Key Takeaways

- 75% of Bitcoin has not moved in over six months, showing a strong holding pattern.

- Increased holding may reduce Bitcoin’s trading supply, potentially driving up prices, but CryptoQuant’s report suggests that Bitcoin could face a miner capitulation.

Around 75% of circulating Bitcoin has stayed dormant for at least six months, according to Glassnode’s HODL Waves chart, which offers insights into the holding behavior of investors over time.

The figure represents an increase from last week, with only around 45% of circulating Bitcoin not being moved over the same period, Glassnode’s data showed.

The high percentage of dormant Bitcoin suggests a strong trend of holding among investors, often associated with a strong belief in Bitcoin’s future value.

Bitcoin’s (BTC) price has been down over 10% over the past month, TradingView’s data shows. However, the flagship crypto still recorded a 12% surge in the last six months. BTC is hovering around $58,000 at press time after losing the $60,000 key level.

With a large portion of Bitcoin unmoved, the liquid supply available for trading is diminished. This could push prices up if demand continues to rise.

On-chain analyst James Check noted that over 80% of short-term Bitcoin holders are currently facing losses, having bought at higher prices. He warned that this could lead to panic selling, similar to patterns observed in 2018, 2019, and mid-2021.

Bitcoin miners may not be done selling

CryptoQuant’s weekly crypto report suggested that Bitcoin miner capitulation might occur throughout the week of August 5 as daily miner outflows surged to 19,000 BTC. Miners might offload their reserves to cope with squeezed profit margins, which had fallen to 25%, the lowest since January 22.

CryptoQuant noted that miners may continue to sell their BTC reserves as they are still underpaid amid price decline and increasing mining difficulty.

“CryptoQuant’s Miner Profit/Loss Sustainability metric is still flagging that miners are underpaid, mostly as mining difficulty has continued to increase (it reached record highs in late July) while prices declined,” the report wrote.

Miner capitulation events historically align with local price bottoms during Bitcoin bull markets, as evidenced in March 2023 following the Silicon Valley bank sell-off and in January 2024 after the debut of US spot Bitcoin exchange-traded funds.

Bitcoin established a record high of $73,000 in mid-March this year ahead of the fourth halving, which was considered different compared to previous cycles.

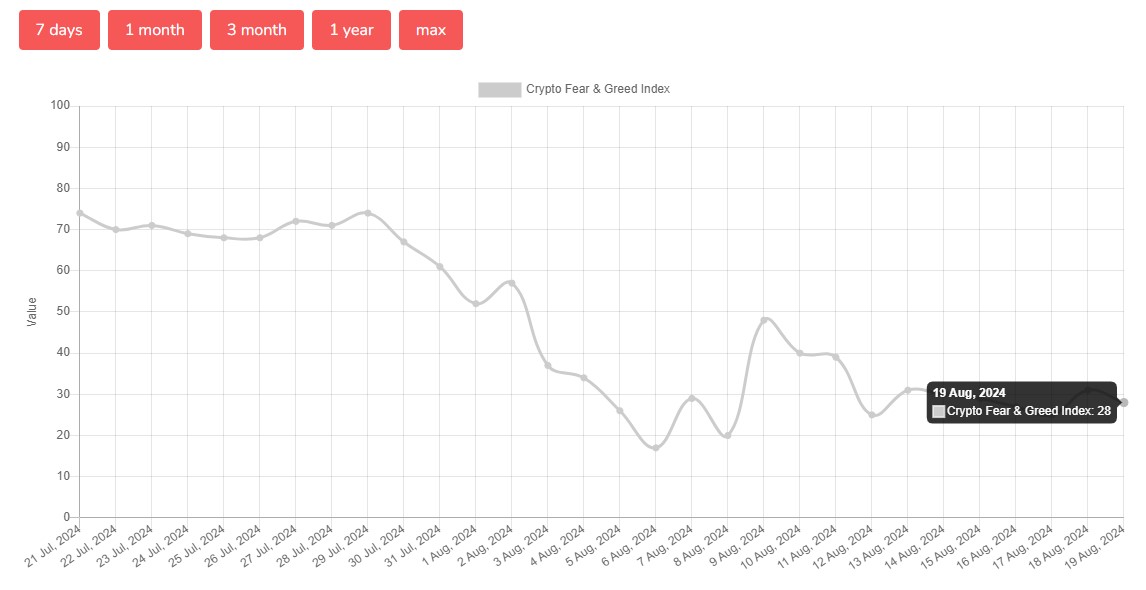

The overall market sentiment has not improved yet. According to Alternative.me, the Bitcoin Fear & Greed Index plunged to 28 on August 19, shifting from “extreme fear” observed earlier this month to “fear.”

Source: https://cryptobriefing.com/bitcoin-holding-trend-analysis/