Tom Lee’s Bitmine Immersion Technologies added 45,759 Ethereum in the past week as ETH kept sliding. The company announced crypto, cash, and “moonshot” holdings worth $9.6 billion, while Bitcoin and Ethereum markets stayed under pressure. At press time, Ethereum traded at $1,974, down by 1.97% in the past day and 40.31% in the past month.

BitMine Expands Ethereum Holdings During Market Weakness

In a press release, Bitmine confirmed the purchase, with Lee calling the pullback “attractive” based on Ethereum fundamentals. He said Bitmine views Ethereum’s utility as stronger than what its current price reflects. Notably, Bitmine said it continues buying ETH regardless of the short-term price trend.

Bitmine reported total Ethereum holdings of 4,371,497 ETH, at an average purchase price of $1,998. The company also reported holding 193 Bitcoin, alongside $670 million in total cash. Additionally, Bitmine listed a $200 million stake in Beast Industries and a $17 million stake in Eightco Holdings.

Bitmine also said its Ethereum position equals 3.62% of the total ETH supply of 120.7 million ETH. The company framed this as progress toward its “Alchemy of 5%” strategy. It added that it reached over 72% of that target in seven months.

Tom Lee Highlights Staking Revenue and MAVAN Rollout Plans

Bitmine reported 3,040,483 staked ETH valued at $6.1 billion at $1,998 per ETH. Lee said Bitmine’s staking rewards could reach $252 million annually at scale, based on a 2.89% seven-day yield. However, the company also listed annualized staking revenues at $176 million.

The firm compared its yield to Quatrefoil’s Composite Ethereum Staking Rate, which it said stands at 2.84%. Bitmine stated its staking operations produced a 2.89% seven-day yield, annualized. Also, Lee said Bitmine is building its Made in America Validator Network (MAVAN).

Bitmine said MAVAN will launch in early calendar year 2026 and remains on track for Q1. Bitmine remains the second-largest crypto treasury globally, behind Strategy, which announced a 2,486 BTC purchase today. The company added that it is currently working with three staking providers ahead of deployment. Lee also referenced his remarks from Consensus Hong Kong, where he discussed tokenization, AI agents, and creator-focused identity standards.

BMNR Stock Slides as CryptoQuant Notes Whale Losses

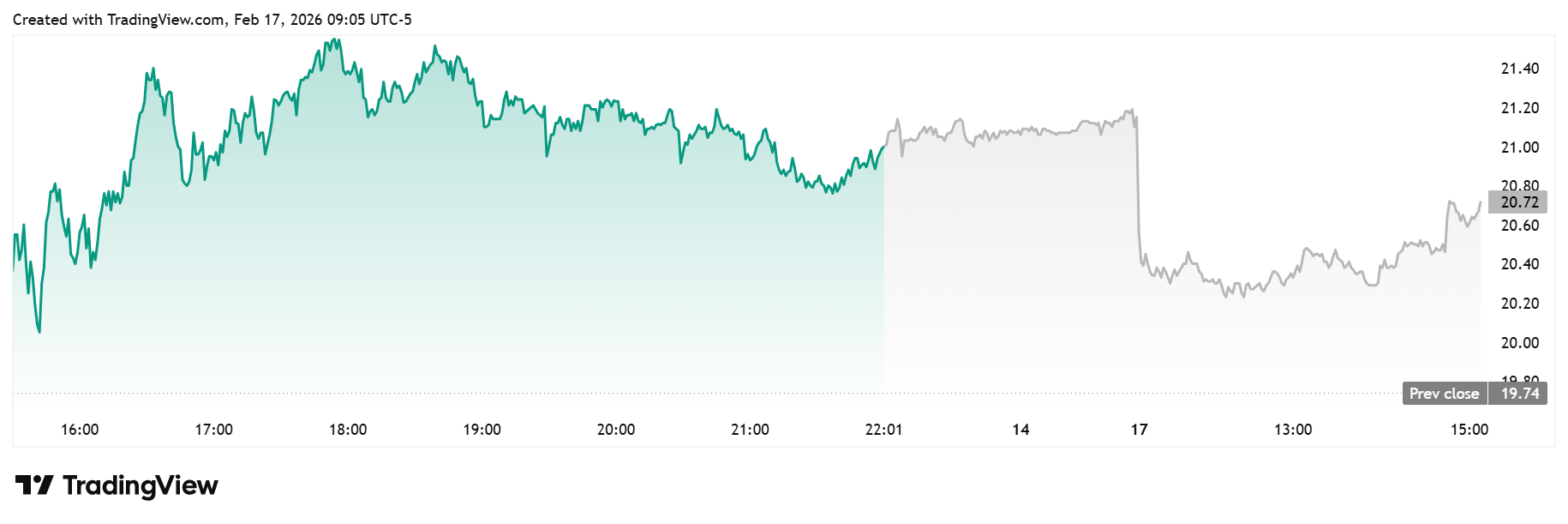

In premarket trading, BMNR stock stood at $20.40, down 2.67%, or 0.56, over 24 hours. The previous close was $19.74, with a day range of $20.04 to $21.60. The crypto stock has a market cap of $9.53 billion.

Meanwhile, CryptoQuant said Ethereum whales are currently holding losses similar to prior market bottoms. The firm stated that whales have not taken profits this cycle and have continued accumulating. CryptoQuant added that whales now hold their largest positions ever and remain focused on an upcoming rally.