Bitcoin [BTC] has faced intense selling pressure over the past week. On Wednesday, the 28th of January, Bitcoin bounced to a local high of $90.6k. Since this high, it has shed 16.8% in under five days.

Source: CoinGlass

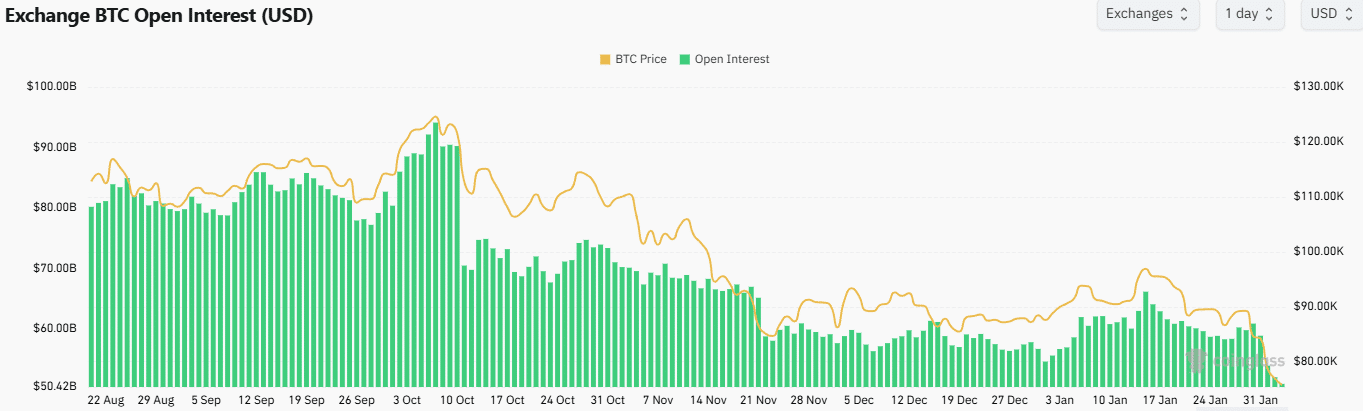

CoinGlass data showed a downtrend in speculative interest since September 2025.

The dwindling Open Interest saw a stir of positive sentiment at the beginning of the year but continued the previous downtrend after mid-January.

This reflected increasing malaise in the Bitcoin market. Speculators were less willing to bid, growing more and more unconvinced of a recovery.

Combined with the heavy liquidation volume since October, it showed leverage traders looking to ride a higher recovery were being punished.

The current move was the confirmation of a bear market or a ruthless liquidity hunt that is almost at its max pain level.

Bitcoin bulls were quickly punished

Source: CryptoQuant

The Estimated Leverage Ratio (ELR) is the exchange’s Open Interest for a coin divided by the coin’s reserve. This gives an idea of whether users are using more leverage, on average.

From the 26th to the 29th of January, the ELR rose from 0.220 to 0.242. At that time, BTC was trading at $86k, rose briefly to $88k, then fell to $84.6k on the 29th.

The noticeable increase in ELR indicated increased leverage in the market as BTC tested a significant support level, stretching back to the 22nd of November 2025.

It should be noted that exchange reserves increased during this time, making the OI spike even more transparent.

Source: Axel Adler Jr. Insights

Crypto analyst Axel Adler Jr. observed that the market conditions reflected “extreme deleveraging.”

Over the past week, the OI has been falling at par or faster than the price, falling significantly below the 90-day norm by the end of the week.

The Open Interest Momentum Index values fell to moderate and extreme deleveraging values. The analyst noted that this is typical for “forced leverage compression and position closing.”

It was not a complete derivatives washout, since the funding rate remained positive. Therefore, a technical price bounce is possible, but sustained recovery needs OI to stabilize.

Final Thoughts

- The Open Interest and market leverage dropped hard over the past week.

- It represented an extreme deleveraging event, but analysts noted that a technical price bounce is still possible.

Source: https://ambcrypto.com/bitcoin-drops-16-in-five-days-massive-market-stress-ahead/