Key Takeaways

Why has retail participation fallen so dramatically?

The arrival of ETFs in January 2024 was a major cause for the fall in small investor participation in Bitcoin flows to exchanges.

What does it mean for Bitcoin?

It will not affect Bitcoin or its price trends, though it does highlight how reality has shifted dramatically from the original vision that Satoshi had for Bitcoin.

Bitcoin [BTC] faced another wave of selling pressure on Monday, the 3rd of November. An earlier AMBCrypto report noted that this could be the early phase of a broader unwind, driven by stretched leverage and fading sentiment.

There was a risk of a deeper flush. The build-up of stablecoin firepower could catalyze a bullish reversal, and the recent weeks’ price action could be yet another market bottom.

Of course, the large liquidations last month left new investors hesitant to step in.

Retail participation has been dropping, but it was not just the recent chaos that has driven smaller participants away from onchain activity.

Charting the Bitcoin inflows from retail investors

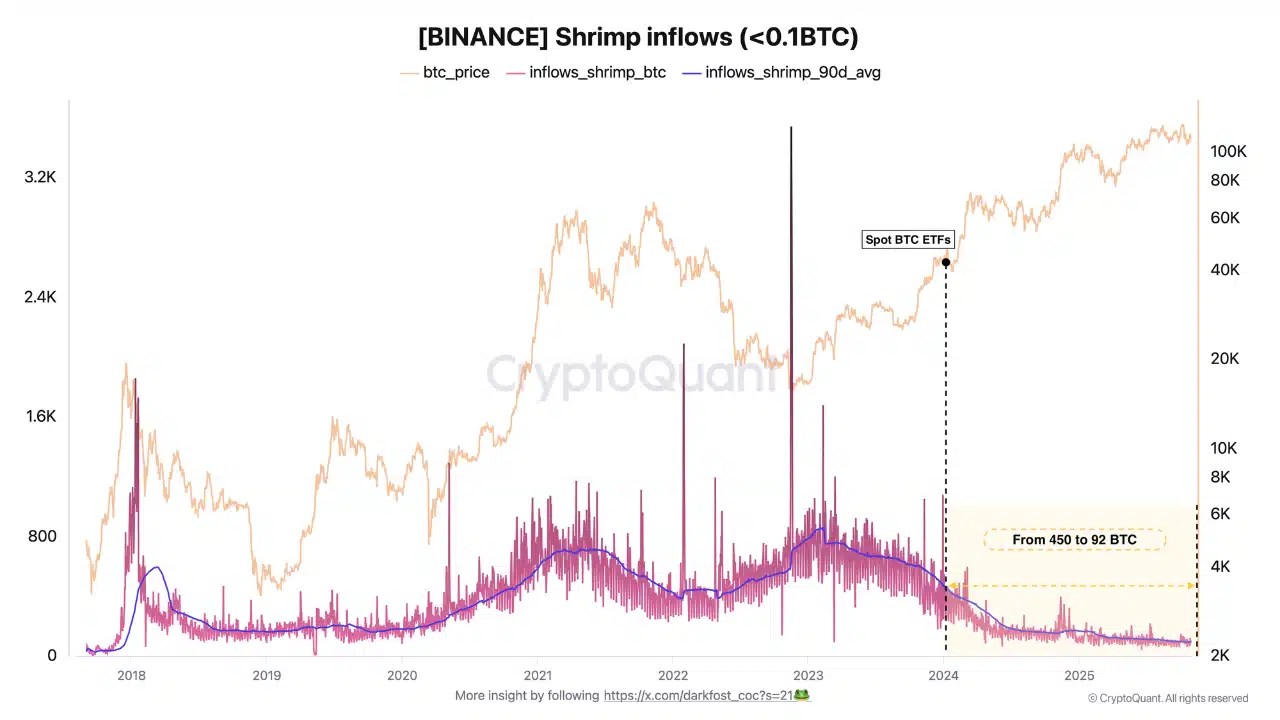

The collapse in retail participation was not sudden and catastrophic, but steady and drawn out. In a post on CryptoQuant Insights, user Darkfost pointed out how retail inflows have fallen to just 20% of what they had been in early 2024.

Source: CryptoQuant Insights

Using the 90-day moving average of shrimp inflows to Binance, Darkfost observed that the launch of Spot Bitcoin ETFs in January 2024 accelerated the drop. For the uninitiated, these investors hold less than 0.1 BTC.

Average daily inflows sank from about 450 BTC early in the year to just 92 BTC at press time.

On top of that, this aligns with broader on-chain evidence showing smaller investors have been less active even as prices rallied.

Shrimp addresses hit slowdown

Source: Glassnode

AMBCrypto’s review of Glassnode data confirmed the number of addresses holding at least 0.1 BTC stalled after a strong 2022 run. The count rose steadily until late 2023, reaching 4.58 million, but has since slipped to 4.44 million.

That slowdown implied many retail users shifted to ETF exposure rather than buying Bitcoin directly and moving it off exchanges. It suggested a structural shift in how newcomers gain BTC exposure.

Shrimp impact fades as institutions rise

Source: CryptoQuant

The effect of falling small investor participation was likely negligible.

Since 2023, the lowest 7-DMA BTC inflow to Binance was 3,936.4 BTC in early July 2025. This was an order of magnitude bigger than the inflows from shrimp addresses by the end of 2023.

Shrimp-sized transactions no longer move the market needle. Institutional dominance and ETF vehicles have changed how retail interacts with the network.

The original vision of Bitcoin was to be used as a permissionless, peer-to-peer electronic cash. Much has changed in recent years, yet Bitcoin continues to function, though it does differ now from what Satoshi might have imagined.

Source: https://ambcrypto.com/450-btc-to-92-btc-analyzing-the-biggest-drop-in-bitcoin-retail-inflows/