- Whales have started buying more Bitcoin, spending tens of millions on acquisitions over the past few months.

- Market sentiment shows these whales might be holding the asset for the long term.

Bitcoin [BTC] has maintained a steady threshold in the market, moving within a tight range and recording no significant gain—only up to 1% in the past month.

New market insight suggests that sentiment could soon shift, with Bitcoin potentially rising in value as whales continue to accumulate the asset.

Whale interest in Bitcoin rises

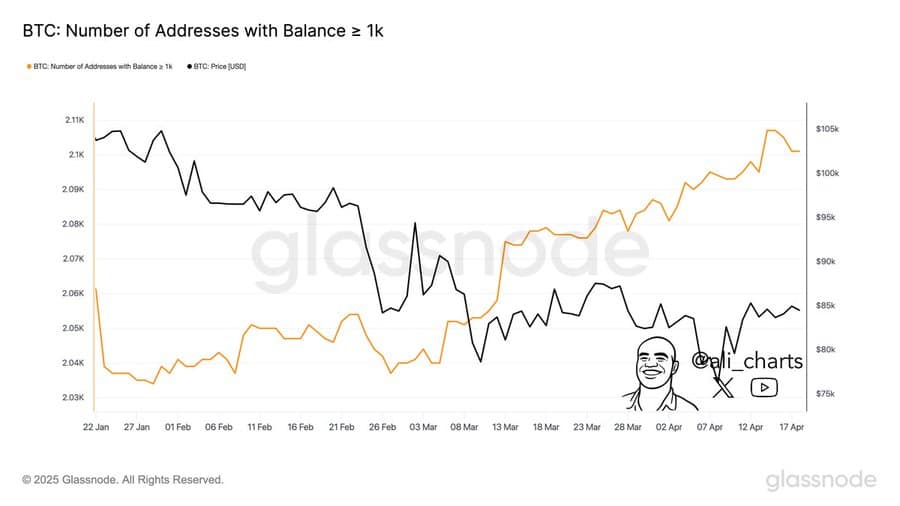

Whales, known to control a significant portion of any asset, have shown renewed interest in Bitcoin over the past few months.

Since early March, analysis shows new whales have entered the market and started acquiring Bitcoin. So far, 60 of these investors have each purchased no less than 1,000 Bitcoin, totaling approximately $85 million.

Source: Glassnode

Naturally, this influx came while BTC traded well below its all-time high, hinting at undervaluation in the eyes of large investors.

This increase in whale participation is also noteworthy given the overall decline in crypto market liquidity.

In just the past two weeks, capital inflow has dropped from $8.2 billion to $2.38 billion.

With shrinking funds entering the market, assets receiving liquidity become more interesting, as they are likely to outperform others. Whale activity in BTC confirms it may continue to lead market gains.

Institutions and key whales are making moves

Having said that, it wasn’t just whales buying the dip.

AMBCrypto analysis identified one whale taking advantage of Bitcoin’s recent price decline to accumulate a significant amount of the asset.

According to insights from Arkham Intelligence, a whale identified as “Abraxas Capital Mgmt” has been actively acquiring Bitcoin.

Since the beginning of April, this whale has grown its Bitcoin holdings from $2.8 million to $253 million, confirming strong investor bias toward the asset.

Interestingly, under a different address, this whale also holds another $43 million in LBTC, bringing its total to $296 million.

Source: CoinGlass

Institutional investors have also slowed their selling and ended the week with inflows into Bitcoin ETFs (exchange-traded funds). Analysis shows this group bought $106.90 million worth of BTC by week’s end.

If accumulation by whales and institutions continues, Bitcoin’s value could rise, potentially leading to a rally.

Long-term traders are buying

To determine whether this accumulation is temporary or sustainable, AMBCrypto examined the behavior of long-term holders.

Using Bitcoin’s Coin Days Destroyed (CDD) metric which indicates whether long-term holders are selling or holding, AMBCrypto found the latter to be true.

Source: CryptoQuant

Currently, the CDD trended near zero—implying long-term holders were not selling. In fact, they’ve continued to hold their positions, even through market chop.

With whales accumulating, institutions rotating back in, and long-term holders staying put, Bitcoin has emerged as the primary liquidity magnet in a drying market.

If these tailwinds persist, BTC may not just hold steady—it could be gearing up for its next rally.

Source: https://ambcrypto.com/60-new-bitcoin-whales-are-loading-up-what-secrets-do-they-know/