Key Insights:

- Aave becomes first lending protocol to exceed $1 billion in RWAs.

- Tokenized U.S. Treasuries grow past $10 billion by February 2026.

- DeFi TVL remains near $100 billion after prior market recovery.

Aave has crossed $1 billion in real-world assets (RWAs) deposited on its platform. The protocol said it is “the first lending protocol with over $1 billion in RWAs deposited.” The milestone comes as tokenized assets expand across decentralized finance.

Data from September 2025 to February 2026 shows RWA balances on Aave rising from near zero to above $1 billion within months. The increase took place during a period of broader recovery in DeFi markets.

RWA Deposits Rise Through Late 2025

The chart tracking RWAs on Aave shows deposits moving past $500 million in the fourth quarter of 2025. Balances continued climbing and later crossed the $1 billion level in early 2026.

The growth curve shows two stages. Deposits increased quickly during the initial phase. After crossing $800 million, balances advanced at a steadier pace. There were no sharp declines during the period shown.

Across the wider market, total distributed RWA value increased from roughly $1–2 billion in early 2023 to about $25 billion by early 2026. US Treasury debt accounts for the largest share, while private credit expanded during 2025.

Tokenized Treasuries Pass $10B

Data on tokenized U.S. Treasuries shows total value locked rising from under $1 billion in April 2024 to more than $10 billion by February 2026. Growth picked up during 2025.

BlackRock’s BUIDL product holds the largest allocation. Circle’s USYC and Ondo’s USDY also increased over the same period. Franklin OnChain, Superstate, WisdomTree, and others represent smaller portions.

The chart shows step-like increases rather than a smooth line, indicating larger allocations at certain points. After short pullbacks, balances resumed their upward move.

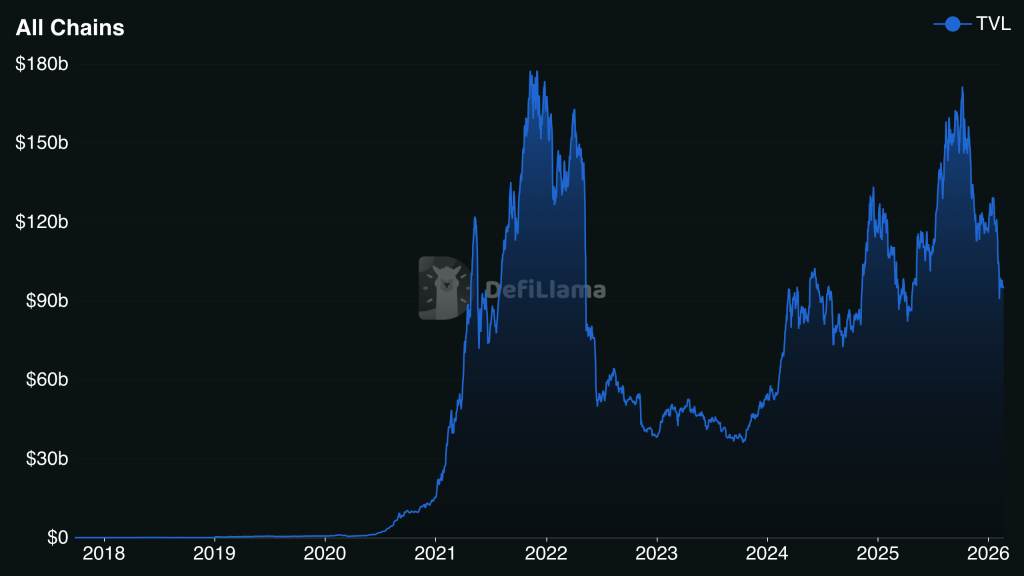

DeFi TVL Remains Above 2023 Lows

Total value locked in DeFi reached about $175–$180 billion in late 2021. It later declined to near $40–$50 billion in 2023. Recovery began in 2024, with TVL rising above $120 billion and later reaching $160–$170 billion in 2025.

Early 2026 figures place TVL near $90–$100 billion after a pullback. The level remains above the 2023 range.

AAVE trades at $126.30, up 3.2% over 24 hours and 12.7% over seven days. Daily trading volume stands at $297.5 million.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Source: https://coincu.com/news/aave-surpasses-1b-in-rwas-as-token/