In his latest remarks, Richmond Fed President Tom Barkin said his focus is on inflation, signaling he is not opposed to further Fed rate cuts until inflation is at the central bank’s 2% target. His comment comes as crypto market participants speculate on how many cuts the FOMC will make this year, especially with the nomination of Kevin Warsh as Jerome Powell’s successor as Fed Chair.

Barkin Signals Opposition To More Fed Rate Cuts For Now

The Richmond Fed president stated in his remarks for an event in Columbia that he believes that the three rate cuts they made last year have taken out some insurance to support the labor market as they work to complete the “last mile” to bring inflation to their 2% target. Barkin admitted that the current outlook could change and that, as they do, they remain ready to respond as appropriate.

However, he suggested that the focus should be on bringing inflation down, a move that could likely put further Fed rate cuts on hold. The Fed president also noted how last year’s cuts have brought them closer to neutral levels, indicating that they are in a good position even as they look to deliver on their dual mandate on inflation and the labor market.

His comments follow last week’s FOMC meeting, during which the Committee decided to hold rates over concerns that inflation remains somewhat elevated. The Committee also noted that the labor market appears to be stabilizing, which may put them in a good position to adopt a wait-and-see approach.

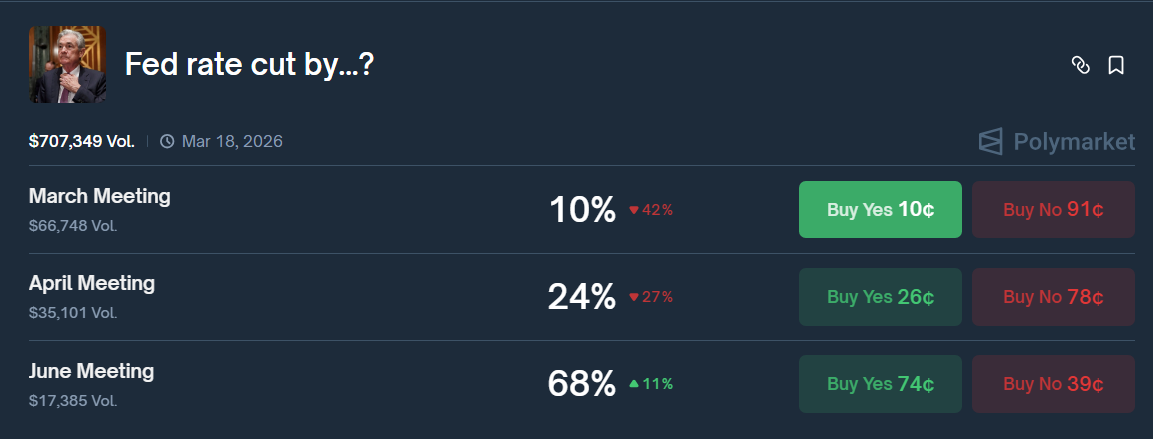

Notably, the Bitcoin price crashed from as high as $89,000 to a new yearly low of $75,000 since the Fed signaled this hawkish pivot at last week’s FOMC meeting. Crypto traders also continue to speculate on when the Committee is likely to make the first Fed rate cut of the year and how many cuts they could eventually make this year. Polymarket data shows a 68% chance that the first cut will come at the June FOMC meeting, while most traders predict that the Committee will make three cuts this year.

Stephen Miran Reiterates Call For More Cuts

In an interview with FOX Business today, Fed Governor Stephen Miran again called for more Fed rate cuts. He stated that he expects an interest rate cut of more than 1% this year, given the absence of strong price pressures in the economy.

Miran, alongside Fed Governor Chris Waller, dissented at last week’s FOMC meeting, voting in favor of a 25 basis points (bps) cut. The Fed governor continues to advocate for lower rates, as he believes current interest rates remain restrictive.

It is worth noting that U.S. President Donald Trump nominated Kevin Warsh as the next Fed chair, a move which could also largely determine how many Fed rate cuts the U.S central bank makes this year. Trump signaled that Warsh will lower interest rates.

However, there remain concerns about Warsh’s stance on monetary policy as he is largely viewed as an ‘inflation hawk.’ The former Fed Governor has also advocated for a smaller Fed balance sheet, which could negate the impact of more rate cuts on crypto prices.