- LDO contributed massively to VC funds portfolios.

- However, the overall velocity of LDO declined.

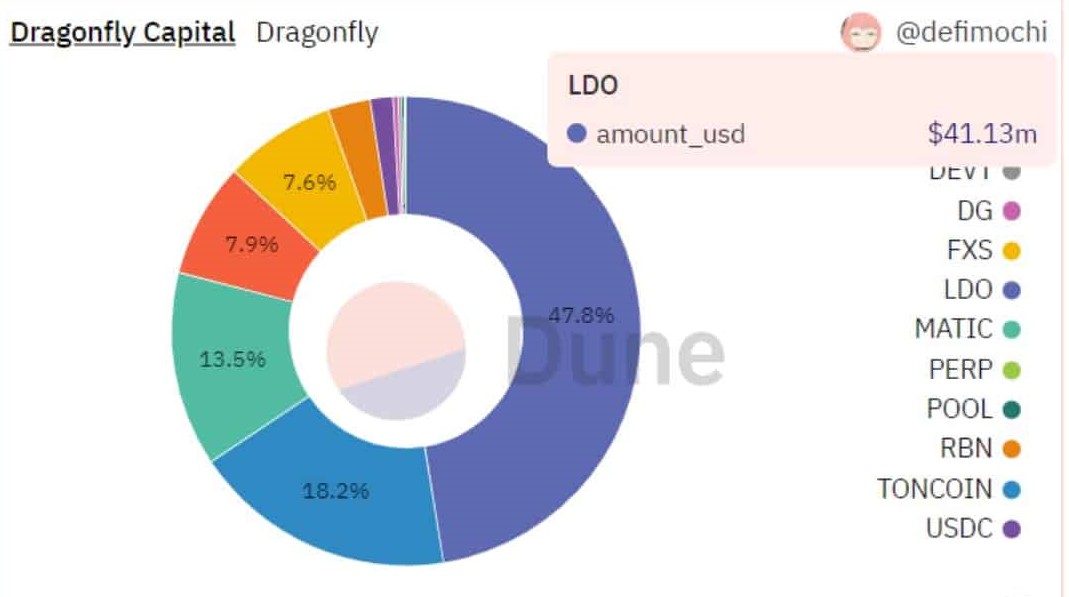

Major VCs (Venture capital) such as Dragonfly and Wintermute observed massive gains in their portfolio over the last few months. According to new data, it was observed that LDO was a prominent token in their respective portfolios.

Dragonfly’s portfolio grew by 39.2% over the last month, it was holding more than 41 million LDO. This was almost half of their overall portfolio.

For Wintermute LDO made up 17% of its $89 million portfolio. However, the fund that profited most was Paradigm. Their portfolio consisted of 90% LDO tokens. And, they saw it grow by 40% in the past month.

Is your portfolio green? Check out the LDO Profit Calculator

Whales shy away

These VC funds have managed to increase their profitability, but investors should proceed with caution.

Over the last month, the overall velocity of LDO declined, this implied that the frequency with which LDO was being traded, went down.

Along with that, the percentage of large addresses holding LDO also decreased. Thus, whales were losing interest in the LDO token.

However, new addresses continued to get attracted to LDO as network growth saw an uptick.

Lido rakes in the cash

Furthermore, the number of unique depositors on Lido increased according to Dune Analytics. 123,840 unique depositors were present on the Lido protocol, at the time of writing.

Coupled with that, the number of unique users on the protocol also increased by 38.06%.

Due to this, the revenue generated by Lido also increased by 32% according to Messari’s data.

How much are 1,10,100 LDOs worth today?

This spike in revenue contributed to Lido’s treasury which surged of late. However, it appeared that the treasury funds weren’t being put to use as the number of code commits being made on the Lido protocols GitHub had declined.

A declining number of code commits suggested that Lido’s developers weren’t actively working on any upgrades or updates on the protocol.

Overall, it appears that funds have managed to profit from the LDO token. Even though the protocol has shown improvements, on-chain metrics do suggest that investors should be cautious while buying LDO.

If Lido manages to capitalize on its dominance and invests its treasury funds into the protocol’s developments, the future could look bright for both the token holders and the protocol.

Source: https://ambcrypto.com/ldo-contributes-massively-to-vc-portfolios-but-heres-the-catch/