Bitcoin [BTC] has been consolidating above $65K for over a week, after dropping 46% from $126K to $60K over the past three months. Despite the weak sentiment, however, overall selling pressure has reduced significantly.

According to VanEck analysts, led by head of digital assets research Mathew Siggel, those who’ve held BTC for 1-2 years were the largest sellers late 2025 and early 2026. However, this cohort has reduced the offloading since most of them (who bought at an average price of $72K) are now underwater.

“Over the past month, selling from older cohorts, >1yr, has fallen significantly to an expected total of 517k BTC in February. In the 1yr-2yr band, token sales have dropped the most dramatically, falling to a pace of 190k.”

Source: VanEck

Sigel concluded that Bitcoin distribution was ‘slowing,’ but warned that investors might still take painful losses.

So far, realized losses have crossed $22 billion, underscoring rising capitulation and a lack of conviction to hold BTC for longer.

Market caution persists

That said, the decline has adversely affected miner revenue and likely exacerbated the miner crisis and exit of uncompetitive players. This was illustrated by the drop in the Bitcoin network’s hash rate (the computational power required to mine BTC).

According to VanEck, the network’s hash rate has declined by 14% over the past 90 days. However, the analysts added,

“Sustained 90-day hash rate drawdowns are relatively uncommon. These periods of hash rate contraction have historically preceded strong forward BTC returns over the subsequent 90 days.”

Source: VanEck

This may be short-term relief for the market if validated. And the rising expectation of passage of the crypto market structure bill, the CLARITY Act, could further help stabilize the Bitcoin price.

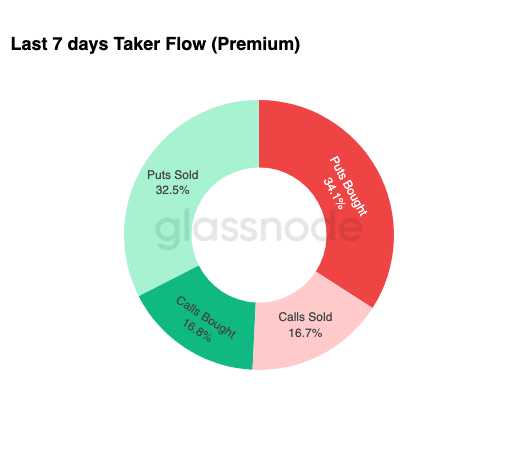

Even so, there was heavy positioning for downside risk. According to Glassnode data, Options flows and skew heavily leaned towards hedging against downside risk. Notably, Put skew remained elevated (demand for puts, bearish bets) was relatively higher than calls (bullish bets).

Source: Glassnode

Put differently, investors didn’t want to be surprised by another leg down despite the potential recovery amid improving passage odds for the CLARITY Act.

Final Summary

- VanEck said that Bitcoin’s main sellers (1-2 year holders) have significantly reduced their dumping spree after BTC dropped below $72K.

- The asset manager projected that BTC could recover in Q2, citing historical patterns of hash rate contraction.

Source: https://ambcrypto.com/bitcoin-is-slowing-distribution-a-relief-after-22b-in-losses/