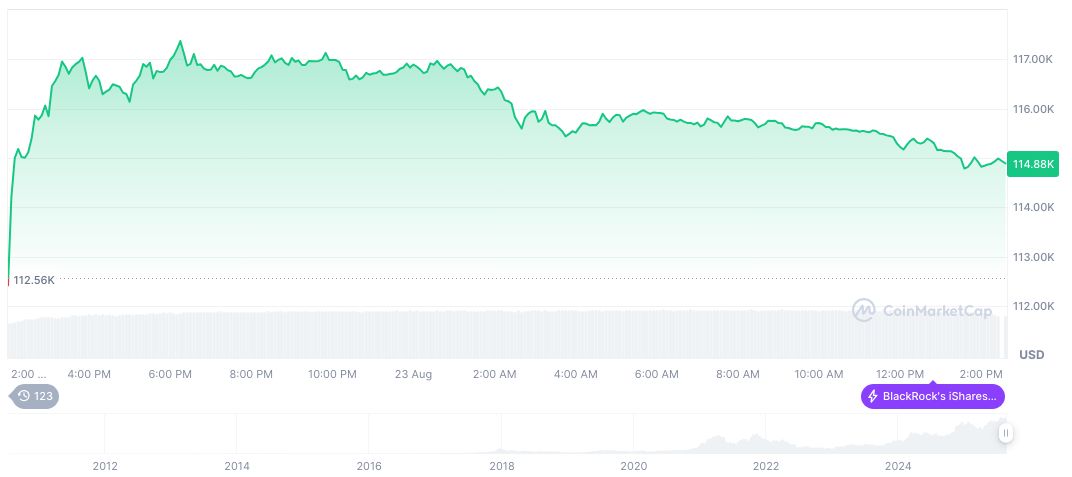

Bitcoin Hits $114,890.14 Amid Strategic Whale Movements

Did you know? The Altcoin Season Index has historically served as a barometer for capital rotation within the cryptocurrency market, with previous lows indicating Bitcoin dominance as seen during similar downturns in June 2022 and May 2023.

According to CoinMarketCap data, Bitcoin (BTC) is priced at $114,890.14, with a market cap of $2.29 trillion and a dominance of 57.53%. The 24-hour trading volume has declined by 37.48%, reflecting recent market shifts. Over the past 90 days, BTC experienced a 4.48% increase. Current circulating supply is 19,910,753 out of a max of 21 million, as of 09:35 UTC, August 24, 2025.

The Coincu research team suggests that the current whale activity and significant on-chain transactions could lead to further consolidation in Bitcoin and Ethereum. These strategic reallocations, supported by historical trends, may influence market stability and investor strategies moving forward.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/altcoin/altcoin-season-index-falls-bitcoin-shift/