Michael Saylor’s Strategy is currently sitting on an unrealized loss of over $4.5 billion on its Bitcoin position following the BTC crash below the psychological $70,000 level. MSTR stock is also facing further downside pressure amid this development, especially as experts predict Bitcoin will see lower prices as the bear market deepens.

Strategy Faces Unrealized Loss Of Over $4.5B As BTC Crash Extends

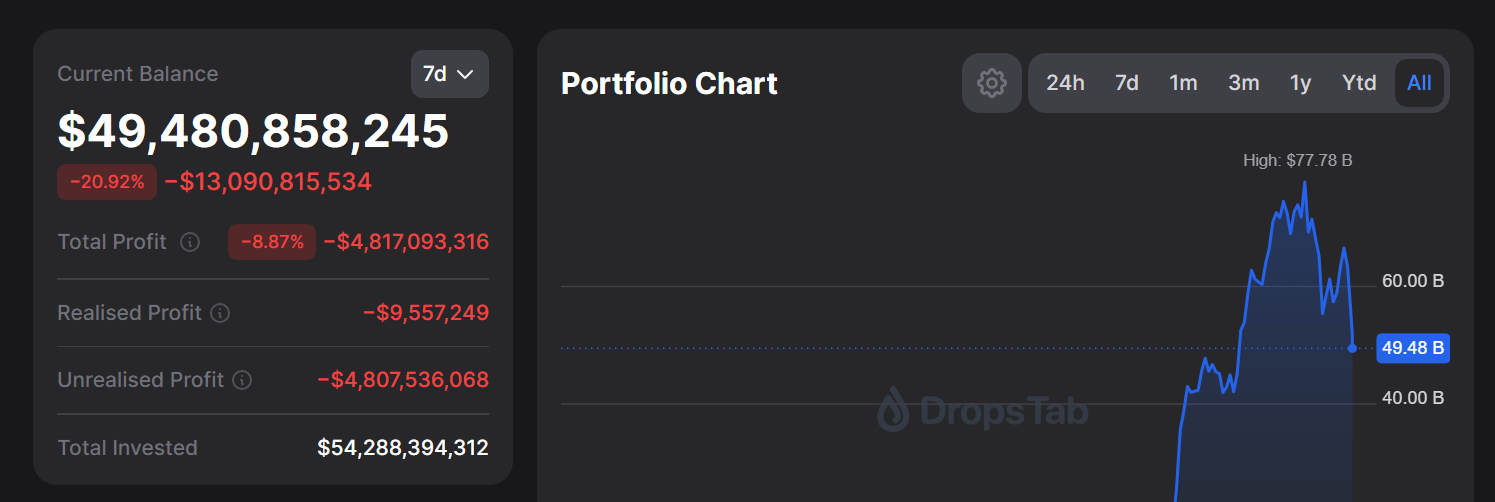

DropsTab data shows that Saylor’s company is now facing an unrealized loss of around $4.8 billion on its $54.3 billion Bitcoin investment. This follows the BTC crash below $70,000 for the first time since November 2024, just before U.S. President Donald Trump’s election victory.

Saylor’s Strategy currently holds 713,502 BTC, which it acquired for $54.26 billion at an average price of $76,052 per Bitcoin. The recent Bitcoin crash has marked a huge turnaround for Strategy, whose BTC position was worth over $80 billion when the leading crypto hit its current all-time high (ATH) of $126,000 in October.

The MSTR stock is also facing further downside thanks to the BTC crash and Strategy’s Bitcoin exposure. Yahoo Finance data show the stock is trading at around $120 in premarket trading today, down over 7% from yesterday’s close of $129. This marks a new multi-year low for the stock, which is now down over 16% year-to-date (YTD).

Bitcoin critic and renowned economist Peter Schiff has predicted deeper losses for Strategy based on his belief that the BTC crash could further extend. In his most recent X post, he noted that MSTR’s losses are just beginning to mount, with shareholders selling their shares.

Bitcoin is about to trade below it’s Nov. 2021 high of $69,000. More significantly, measured in gold, Bitcoin is now 60% lower than it was then. @Saylor is down 9% on his $54 billion Bitcoin bet, and $MSTR‘s losses are just beginning to pile up. HODLers, abadnon a sinking ship!

— Peter Schiff (@PeterSchiff) February 5, 2026

Experts like investment bank Stifel have also predicted that Bitcoin could drop to lower prices, which would further put Saylor’s company underwater on its BTC position. Stifel warned that the leading crypto could fall below $40,000, citing past cycles, a hawkish Fed pivot, slowing U.S. crypto regulation, shrinking liquidity, and heavy ETF outflows.

Strategy Still Unlikely To Offload Its Bitcoin

Crypto traders are still betting against Strategy selling its Bitcoin holdings despite the BTC crash below the company’s average buy price. Polymarket data shows only 27% chance that Saylor’s company will sell any of its holdings by year-end.

Crypto commentator Atlas stated that Bitcoin’s price drop below Strategy average buy price doesn’t mean that the company is about to go bankrupt or dump its holdings. Atlas noted that this occurred in the last cycle, when the company’s average buy price was around $30,000, and BTC fell to $16,000, representing a 45% drawdown from the average buy price.

Despite the BTC crash at the time, Strategy did not sell a single coin or face liquidation. Furthermore, the crypto commentator noted that Strategy’s total debt is around $8 billion, which is still well below the value of the company’s Bitcoin holdings.

It is worth noting that Michael Saylor recently indicated that they have no plans to sell their Bitcoin, regardless of current market conditions. The company has a USD reserve, which it established last year to cover all debt and dividend obligations.

Strategy’s CEO, Phong Le, noted at the time that the reserve could cover about two years of debt and interest payments. As such, Strategy selling its Bitcoin holdings anytime soon looks unlikely despite the BTC crash. The company holds its Q4 earnings call today, where it is likely to provide further guidance on its Bitcoin accumulation plans amid this market downtrend.