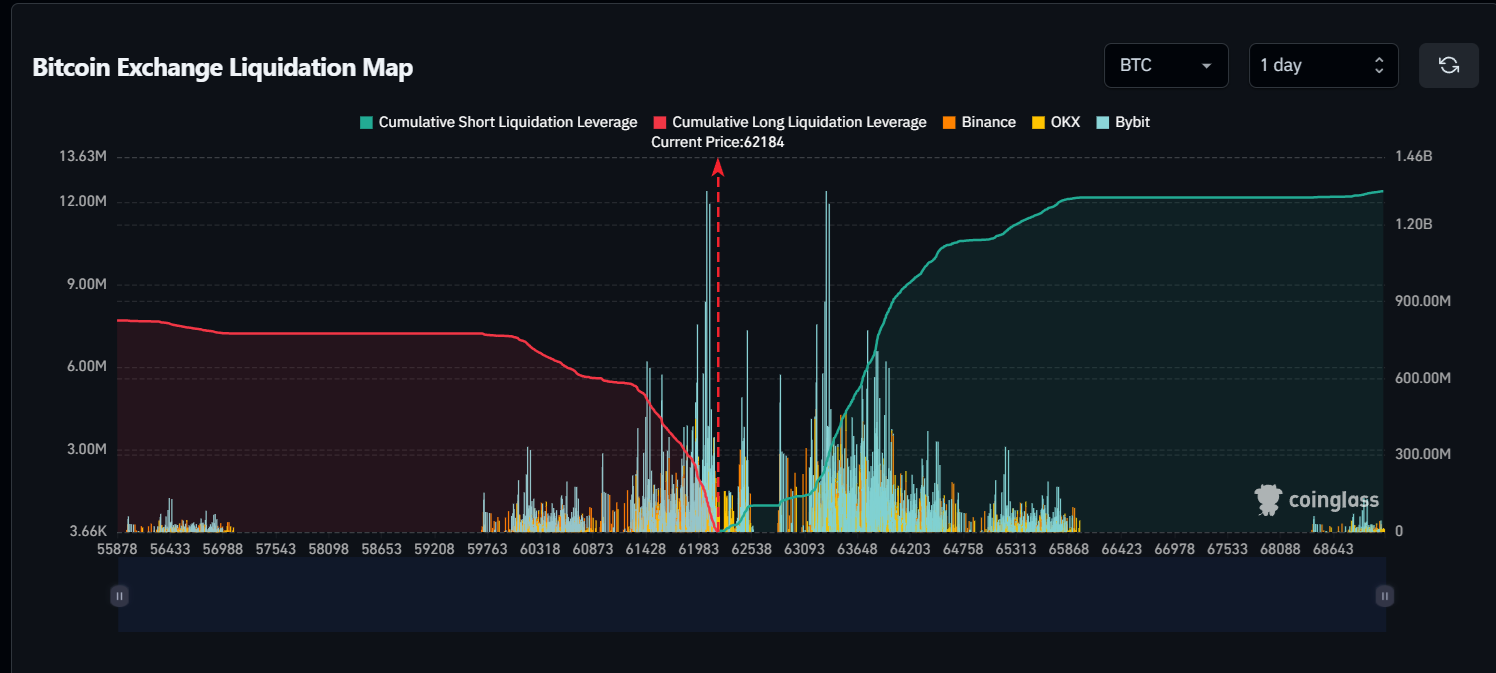

According to the latest data from Coinglass, Bitcoin’s price action could trigger significant liquidation events on mainstream centralized exchanges (CEXs). If Bitcoin’s value drops below $61,000, the cumulative liquidation intensity of long orders could reach a staggering $653 million.

On the other hand, if Bitcoin breaks the $64,000 threshold, short orders could face an even larger liquidation concentration of $848 million.

The liquidation chart provided by Coinglass highlights the relative importance of these clusters, but does not specify the exact number or value of contracts that will be liquidated. Instead, the chart shows the importance of each liquidation cluster compared to neighboring clusters, indicating its strength and potential impact.

The data suggests that these clusters represent critical price levels and how much the underlying price of Bitcoin could be affected if they were to reach these points. A higher “liquidation column” indicates a more intense reaction in price action, reflecting the strength of liquidity waves as Bitcoin approaches these levels.

*This is not investment advice.

Follow our Telegram and Twitter account now for exclusive news, analytics and on-chain data!

Source: https://en.bitcoinsistemi.com/a-653-million-liquidation-could-be-triggered-if-bitcoin-price-falls-below-this-level/