In Brief

- $215M in BTC shorts mark 2025’s largest negative volume spike on Binance.

- Institutions accumulate 944K BTC YTD, surpassing 2024’s total amid supply drop.

- ETF exposure surges 63K BTC, hinting at renewed long-term confidence and demand.

Short interest surged on Binance, with over $215 million in net BTC shorts recorded in just a few hours. This marks the largest negative Net Taker Volume spike of 2025, signalling growing bearish sentiment and excessive positioning.

Over $130 billion was wiped from the crypto market in 24 hours, led by Bitcoin’s 2.7% decline to $123,000. Ethereum dropped 4.83%, BNB lost 5.43%, and Solana slid 3.71%, reflecting broad risk-off sentiment and heightened volatility.

Across major exchanges, short positions dominate, with Binance showing 53.83% short exposure and $15.14 billion in shorts. Bybit and OKX reflect similar trends, with total market short volume outpacing long exposure by over $4.5 billion.

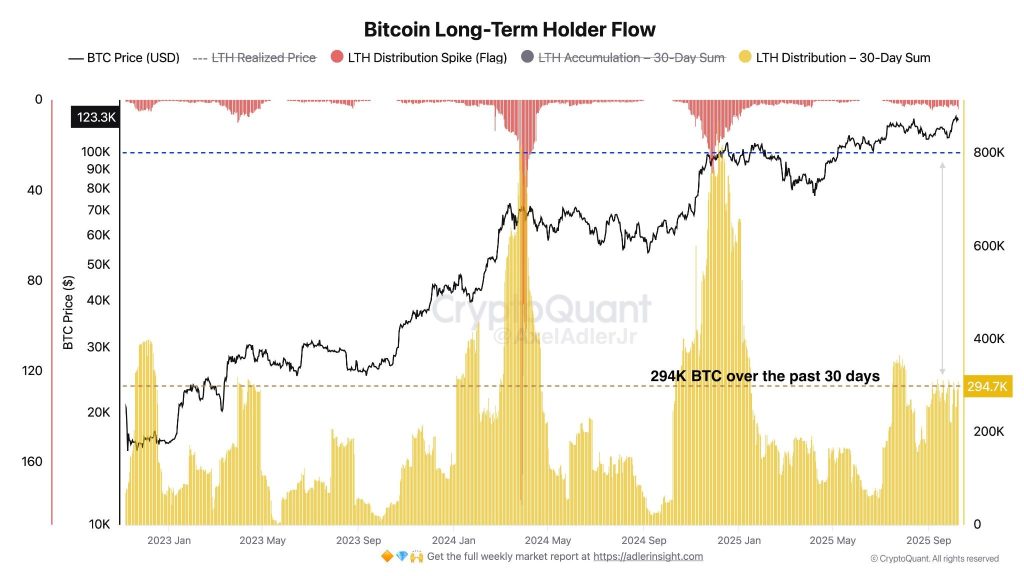

On-chain data from CryptoQuant shows long-term holders sold 295,000 BTC in the past 30 days, averaging 9,800 BTC daily. While elevated, this remains below historical peaks and suggests profit-taking rather than full-scale distribution.

A large whale reportedly sold 3,000 BTC, shorted $80M worth on Hyperliquid, and moved $50M USDC to Binance. This coordinated selling adds pressure, but could set the stage for a potential technical bounce if liquidity remains stable.

Institutional Accumulation Hits Yearly High as ETF Exposure and Scarcity Grow

Despite bearish positioning, institutional demand has accelerated, led by ETF and derivatives exposure growing by 63,083 BTC in one week. K33 Research confirms this as the largest institutional accumulation of 2025, signalling strong confidence in long-term price appreciation.

Additionally, Bitwise reports institutions have bought 944,330 BTC year-to-date, already surpassing 2024’s full-year total of 913,006 BTC. In contrast, new Bitcoin supply dropped to 127,622 BTC in 2025, down from 217,771 BTC last year.

This widening gap underscores increasing scarcity as demand outpaces supply at an unprecedented scale in the digital asset market. Meanwhile, nearly 60% of institutional investors plan to increase crypto exposure in 2026, according to State Street.

If short positions unwind and spot demand holds, the stage may be set for a strong rebound driven by institutional momentum. The contrasting forces now define a critical turning point for market direction as Q4 gains traction.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/215m-btc-shorts-pile-up-on-binance-but/