Chainlink dropped and held ground below $10, touching a low of $8.9 for the first time since September 2024.

At press time, LINK traded at $9.1, down 7.9% on daily charts and 21% on weekly charts, reflecting sharp bearish pressure.

AMBCrypto observed that this price drop was largely driven by a massive sell-off, with sellers overwhelming the market.

Chainlink hits September 2024 lows amid massive sell-off

After LINK dropped below $10, long-term holders and traders across the spot and futures market panicked and dumped extensively.

In fact, the seller’s strength climbed to 75 while the buyer’s strength dropped to a low of 25, reflecting seller dominance.

Source: TradingView

At the same time, Sell Volume surged to 26.2 million compared to 22.2 million in buy volume. As a result, the market exhibited a negative delta of 4 million, further validating seller dominance.

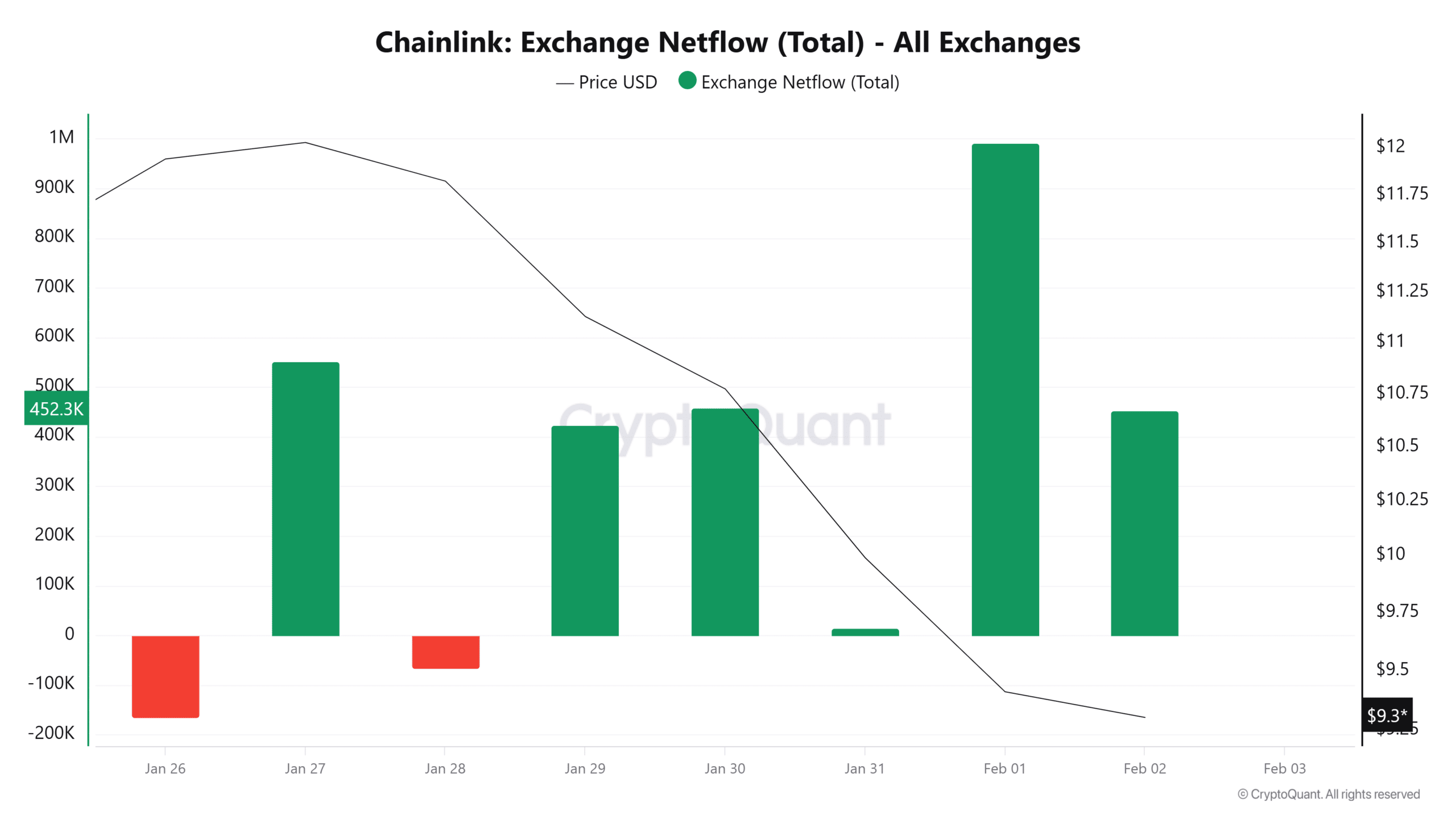

Moreover, exchange activity further echoed this bearish positioning. On the Spot market, buyers have nearly disappeared in the market.

On the 1st of February, over 2.8 million LINK flowed into exchanges, while 973.2k LINK entered exchanges on the next day. In total, 3.8 million Chainlink [LINK] have flowed into exchanges over this period.

Source: CryptoQuant

On the other hand, only 2.3 million LINK have been left on exchanges, leaving the market with a negative delta.

As a result, Chainlink’s Exchange Netflow jumped to 1.4 million over this period, a clear sign of aggressive spot dumping.

Exposure hits a yearly low

On the Futures side, investors have significantly reduced their exposure. According to CoinGlass data, Open Interest (OI) fell to a yearly low of $458 million.

Source: CoinGlass

At the same time, Derivatives Volume dropped 22% to $1.09 billion, reflecting massive capital outflows.

In fact, the altcoin saw $318 million in Futures Outflow compared to $312 million in Futures Inflow according to CoinGlass data. For that reason, Futures Netflow declined to -$6.49 million, indicating substantial futures selling.

Historically, combined selling pressure from both spot and futures market have accelerated downward pressure, prelude to a price drop.

Can LINK hold the $9 support level?

Chainlink extended its bearish streak, as holders panicked and aggressively closed positions. In doing so, the altcoin’s Relative Strength Index (RSI) fell further into oversold territory at 20.

The drop suggested strong seller dominance, which further accelerated the altcoin’s downward momentum. Often, these market conditions have preceded lower prices, as evidenced by the last three days.

Source: TradingView

Therefore, if seller dominance continues to increase, LINK may incur further losses. Continuation of the trend could push LINK below the $9 support level toward $8.3.

To invalidate this bearish move, LINK must reclaim and close above its Short term Moving average, EMA20, at $11.5. Such a move will position LINK for a significant bullish reversal.

Final Thoughts

- LINK fell to a September 2024 low of $8.99 before slightly rebounding to $9.1 at press time.

- Chainlink experienced a substantial sell-off across both spot and futures markets, with Open Interest reaching an annual low.