- Bernstein analysts envision Bitcoin peaking at $200,000 by 2025.

- Amid inflation concerns, BTC emerges as a safe-haven asset.

After the ‘Uptober’ rally took the market by storm, Bitcoin’s [BTC] price has experienced a slight dip. However, analysts at Bernstein Research remain optimistic, issuing a bullish forecast for the cryptocurrency.

Matthew Sigel, Head of Digital Assets Research at VanEck, shared key insights from Bernstein’s report titled “From Coin to Compute: The Bitcoin Investing Guide” on X.

The report projects Bitcoin to reach an ambitious target of $200,000 by next year.

Analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia identified key factors driving their price target for BTC, stating:

“The new institutional era, in our view, could push Bitcoin to a high of $200,000 by the end of 2025.”

Worth noting that the king coin has appreciated by around 110% over the past year, according to CoinMarketCap.

At the time of writing, its market capitalization stood at $1.3 trillion, comprising over half of the total global crypto market cap of $2.32 trillion.

Institutional adoption fuels Bitcoin’s growth

Bernstein’s extensive 160-page “Black Book” emphasized the significant role institutional investors are playing in Bitcoin’s present and future growth.

According to the report, ten global asset managers now hold over $60 billion in BTC through regulated exchange-traded funds (ETFs). This marked a sharp rise from just $12 billion in September 2022.

Moreover, Bitcoin ETFs have seen one of the most successful rollouts in ETF history, attracting $21 billion in inflows year-to-date.

AMBCrypto recently reported that the top BTC ETF, IBIT, has surpassed Vanguard’s VTI, taking third place in YTD flows.

In light of this substantial institutional interest, Bernstein’s report highlighted:

“By the end of 2024, we expect Wall Street to replace Satoshi as the top Bitcoin wallet.”

Eric Balchunas, senior ETF analyst at Bloomberg, also shared this sentiment. For reference, Satoshi Nakamoto, the creator of Bitcoin, is believed to hold around 1.1 million BTC.

The evolving Bitcoin mining industry

In addition to institutional adoption, the report shines a spotlight on the mining industry, which is expected to recover following the April 2024 halving event.

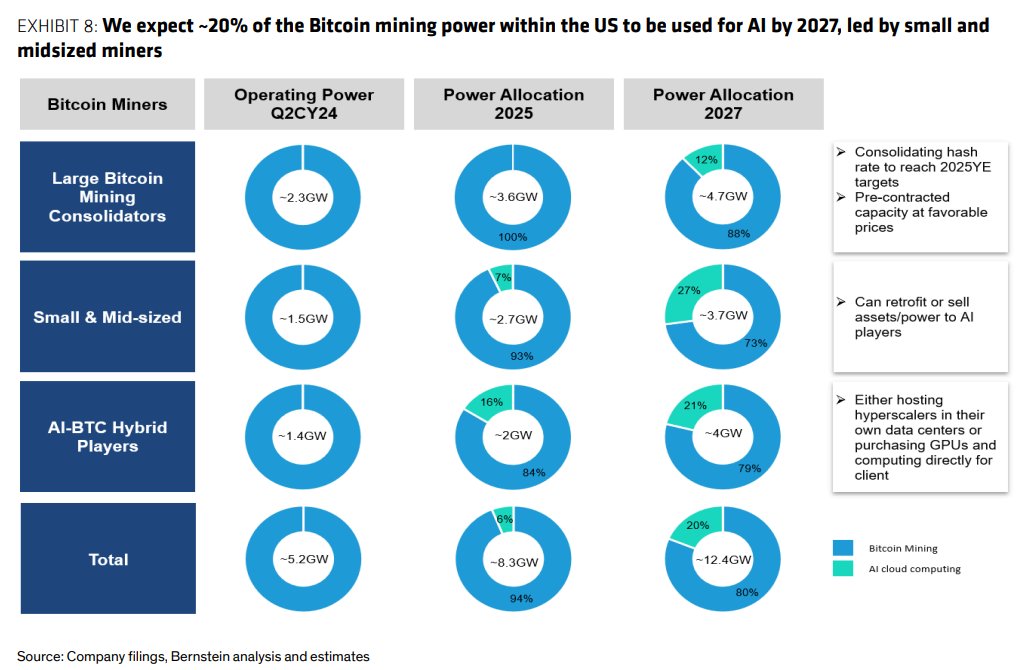

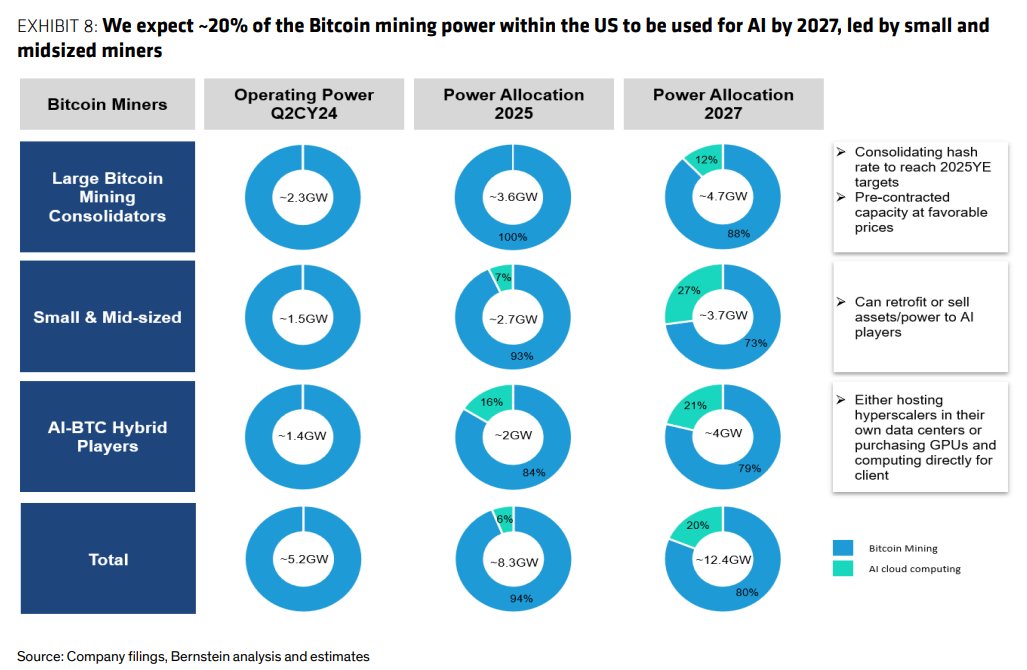

It noted that leading U.S. miners are consolidating their market share and emerging as key energy infrastructure players for AI data centers.

Bernstein’s report forecasts that by 2027, more than 20% of U.S. Bitcoin mining power could be dedicated to AI, with smaller miners driving this shift.

Furthermore, revenue from the Bitcoin mining hardware industry is projected to reach over $20 billion over the next five years.

Source: Matthew Sigel/X

A ‘conservative’ price estimate?

Meanwhile, Chhugani, one of the report’s lead analysts, referred to the $200,000 Bitcoin price prediction as a “conservative estimate,” citing the rising U.S. debt levels.

With the national debt surpassing $35 trillion, Bitcoin’s limited supply makes it an increasingly attractive store of value.

Previously, high-profile investors like Paul Tudor Jones also advocated for Bitcoin as an inflation hedge.

Amid the backdrop of these factors, Bitcoin reaching $200,000 by 2025 seems increasingly plausible.

Source: https://ambcrypto.com/200000-bitcoin-by-2025-bernstein-sees-a-bullish-future-for-btc/