Bitcoin Analysis

Bitcoin’s price sold off to lower prices for the fourth consecutive day and closed its daily candle on Sunday -$148.1.

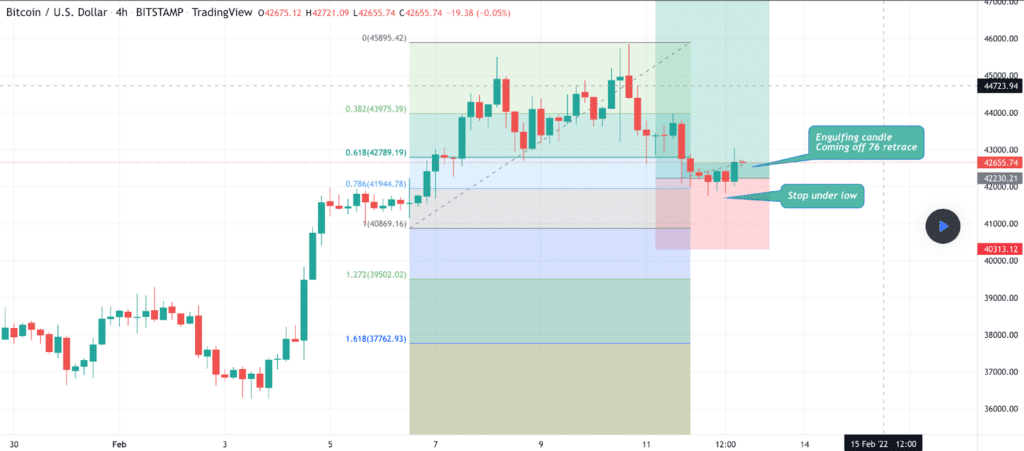

The first chart we’re analyzing today is the BTC/USD 4HR chart below from holeyprofit. After rejecting a full retracement on the 4HR timescale at $45,895.42, BTC’s price trended lower over the weekend.

Now bitcoin bulls are trying to hold the 0.786 fib level [$41,944.78] and then regain the 0.618 [$42,789.19]. If they can reclaim the 0.618, they’ve got a secondary target of 0.382 [$42,975.39] before a retest of the $46k level.

Bearish BTC market participants are conversely looking to push BTC’s price below the 0.786 level and retest 1 [$40,869.16]. If they’re successful, they’ve got a third target of 1.272 [$39,502.02]. The last target to the downside on this 4HR chart for bears to target is 1.618 [$37,762.93].

The Fear & Greed Index is 46 Fear and +2 from Sunday’s reading of 44 Fear.

Bitcoin’s Moving Averages: 20-Day [$39,931.44], 50-Day [$44,134.77], 100-Day [$51,028.21], 200-Day [$45,844.48], Year to Date [$41,129.14].

BTC’s 24-hour price range is $41,913-$42,751 and its 7-day price range is $41,652-$45,481. Bitcoin’s 52-week price range is $29,341-$69,044.

The price of bitcoin on this date last year was $48,607.

The average price of BTC for the last 30 days is $40,258.

Bitcoin’s price [-0.35%] closed its daily candle worth $42,091 on Sunday.

Ethereum Analysis

Ether’s price also dropped on Sunday for a fourth consecutive day and closed its daily session -$45.86.

The second chart we’re examining today is the ETH/USD 1D chart below from Rawlings_NG. Bullish Ether traders lost the $3k level over the weekend and failed to hold support at the 0.618 [$2,928.01] during Sunday’s session. The next support for bullish traders is the 0.786 [$2,402.21]. Below that level is the last line of support before a dramatic markdown in the price for Ether all the way down at 1 [$1,732.11].

If bullish traders can somehow fend off bears and continue the recent uptrend, they need to pivot and reclaim the $3k level before flipping 0.5 [$3,297.32] from resistance to support. Bullish traders have targets then of 0.382 [$3,666.64] and of 0.236 [$4,123.58].

Ether’s Moving Averages: 20-Day [$2,830.21], 50-Day [$3,412.40], 100-Day [$3,731.39], 200-Day [$3,249.67], Year to Date [$3,021.25].

ETH’s 24-hour price range is $2,853-$2,979 and its 7-day price range is $2,853-$3,261. Ether’s 52-week price range is $1,353-$4,878.

The price of ETH on this date in 2021 was $1,804.

The average price of ETH for the last 30 days is $2,873.

Ether’s price [-1.57%] closed its daily candle on Sunday, worth $2,871.02.

Dogecoin Analysis

Dogecoin’s price was one of the positive outliers on Sunday and snapped three consecutive days of selling. DOGE closed its daily candle yesterday +$0.004.

The third chart we’re analyzing today is the DOGECOIN/USD 1D chart below from abrecombie-no-fitch. DOGE’s price is currently trading between two levels and ranging between $0.14-$0.18.

Bitcoin bulls are trying to hold support at the 0.886 fib level [$0.121]. They’re targeting a break to the upside of the 0.786 [$0.191] with a secondary target of 0.618 [$0.25] and the third target of 0.786 [$0.293].

Dogecoin Moving Averages: 20-Day [$0.149], 50-Day [$0.162], 100-Day [$0.201], 200-Day [$0.24], Year to Date [$0.153].

Dogecoin’s 24-hour price range is $0.142-$0.156, and its 7-day price range is $0.142-$0.168. DOGE’s 52-week price range is $0.044-$0.731.

Dogecoin’s price on this date last year was $0.062.

The average price of DOGE over the last 30 days is $0.151.

Dogecoin’s price [+2.63%] closed its daily session on Sunday, valued at $0.148.

Source: https://en.cryptonomist.ch/2022/02/14/bitcoin-ethereum-dogecoin-price-analyses/