- Aave outperforms Bitcoin but faces key resistance.

- The protocol’s fundamentals are looking good.

Aave [AAVE] continues to lead in the crypto space despite doubts surrounding the revenue models of Decentralized Finance (DeFi) blue chips.

Some industry voices suggest a reevaluation of what qualifies as earnings and expenses in decentralized systems since these protocols are not traditional corporations.

Nevertheless, the AAVE/USDT pair broke a significant 800-day range, causing the pair to trend higher for the past two months, outperforming Bitcoin [BTC] during this period.

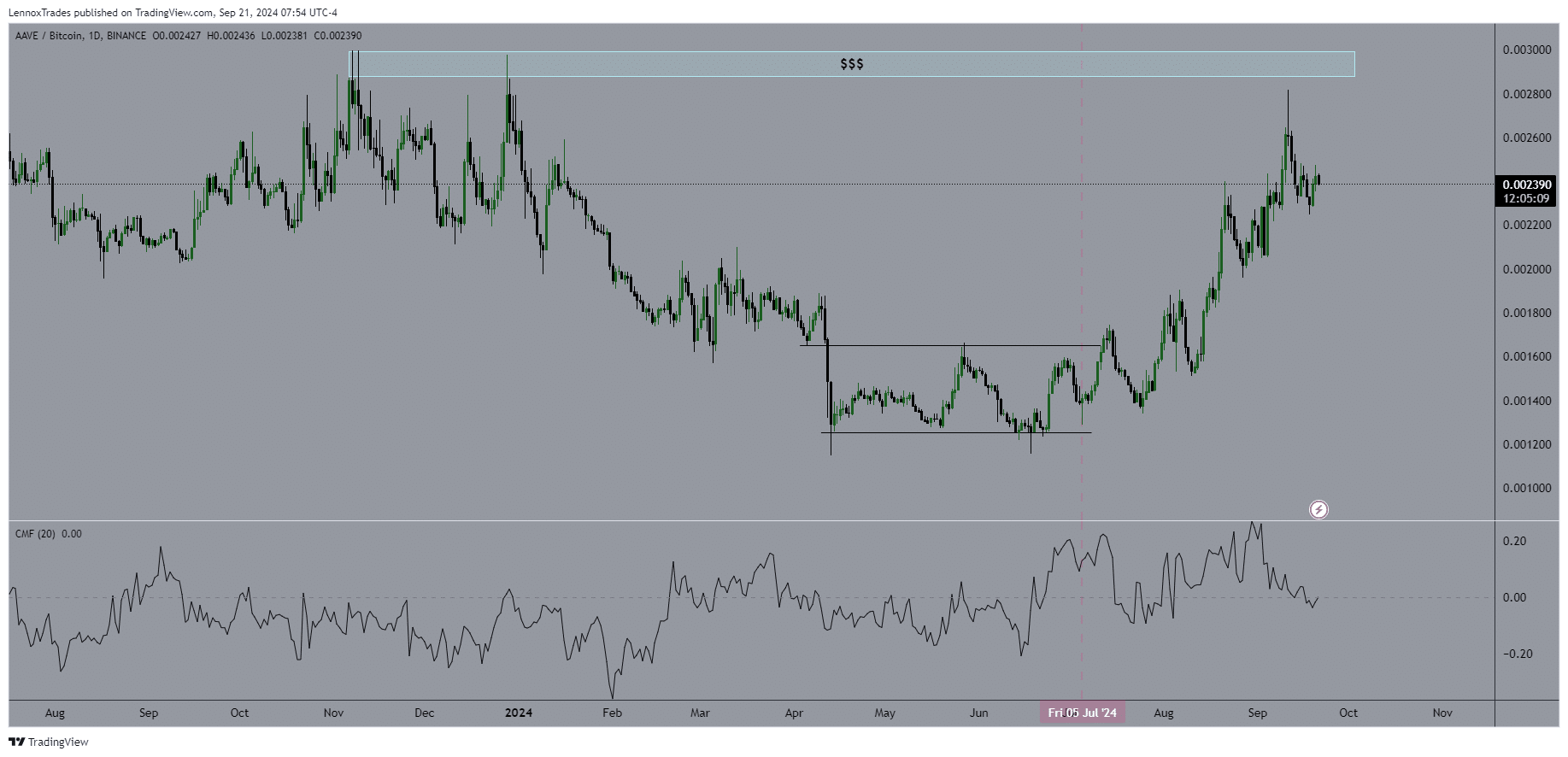

From 18th June, AAVE/BTC has shown higher highs and higher lows, but it recently faced strong resistance near 0.003 BTC zone. This rejection, combined with Bitcoin’s recent performance, has slowed the pair’s rise.

While Aave is expected to continue its upward trend due to strong fundamentals, its pairing with Bitcoin may struggle in the near term.

Source: TradingView

Additionally, the Chaikin Money Flow (CMF) indicator also shows traders taking profits, with money flowing out of AAVE/BTC pair.

However, it’s overall trajectory remains positive, especially when traded against stablecoins, which it is expected to outperform as both AAVE and Bitcoin could surge in Q4.

This could be the start of a reversal of Aave’s BTC pair but is yet to be confirmed since…

Aave’s stablecoin surpassed $150 million

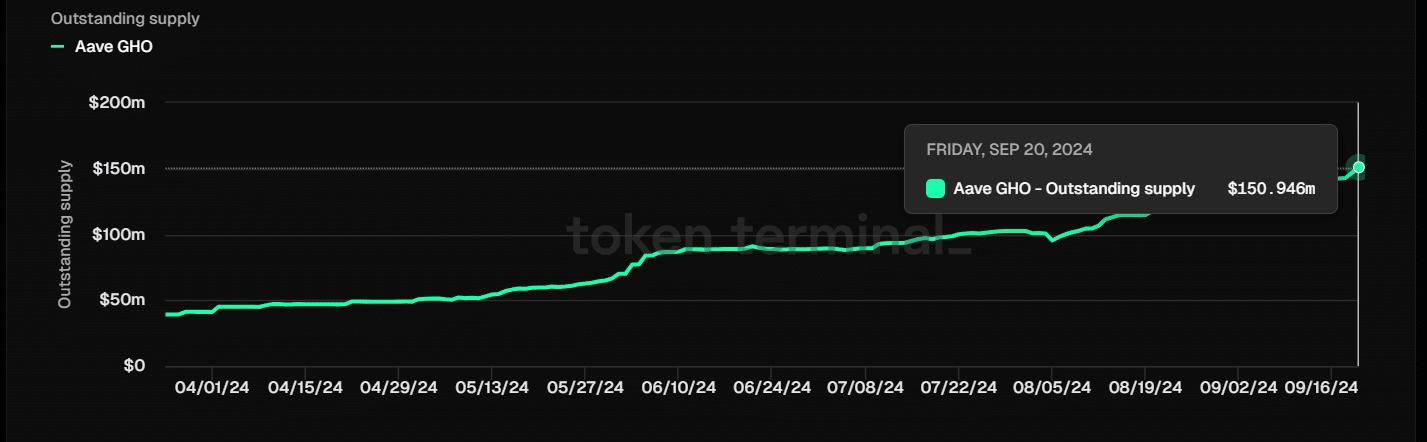

One important factor driving Aave’s bullish momentum is its stablecoin, GHO. GHO has seen steady growth since its launch during a bear market, alongside Curve’s stablecoin (CRV).

In early September 2024, GHO’s supply increased by more than 6.7%, and now has reached a milestone of more than $150 million in outstanding supply.

Source: Token Terminal

Despite CRV having a larger supply than GHO, both stablecoins have potential for significant growth.

As GHO continues to grow, it strengthens the broader Aave protocol and its potential for long-term growth.

Positive OI-weighted funding rates

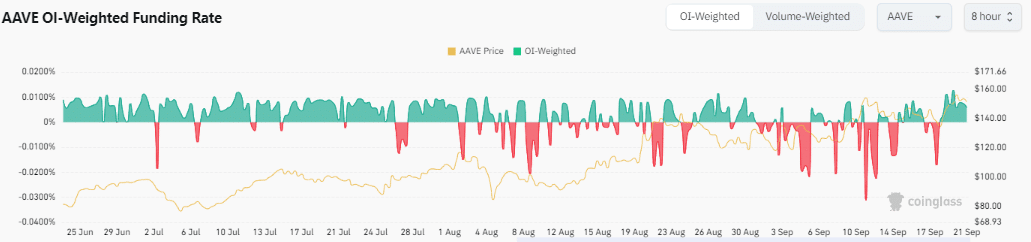

Additionally, the OI-weighted funding rates reflect bullish sentiment. As of the latest data, the rate stood at 0.0058%, indicating that long positions are paying shorts.

Source: Coinglass

This suggests a strong buying demand for Aave and aligns with its positive price outlook. The rising demand highlights that traders remain optimistic about Aave’s price moving higher in the near future.

Sentiment & mindshare on the rise

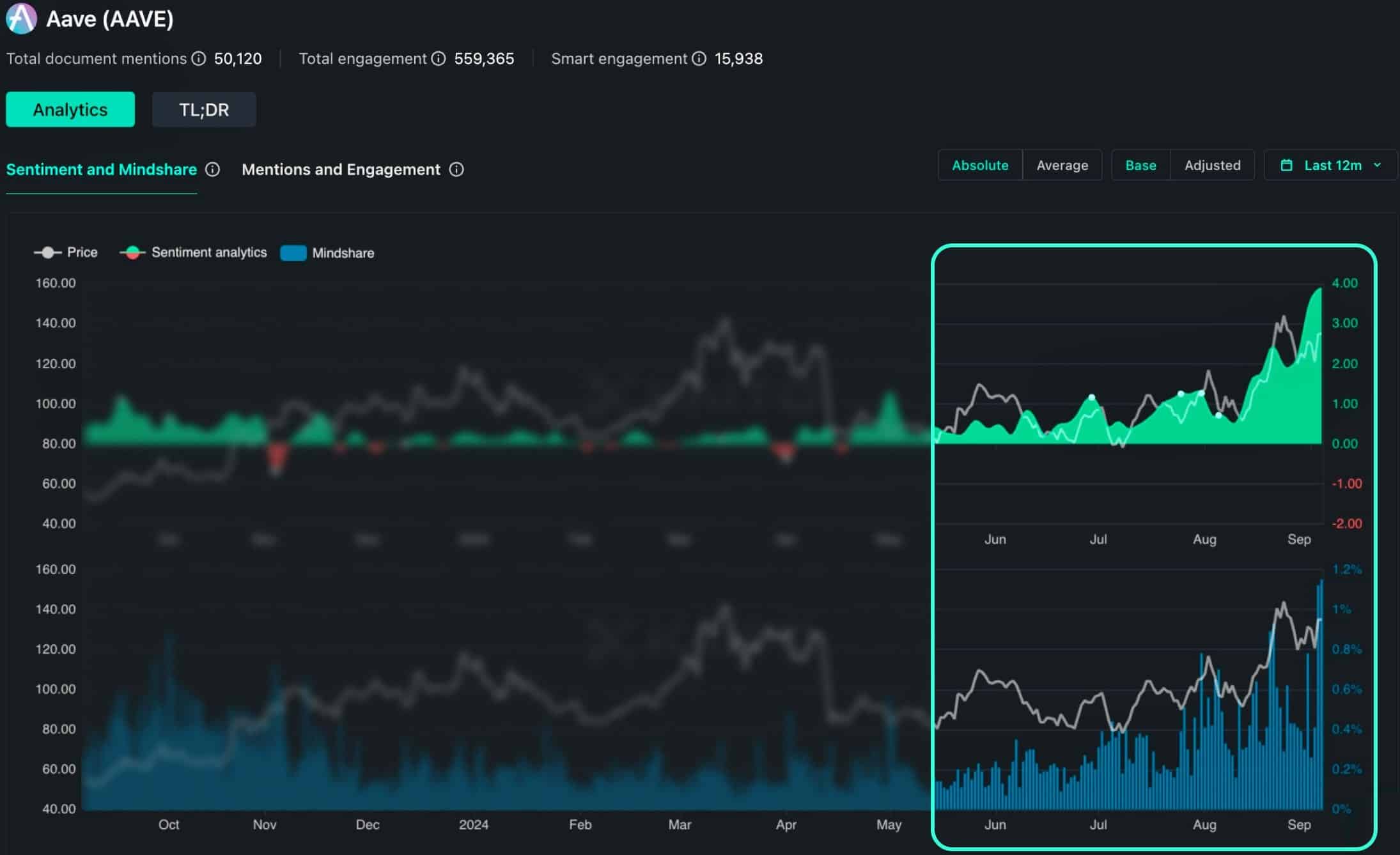

Lastly, Aave’s social sentiment and mindshare are also bullish. Data from Kaito AI platform reveals record-high levels of positivity surrounding Aave.

Read Aave’s [AAVE] Price Prediction 2024–2025

With potential factors like Trump integration, buybacks, and the Sky partnership, Aave is poised for further growth.

Source: Kaito AI

Aave’s overall outlook is strong, especially against stablecoins, signaling a likely rise in its price. It will continue to perform well in the DeFi space, with higher prices ahead.

Source: https://ambcrypto.com/aave-outpaces-btc-but-hits-resistance-is-a-reversal-on-the-horizon/