Strategy, an enterprise software company and the world’s largest corporate Bitcoin holder, announced Monday it had added 855 BTC to its balance sheet for $75 million last week, spending an average of roughly $88,000 per coin.

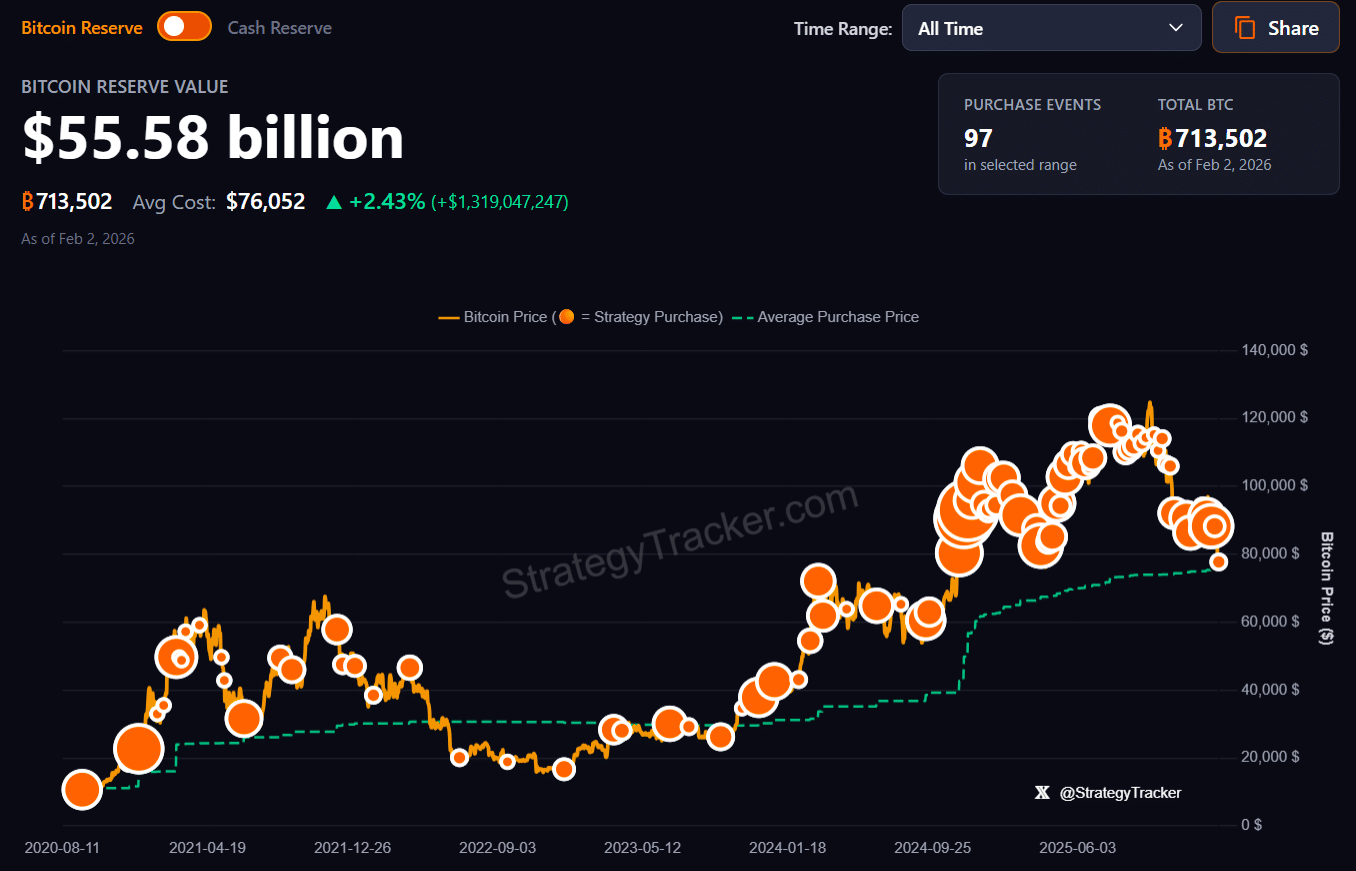

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin. As of 2/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

To fund the acquisition, the company sold 673,527 shares of Class A common stock (MSTR), raising $106 million in net proceeds, according to a recent SEC disclosure. Strategy retains over $8 billion in capacity under its current stock-sale program.

The firm did not sell any of its registered preferred stock offerings, including STRF and STRC, during this period.

With this purchase, Strategy’s Bitcoin holdings reach 713,502 BTC, valued at more than $55 billion. The company holds roughly $1.3 billion in unrealized profits, after briefly slipping into losses during Bitcoin’s sharp weekend sell-off.

Bitcoin was trading at $77,800 at press time, down roughly 10% in the last seven days, TradingView data shows.

MSTR, which usually moves in line with Bitcoin, was down 7% in premarket trading today, after closing up 4.5% last Friday, per Yahoo Finance.

Source: https://cryptobriefing.com/strategy-buys-855-bitcoin/