Key Insights:

- Litecoin trades above $55 as analysts monitor resistance and a potential breakout toward $70 target.

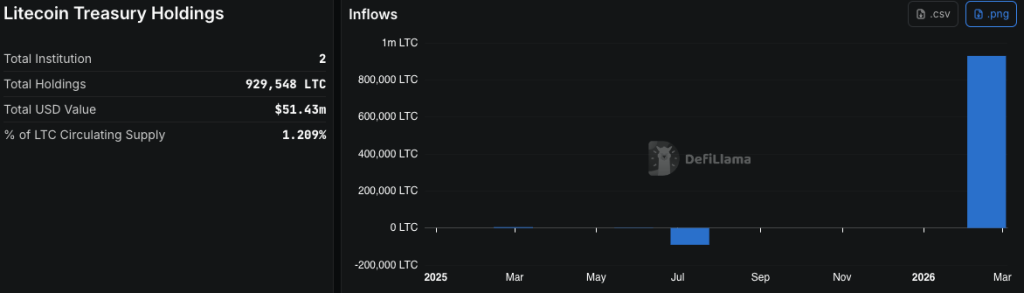

- Two institutions hold 929,548 LTC, representing 1.209% of the Litecoin circulating supply concentration.

- Early 2026 data shows nearly 1 million LTC inflow spike after months of low activity.

Litecoin is nearing a key price level, with market data pointing to rising interest. Traders are watching the $70 target while LTC trades above $55. Recent charts show a sharp spike in inflows and concentrated institutional holdings.

LTC Price Nears Breakout as $70 Target Comes Into View

Litecoin price stands at $55.23, with a 24-hour trading volume of $255,491,350. The token is up 0.23% over the past day. Market observers highlight that LTC is “knocking on the door” of a breakout level.

Technical charts shared by ZAYK Chart suggest that “a clean breakout here clears the path for a move toward the $70 target.” The analysis places focus on a resistance zone that has capped recent gains. If the price moves above this level, traders expect increased activity.

The current setup shows steady consolidation below resistance with volume remaining stable, and volatility is limited. Many traders now watch for confirmation above the breakout line.

Institutional Litecoin Holdings Remain Concentrated

Data from the chart shows Litecoin treasury holdings are concentrated in two institutions. Only two institutions are listed, yet their combined stash reaches 929,548 LTC. The value of these holdings is about $51.43 million.

This amount equals 1.209% of Litecoin’s circulating supply. A small number of entities control this share of available coins. The holdings count has not expanded beyond these two institutions.

Litecoin Treasury Holdings | Source: DeFiLlama

The data suggests treasury-style accumulation rather than wide institutional participation. No additional entities appear in the latest count as the Market participants continue to monitor any change in the number of holders.

Massive Inflow Spike Signals High-Conviction Accumulation

The inflows panel shows quiet activity through most of 2025. Bars during that period remain close to the baseline. This pattern reflects limited net inflows. Near early 2026, the chart records a sharp spike close to 1 million LTC. The move stands above all previous inflow periods.

Such a large inflow often points to a single major buyer or a small group acting quickly. Since holdings remain limited to two institutions, the data aligns with concentrated accumulation. As bullish momentum builds, Litecoin approaches a key breakout level with $70 in focus.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bullish-build-ltc-approaches-key-breakout/