As highlighted by the $9 trillion firm BlackRock, Bitcoin has positioned itself as a pivotal player in the financial landscape.

In a recent publication, Blackrock noted that Bitcoin’s value is derived from several key attributes that distinguish it from traditional forms of money.

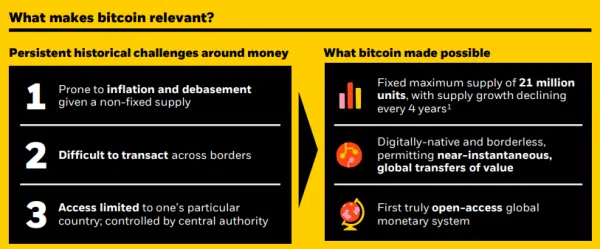

These features have provided solutions to long-standing issues in the monetary system. Notably, Bitcoin’s supply cap of 21 million units ensures that it cannot be easily debased, offering a degree of stability in an inflation-prone world.

Additionally, its digital and global nature allows for near-instant, cost-effective transfers across borders, addressing the inefficiencies of cross-border value transfers.

Furthermore, Bitcoin’s decentralized structure and permissionless access give it a unique advantage, making it the world’s first open-access monetary system. Blackrock stressed that, unlike other financial systems, Bitcoin does not rely on central authorities, which opens up financial inclusion to a broader global population.

Bitcoin’s Position Among Crypto Assets

While the broader crypto space has seen the development of other assets with diverse use cases, Bitcoin remains the most prominent, per the report. The analysis highlights that Bitcoin, due to its unique properties, has cemented its place as a global monetary alternative.

The $9 trillion firm also notes that Bitcoin’s growth trajectory has been substantial over the decade, with its market capitalization surpassing $1 trillion despite fluctuations in its value.

Bitcoin’s Growth and Correction Cycles

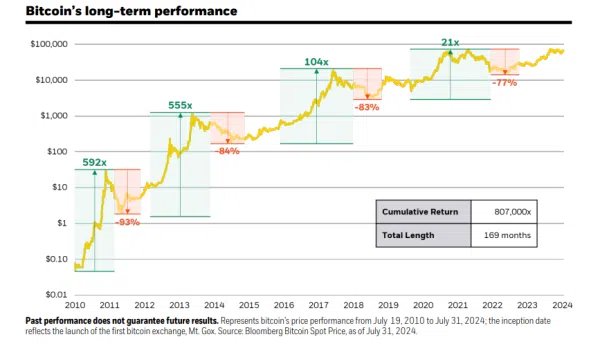

For instance, historically, Bitcoin has shown resilience, rebounding from multiple market corrections to achieve new highs. Blackrock went ahead to share a snapshot of the distinct growth and correction phases.

From 2010 to 2011, Bitcoin experienced a 592x increase, followed by another 555x surge from 2012 to 2014. Subsequent rallies continued in 2016-2018 and 2019-2021, driving Bitcoin’s value to new peaks.

However, each of these price rallies were followed by notable corrections. An example is the 2019 / 2022 rally, followed by a 77% drop. The most significant correction recorded in a cycle was in 2011/2012 when Bitcoin tanked by 93% after a 592X surge.

Meanwhile, Bitcoin boasts a cumulative return of 807,000X through 169 months.

Low Correlation With Equities

BlackRock’s report also emphasizes that Bitcoin has demonstrated a low correlation with other macroeconomic factors, setting it apart from traditional financial assets. Although short-term spikes in correlation occur during market volatility, Bitcoin remains largely independent of equities and other risk assets.

Recall that the U.S. Department of Justice subpoenaed Nvidia in early September, sparking a 10% plunge in its stock and triggering a 2.16% drop in the S&P 500.

This marked one of 2024’s worst trading days as large-cap tech giants faltered. However, Bitcoin weathered the decline better than during the previous month’s market crash.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/18/9-trillion-firm-discusses-why-bitcoin-matters-in-todays-financial-landscape/?utm_source=rss&utm_medium=rss&utm_campaign=9-trillion-firm-discusses-why-bitcoin-matters-in-todays-financial-landscape