- Bitcoin price consolidates near $120,800 resistance, with $124,500 in focus if breakout strength holds.

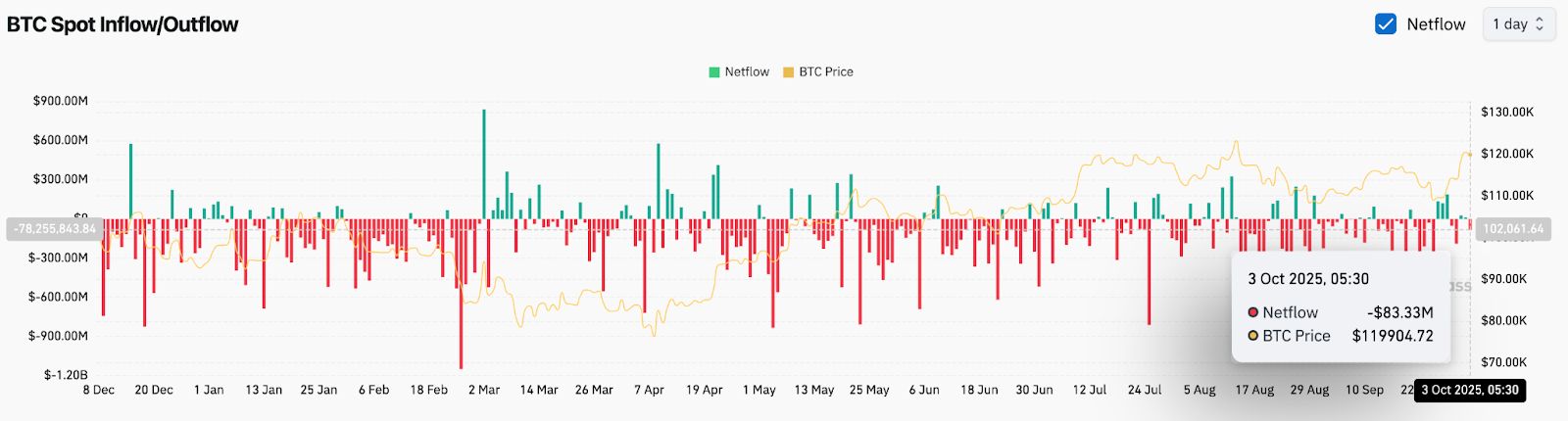

- On-chain data shows $83M in net outflows, signaling accumulation despite mixed September flows.

- MicroStrategy’s $77.4B Bitcoin holdings reinforce institutional confidence and boost market sentiment.

Bitcoin price today is trading at $119,996, consolidating just under the $120,800 resistance cluster after an explosive rally from $111,000. The recovery has put BTC back at its highest levels in weeks, but momentum faces a key test at the 0.786 Fibonacci retracement and the descending trendline.

Bitcoin Price Faces Resistance At Fibonacci Levels

The daily chart shows Bitcoin staging a sharp rebound from the $111,300–$112,000 zone, aligning with the 0.236 Fibonacci retracement and long-term ascending trendline support. Price now trades near $120,800, where the 0.786 Fibonacci level intersects with the upper boundary of the descending channel.

A sustained close above this ceiling would confirm bullish continuation, opening the path to retest $124,500, the previous cycle high. On the downside, immediate support rests at $117,900 and $115,900, while a deeper retracement risks revisiting $111,000.

Momentum indicators remain constructive. The RSI has pushed into bullish territory without entering overbought conditions, while the MACD histogram has flipped positive, suggesting upside pressure is regaining strength.

Related: Ethereum Price Prediction: Analysts Predict Breakout as U.S. Tax Exemption Boosts Confidence

On-Chain Flows Show $83M Outflow

Exchange flow data underscores investor positioning behind this rebound. On October 3, Bitcoin recorded a net outflow of $83 million, marking one of the stronger daily withdrawals in recent weeks.

Outflows at elevated price levels often signal accumulation, as coins move into cold storage rather than trading venues. This aligns with the recent spot price rally, with traders positioning for further upside despite volatility. However, flows remain inconsistent, with alternating inflows and outflows earlier in September reflecting cautious conviction among larger holders.

MicroStrategy’s Holdings Provide Institutional Tailwind

A major fundamental catalyst came from MicroStrategy’s disclosure of a record $77.4 billion in Bitcoin net asset value, highlighted by executive chairman Michael Saylor. The company’s long-standing treasury allocation has grown into one of the largest corporate crypto positions in history, reinforcing institutional confidence in Bitcoin’s long-term value.

This development has provided a significant tailwind for market sentiment. It emphasizes the growing role of listed corporations in legitimizing Bitcoin as a strategic reserve asset. Traders are drawing parallels with earlier cycles where corporate adoption acted as a catalyst for higher valuations.

Related: Shiba Inu Price Prediction: SHIB Bulls Target Breakout Above $0.00001271

Technical Outlook For Bitcoin Price

Bitcoin’s technical roadmap remains finely balanced between breakout potential and retracement risk. Key levels are defined as follows:

- Upside targets: $120,800, $124,500, and $127,000 if momentum continues.

- Downside support: $117,900, $115,900, and $111,300 as critical defense zones.

- Trendline support: $107,200 as the deeper structural floor.

Outlook: Will Bitcoin Go Up?

The path forward for Bitcoin depends on whether buyers can decisively break the $120,800 barrier. On-chain data shows healthy outflows supporting accumulation, while MicroStrategy’s $77.4 billion holdings have amplified institutional credibility.

Analysts remain cautiously optimistic. A breakout above $124,500 would likely trigger momentum toward $127,000, while failure to hold $117,900 could shift focus back to the $111,000 base. For now, Bitcoin’s cycle outlook remains intact as long as it holds above its rising trendline support.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.