Key Insights:

- ENA trades near $0.108 support, pointing to a potential move toward $0.129 resistance.

- Ethena’s USDe supply grew from $120 million to $1.15 billion in nine months.

- The token TVL stabilizes at $6.96 billion while daily fees stand at $3.28 million.

Traders are watching Ethena as the price tests a key support level. The $0.108 mark has become a focus point in recent sessions. Market participants now track whether the token can hold this range and move toward $0.129.

ENA Price Holds Near Key Support

Crypto analyst Ali Charts stated that $0.108 is the level for the asset. He added, “Hold it, and $0.129 comes into focus.” Traders are now monitoring price action around this support.

The live ENA price stands at $0.109797 at the time of writing. The token is down 2.05% in the past 24 hours. Trading volume reached $103,105,983 during the same period.

The narrow gap between the current price and support keeps attention on short-term moves. A stable hold above $0.108 may guide momentum toward the next resistance. Market data shows steady trading activity despite the daily decline.

Ethena’s USDe Records Rapid Growth

However, toke’s USDe supply has expanded sharply over the past nine months. Crypto.news reported that “$USDe has grown 10x in 9 months.” The report stated that supply rose from $120 million in May to $1.15 billion.

This growth places the asset among fast-growing stablecoin projects in 2026. The expansion reflects higher adoption and increased on-chain usage. Market observers track how USDe demand connects with token price trends.

Rising stablecoin supply often aligns with higher ecosystem activity. However, price movements still depend on broader market conditions. Traders continue to monitor both USDe data and the token chart levels.

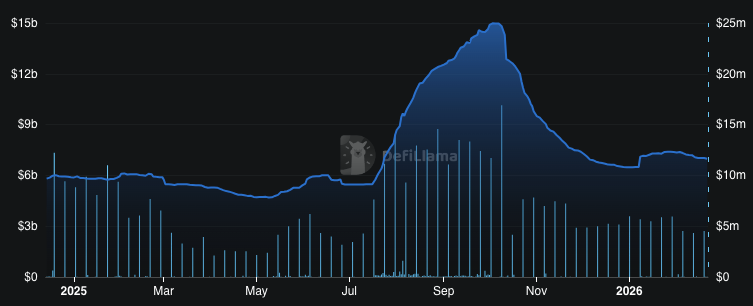

Ethena TVL and Fee Data Show Stabilization

Ethena’s total value locked stands at $6.95 billion as of Feb. 21, 2026. Daily fees are recorded at 30,957 million. TVL peaked near $15 billion in November 2025 before declining.

The network saw three phases during the past year. Early 2025 showed steady growth, followed by a strong Q3 breakout. Q4 then brought a pullback with lower fees and reduced capital inflows.

Recent data shows TVL moving between $6 billion and $7 billion. Fees now move sideways instead of falling further. This pattern suggests consolidation after months of contraction.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/traders-eye-ena-0-108-support-move-0-129/