Key Highlights

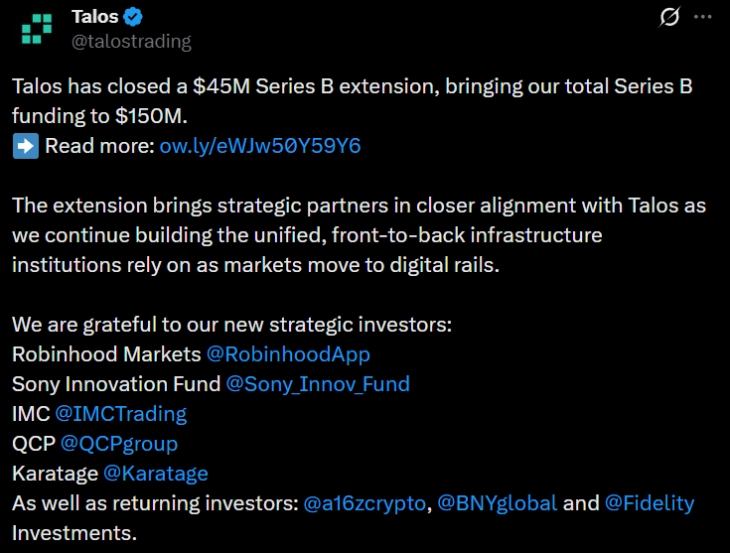

- Talos has announced that it raised a $45 million in extension to its Series B funding round, which brings the total for the round to $150 million

- The funding round witnessed the participation of new and returning investors, including Robinhood Markets, Sony Innovation, a16z crypto, BNY Mellon, and Fidelity Investments

- The company will use this capital to accelerate product development

On January 29, Talos, the leading digital asset trading infrastructure provider, announced that it has raised an additional $45 million in a Series B fundraising round.

(Source: Talos on X)

This fundraising round will value the New York-based company at approximately $1.5 billion after the investment.

This extension of its Series B funding round brings the total raised in this series to $150 million.

This funding round is seen as a landmark moment for Talos as it involves major investors. It attracted new strategic partners, including the retail trading giant Robinhood Markets, Sony Innovation Fund, IMC, QCP, and Karatage, alongside returning investors a16z crypto, BNY, and Fidelity Investments.

Anton Katz, CEO and Co-Founder of Talos, stated in the press release, “We’re proud to have some of the world’s most respected institutions, most of them existing clients and partners, join us as investors. We extended our Series B round to accommodate interest from strategic partners who recognize Talos’s role in providing core institutional infrastructure for digital assets.”

“At a time when traditional asset classes are increasingly migrating to digital rails, these partners wanted to be more closely aligned with our growth. Together, we’re building the foundation for the next generation of financial markets,” he said.

The involvement of various partners creates a very important coalition for Talos. Robinhood comes with insight into retail markets, as it is leading the cryptocurrency platform. On the other hand, firms like IMC and Fidelity also come with their expertise in market structure and traditional asset management. Their involvement in the funding round shows their confidence in retail and institutional finance on a shared technological foundation developed by Talos.

“Talos’s flexibility and rapid adaptability allow us to deepen our liquidity and deliver even more advanced features to Robinhood Crypto customers,” Johann Kerbrat, SVP and GM of Crypto at Robinhood, said. “We’re happy to support their growth as they work to power the digital asset ecosystem.”

“Talos has built a comprehensive crypto platform from the ground up to address the complex needs of large financial institutions as they rapidly scale their businesses,” Kazuhito Hadano, CEO, Sony Ventures Corporation, shared in his remark in the press release. “At Sony Innovation Fund, we’ve been particularly impressed by the company’s evolution from order execution to a full front-, middle- and back-office solution, complemented by robust digital asset data and analytics. We’re excited to support Talos in this next phase of growth and help accelerate its continued expansion.”

Talos Gets Fresh Capital to Expand Its Operations

The latest inflow of cash comes after Talos’s earlier Series B round in May 2022. At that time, the company raised $105 million in a round led by General Atlantic that helped it to achieve a valuation of $1.25 billion. That round included investors like Citi, Wells Fargo Strategic Capital, PayPal Ventures, and Galaxy Digital. The capital helped the company to expand into Europe and the Asia-Pacific region, along with its product suite.

The new $45 million fund will increase the pace for product development. With this capital, the company is planning to advance its portfolio construction tools, risk analytics systems, and automated trading algorithms.

Marius Barnett, Co-Founder and CEO, Karatage, stated in the press release, “Anton and the Talos team have built an exceptional, institutional-grade platform that is the essential infrastructure for the evolving digital asset ecosystem. Their relentless focus on innovation, combined with best-in-class execution, positions Talos as the dominant leader as traditional finance migrates to digital rails.”

It is also planning to increase its integration with decentralized finance protocols. The company has recently partnered with Uniswap Labs and Fireblocks to create institutional-grade access to DeFi liquidity, allowing traditional firms to safely tap into on-chain opportunities.

Also Read: Liquid Capital’s JackYi Rejects Bear Cycle, Backs Strategy

Source: https://www.cryptonewsz.com/talos-45m-series-b-extension-with-robinhood/