Bitcoin has been consolidating within $60K-$70K price range for about 12 days since the crash on the 5th of February.

Some analysts have called this range the likely market bottom that could act as a springboard for BTC’s recovery. However, others remain pessimistic.

According to renowned Bitcoin analyst Willy Woo, the worst may be far from over. He cautioned,

“I have bad news for the perma bulls. BTC is still strengthening its bear trend. Volatility is a key metric used by quants to detect trends.”

He added,

“BTC entered its bear market when volatility spiked upwards quickly. Volatility then continues to climb, meaning the bear trend is strengthening.”

Source: X/Willy Woo

He continued that the Bitcoin bear market only weakens when volatility (red spikes) peaks in the mid- or late-bear market phase.

The macro bottom comes at the second or third smaller volatility spikes. In other words, the market was not yet out of the woods despite holding above $60K.

Woo added that a bearish move in global equities would usher BTC into the second phase of the bear market, while the final third phase would happen when capital outflows peak.

Weak BTC demand, but Options traders still eye $75K

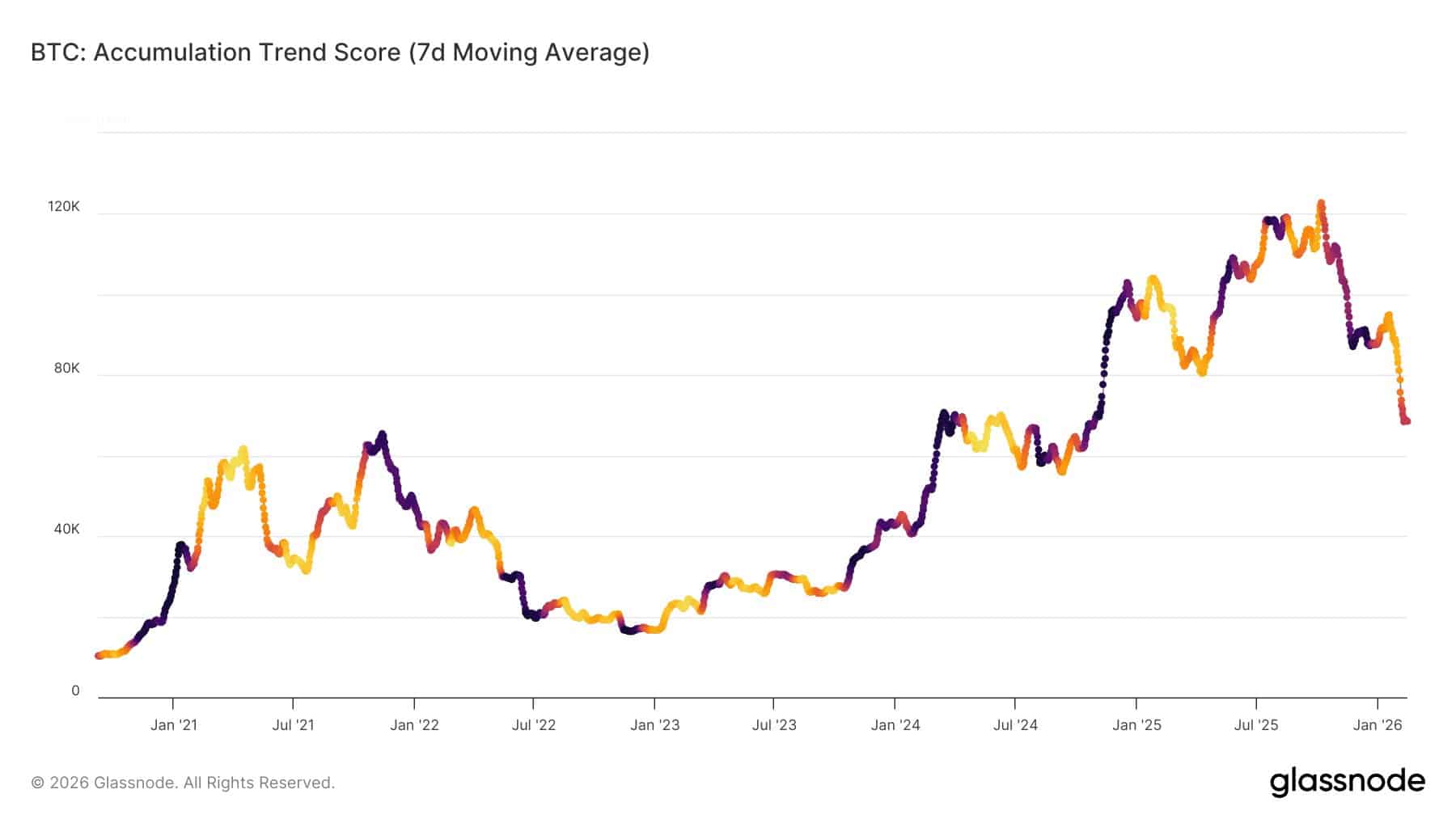

Glassnode shared a similar stance, citing accumulation during recent drawdowns and past market bottoms. The analytics firm noted that the November 2025 drop and post-LUNA crash and FTX implosion were met with massive accumulation (darker shades).

When the Accumulation Trend Score approaches 1 (darker shades), many players are buying aggressively on average.

Source: Glassnode

However, if the score moves closer to zero or brighter shades, then big players are dumping. For a convincing market bottom, the $60K level or any further dip should attract aggressive buying represented by darker shades of color.

That means, another leg down to $65K or below may not be ruled out, as Woo projected the bear market phase could take months to play out.

However, in the short term, Option traders were increasingly leaning bullish, eyeing a breakout above the $60K-$70K range with an immediate target of $75K.

In a statement, Aurelie Barthere, Principal Research Analyst at Nansen, told AMBCrypto that Option traders were less bearish than they were ten days ago.

She added,

“Over the past seven days, calls have dominated put buying, particularly among block trades that tend to be placed by more professional investors. The dominant call strike is $75K, suggesting that traders favor positioning outside the $60K–$70K trading range.”

Calls are bullish bets while puts underscore demand for hedging against downside risk (bearish bets).

In the long term, however, Barthere maintained that a sustained recovery may remain uncertain unless the CLARITY Act, U.S. midterm election outcomes, and the macro landscape favor broader risk-on sentiment.

Final Summary

- Willy Woo warned that the bear market has only begun and still has to go through the second and third phases before truly reaching a bottom.

- Glassnode echoed similar sentiments, but Options traders were contrarians and eyed a potential breakout to $75K in the near term.

Source: https://ambcrypto.com/bad-news-for-bulls-is-bitcoins-bear-market-far-from-over/