This insight comes from an examination of Bitcoin’s on-chain data, offering a granular look at how the digital asset is being redistributed among its diverse investor base.

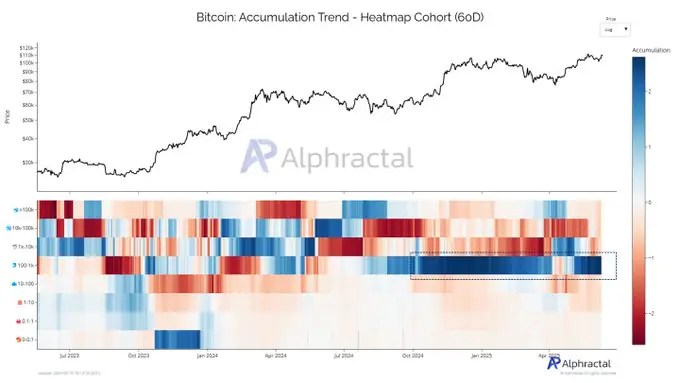

Wedson’s report, based on the Accumulation Trend – Heatmap Cohort, which tracks net changes across various address ranges over a 60-day period, reveals a consistent pattern of accumulation solely from the Dolphin cohort throughout 2025. This group, potentially representing companies, investment funds, or experienced long-term holders, seems to be strategically increasing their Bitcoin positions.

Historically, this Dolphin cohort’s accumulation behavior has shown intriguing parallels. A significant wave of BTC inflows into these addresses coincided with the peak of Bitcoin’s euphoric rally in April 2021. A similar pattern, marked by substantial inflows, was observed in December 2024. Interestingly, despite lighter accumulation in 2021, Bitcoin reached new all-time highs just a few months later, suggesting a potentially similar scenario could be unfolding now.

In contrast to the Dolphins, addresses holding over 1,000 BTC, often referred to as “whales,” have been in a distribution phase. Since July 2024, these larger holders have reduced their balances by more than 546,000 BTC. Wedson highlights a persistent trend of decreasing whale balances since Tesla’s significant BTC purchase in early 2021, prompting questions about potential behind-the-scenes movements or the increasing dominance of exchange wallets in top address rankings.

Regardless of the motivations of the larger holders, the data clearly shows a rapid increase in the BTC balance held by the 100–1,000 BTC addresses. This accumulation by the Dolphin cohort suggests a strategic positioning by a significant segment of the market.

Wedson plans to further explore these trends in future analyses, promising to delve into public interest signals like SEC document mentions, over-the-counter (OTC) desk activity, and Cumulative Volume Delta (CVD) by order size to provide a more conclusive understanding. He also emphasized the importance of evaluating the flow of Bitcoin from large to smaller addresses, citing the Coinbase activity in 2018 as a historical precedent for upcoming discussions.

Source: https://coindoo.com/market/100-1000-btc-wallets-accumulate-amidst-widespread-selling/