- Aether Holdings invests $40M in Bitcoin reserves.

- Bitcoin shows a 0.43% growth over 24 hours.

- Corporate Bitcoin adoption remains a growing trend.

Aether Holdings, identified as a leading financial technology entity, completed a $40 million fundraising round. The majority is designated for purchasing Bitcoin, reflecting the company’s strategic decision to adopt Bitcoin as a treasury reserve. This move, however, lacks direct executive commentary or quotes from Aether leadership on public platforms.

With involvement confirmed, but specifics about investors remaining undisclosed, Bitcoin‘s role stands as central. No details of altcoin purchases or multi-asset allocation emerged. The absence of institutional comments or social media interactions from key leaders creates a gap in broad community awareness. Meanwhile, digital asset markets may show cautious optimism, given the historical sensitivity of Bitcoin acquisitions influencing market dynamics.

Aether Holdings Invests $40M in Bitcoin Reserves

“We are pleased to announce our successful fundraising round aimed primarily at enhancing our treasury reserves with Bitcoin.”

Bitcoin Shows Consistent Growth Amid Corporate Adoption

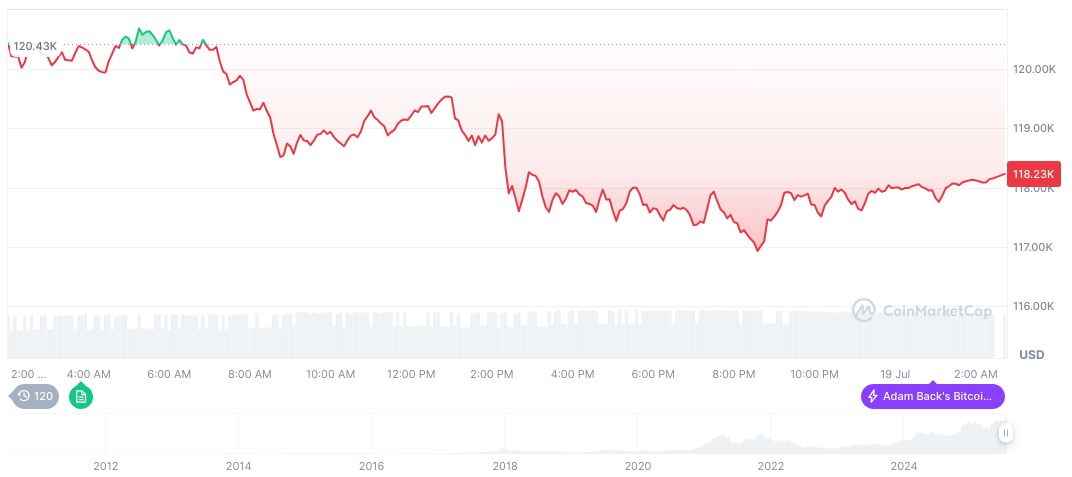

The current price of Bitcoin, at $118,052.43, reflects a steady growth of 0.43% over 24 hours, per CoinMarketCap. With a market cap of $2.35 trillion and dominance at 60.88%, Bitcoin showcases a continued upward trend, growing by 39.59% over 90 days, emphasizing robustness in volatile markets.

Bitcoin Shows Consistent Growth Amid Corporate Adoption

Did you know? MicroStrategy’s similar strategic step in 2020 drew extensive media coverage, propelling interest and trust in Bitcoin as a corporate reserve, encouraging other companies to explore similar reserves.

Coincu research team identifies the potential for expanded Bitcoin adoption among corporates, bolstered by recent institutional reserve allocations. Nevertheless, regulatory developments remain critical, with close monitoring advised. While direct technological impacts are limited, historical patterns indicate possible increased market confidence in Bitcoin-based reserves.

Coincu research team identifies the potential for expanded Bitcoin adoption among corporates, bolstered by recent institutional reserve allocations. Nevertheless, regulatory developments remain critical, with close monitoring advised. While direct technological impacts are limited, historical patterns indicate possible increased market confidence in Bitcoin-based reserves.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349619-aether-holdings-bitcoin-reserves-strategy/