Crypto market sentiment has remained bearish in an unusually persistent manner. February marked the fifth consecutive month of a red monthly close, underscoring sustained downside pressure.

Sentiment continues to deteriorate, with bears firmly in control, as reflected across on-chain data and technical indicators. Momentum remains weak, participation has thinned, and liquidity conditions remain fragile.

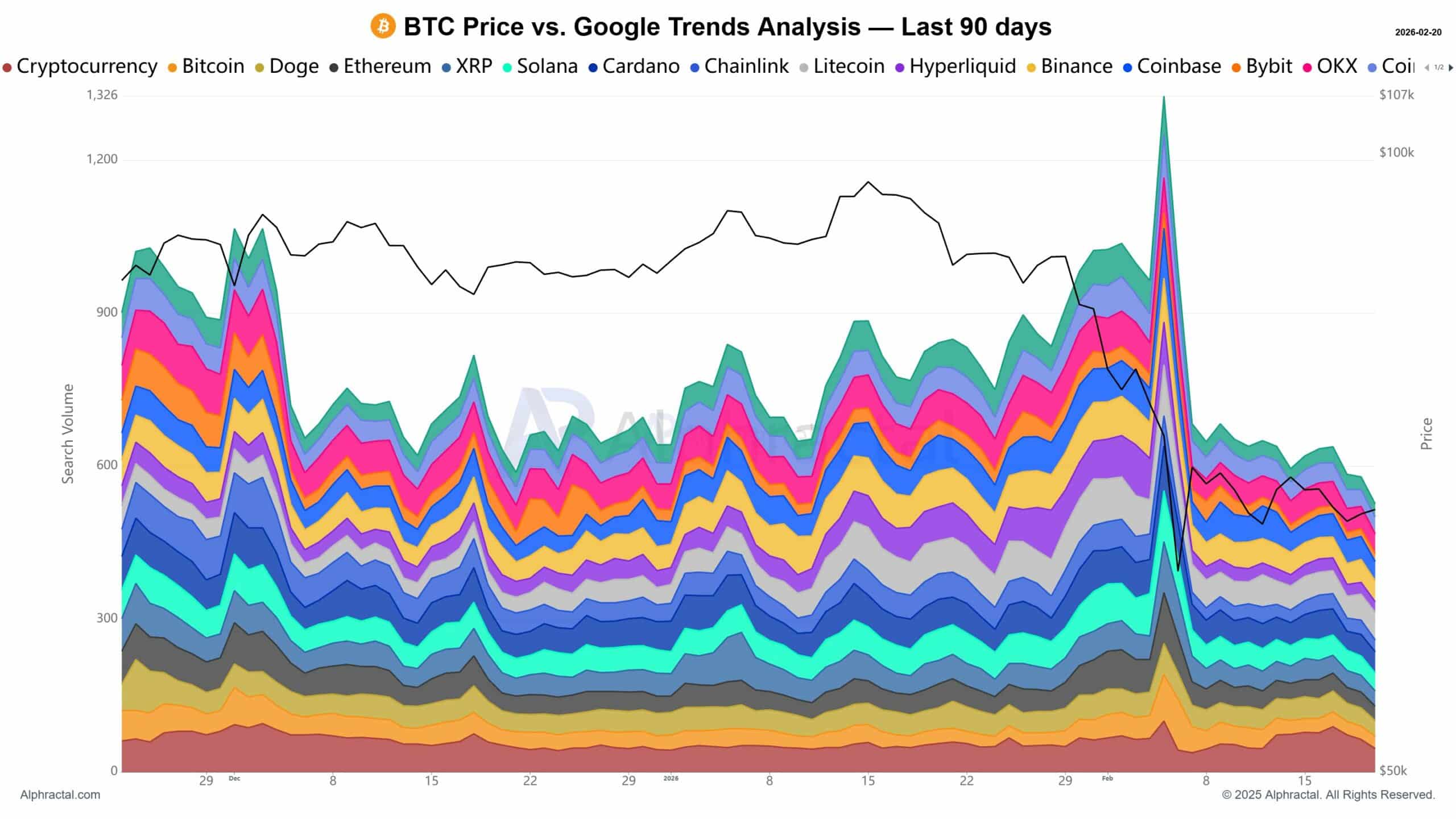

In downturns of this magnitude, investor behavior outside price charts often provides critical context. Off-chain signals, particularly search behavior, offer insight into attention cycles and capital intent.

This analysis uses Google search interest for “crypto” as a behavioral proxy to assess whether the market may be approaching exhaustion or preparing for a structural rebound.

Search interest plunges

Search interest has historically served as a reliable barometer of market participation.

Periods of rising search activity typically coincide with expanding demand and accelerating valuations. Conversely, sharp declines in search volume suggest investor disengagement, often reflecting elevated risk perception and capital preservation strategies.

Source: Alphractal

A close examination of historical data shows a notable correlation between price action (black line) and fluctuations in search interest. While not perfectly synchronized, both metrics have generally moved in tandem across cycles.

At press time, Google search interest in crypto assets has dropped to one of its lowest readings since 2022. Engagement across major platforms, including Twitter, YouTube, Facebook, and Instagram, has also cooled considerably, reinforcing the broader decline in attention.

This contraction suggests capital has rotated toward stablecoins, fiat equivalents, or traditional defensive assets.

The broader market drawdown has coincided with an estimated $1.96 trillion in capital exiting the sector, reflecting both deleveraging and risk-off positioning.

Identifying correlation patterns

To assess potential inflection points, Google Trends data for the keyword “crypto” was analyzed against historical price cycles. The metric has consistently tracked macro price movements with notable reliability.

In previous cycles, suppressed search interest helped mark local bottoms and the early stages of broader recovery trends. Similar dynamics were observed in May 2021, September 2023, October 2024, and April 2025, though typically with a modest lag relative to price.

Source: Google Trends

Two critical search interest zones: 31 and 28, have historically aligned with major market inflection points. Current readings hover near the 42% level, indicating further compression may be required before a sentiment reset is complete.

While this does not guarantee a rebound, the levels remain structurally significant. Price action is simultaneously approaching a key support region (highlighted in blue on the chart), where previous accumulation phases emerged.

Source: TradingView

Beyond search behavior, broader sentiment gauges offer additional confirmation.

The Fear and Greed Index has entered Extreme Fear territory, a zone that has historically preceded medium-term recoveries.

Although the index does not provide precise timing, prior instances of similar fear compression have coincided with accumulation periods that later translated into upward price expansion. Current readings represent one of the most pronounced fear environments in recent cycles.

Bitcoin dominance as a liquidity signal

Bitcoin continues to command the majority of market liquidity, with dominance currently at 58.29% according to CoinGlass. Monitoring Bitcoin dominance provides insight into early recovery dynamics.

In initial rebound phases, capital typically flows into Bitcoin before rotating into higher-beta altcoins. As a result, rising Bitcoin dominance often marks the first structural shift in liquidity conditions.

Key thresholds to monitor include a break above 60%, with the 64% region representing a more decisive structural level on the dominance chart. A sustained move through these zones would indicate capital concentration and potential early-stage recovery conditions.

For now, the market has not confirmed a recovery phase. Liquidity remains constrained, and further downside volatility cannot be ruled out before stabilization occurs.

However, behavioral metrics and sentiment compression suggest the market may be moving closer to a preparatory accumulation phase rather than the midpoint of the decline.

Final Summary

- Search interest remains subdued and has not yet aligned with historical levels or chart structures that typically precede sustained rallies.

- Tracking liquidity rotation into Bitcoin could provide clearer confirmation of capital returning to the broader crypto market.

Source: https://ambcrypto.com/crypto-search-interest-hits-2022-lows-is-market-demand-drying-up/