Ethereum price in recent times has displayed a sense of stability as the asset after coiling up above $1500, stands strong despite a couple of strong bearish attacks. Even during the recent rounds of Tesla selling 75% of their BTC reserves, Ethereum successfully maintained $1500 levels, and hence after a brief consolidation, the asset is expected to make a large move soon.

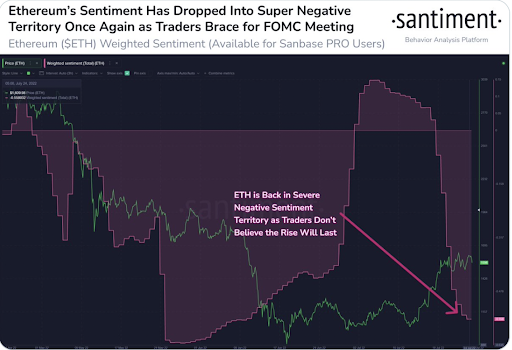

In a recent update, the traders’ trust in the most stable crypto appears to have shaken to a large extent. According to the data from Santiment, most of the traders believe the currently elevated prices are short-lived and hence the ETH-weighted sentiment fell drastically.

This indicates that the traders are not believing in the hype and are expecting the ETH prices to fall ahead of the FOMC meeting. Therefore, the ETH prices are expected to remain highly volatile for the next 24-48 hours. However, the volatility is not expected to drop the price lower but instead gives a strong push upward.

While the market sentiments are pretty bearish, Ethereum’s price displays the possibility of hitting levels beyond $1800 in the coming days. Mainly due to the reason that ETH price is trading within a bullish flag and may undergo a strong breakout very soon. With the breakout, the asset may reach the immediate resistance above $1800 very soon.

Collectively, despite the negative market sentiments, Ethereum chart formations are pretty positive. Therefore, extreme price action may be witnessed in the coming days, where the ETH price may pull a significant le, while the direction remains misty at the moment.

Was this writing helpful?

Source: https://coinpedia.org/price-analysis/ethereumeth-price-tumble-down-ahead-of-fomc-meeting-whats-next/