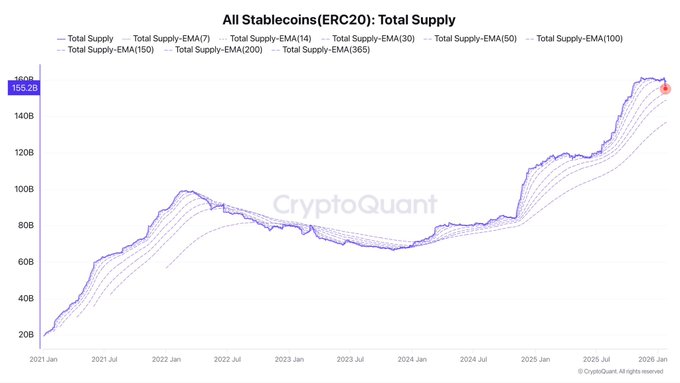

Stablecoin market cap trends have often been used as a proxy for market liquidity. On the 26th of January, total stablecoin supply fell by $7 billion in a week, dropping from $162 billion to $155 billion.

Source: X

The drop reflected a meaningful contraction in available on-chain liquidity rather than a short-term fluctuation.

As stablecoin supply shrank, broader crypto markets struggled to regain momentum, with Bitcoin [BTC] and major altcoins failing to attract sustained buying interest.

Liquidity retreats as stablecoin demand weakens

As demand for stablecoins declined, liquidity steadily exited the crypto ecosystem. Investors were not merely rotating between digital assets; many were converting stablecoins back into fiat, reducing crypto exposure altogether.

When the stablecoin market cap falls, it typically signals lower transactional demand. Issuers respond by burning excess supply, which removes liquidity from circulation.

This dynamic played out across multiple stablecoin platforms, suggesting the pullback was broad-based rather than isolated to a single issuer.

The result was a tightening liquidity environment, which limited capital available for speculative activity and increased downside pressure across crypto markets.

Capital shifts toward traditional safe havens

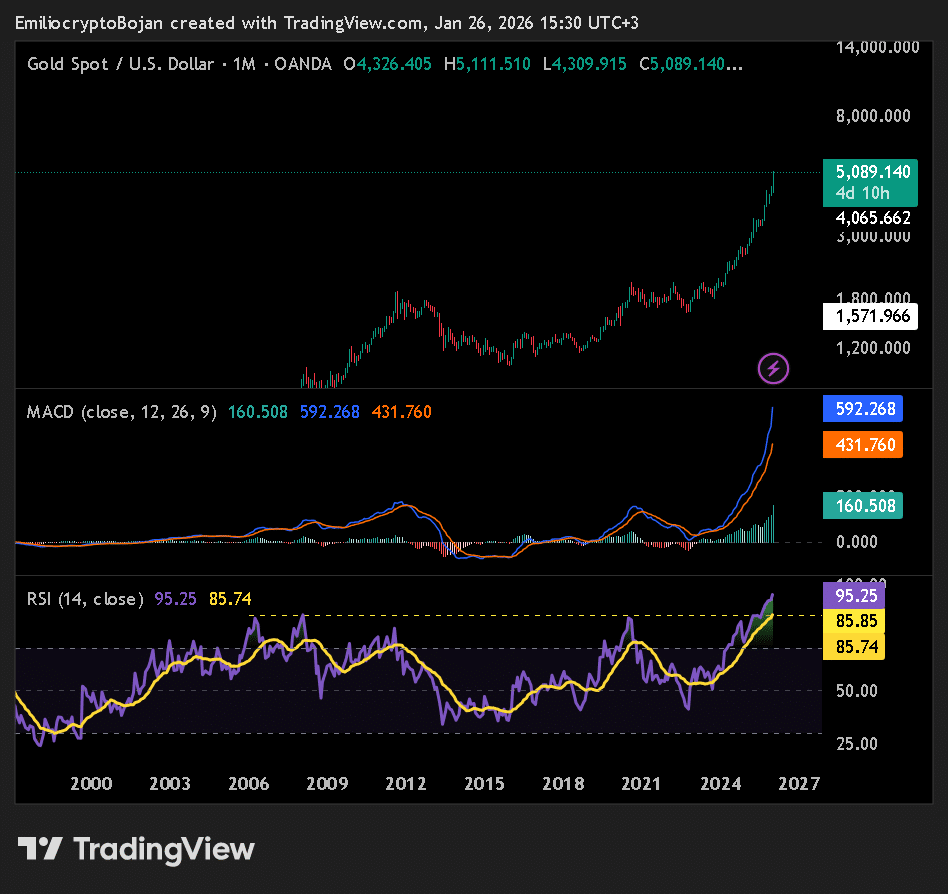

As crypto liquidity thinned, investors increasingly sought refuge in traditional assets.

At press time, gold traded just below its all-time high near $5,100, with momentum indicators showing strong bullish conditions despite overbought readings.

Source: TradingView

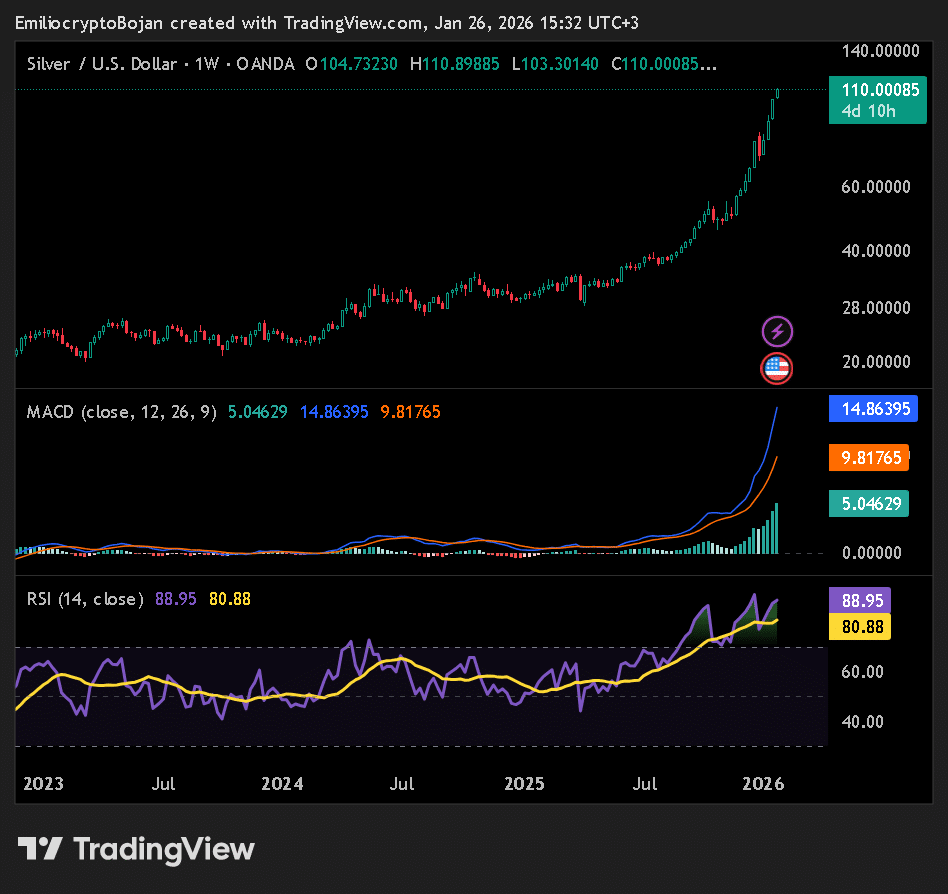

Silver also reached a fresh all-time high near $110 on the 26th of January, supported by sustained buying interest and elevated momentum.

Source: TradingView

The contrast was clear. While precious metals attracted inflows as perceived stores of value, crypto assets struggled to stabilize amid declining liquidity and risk appetite.

Regulatory pressure adds to stablecoin strain

Stablecoins also faced mounting regulatory scrutiny during this period. Rising compliance costs and tightening oversight placed additional pressure on issuers, particularly smaller players with limited resources.

This environment contributed to reduced issuance and weaker confidence in stablecoin growth, reinforcing the liquidity contraction. Without regulatory clarity and scalable compliance frameworks, stablecoin expansion remained constrained.

For crypto markets, the implications were straightforward. Stablecoin growth is closely tied to on-chain activity and capital flows. Until confidence improves and liquidity conditions stabilize, risk assets across the sector may continue to face headwinds.

Final Thoughts

- Stablecoins act as on-chain liquidity. When supply contracts, capital available for trading and speculation shrinks, weakening price support across Bitcoin and altcoins.

- Investors are rotating into traditional safe havens like gold and silver, which have attracted strong inflows amid rising risk aversion.