Bitcoin price dipped below $88,000 on Monday, reflecting continued weakness in the cryptocurrency market.

This downward trend was a part of a bigger fall in the crypto market in general, as the entire crypto market fell by almost 1% in the last 24 hours.

Ethereum price also declined, reaching $2,880, and Solana, XRP, and Cardano also incurred losses. Bitcoin price positions valued at more than $154 million were liquidated, mostly to long traders.

Meanwhile, Gold soared high as it hit an all-time peak of over $5,000. The crypto market loss of 6.64% over the week exemplifies continued risk aversion in investors due to increased volatility.

Gold Price Soars to $5,045, Setting New Record Amid Rising Global Uncertainty

Gold price surged to an unprecedented $5,089 during Monday’s early Asian trading, setting a new all-time high. The trend of investors shifting towards safe-haven assets is increasing with the rising global tensions in geopolitics and economic instability.

Such a historic protest demonstrates the growing questions of the independence of the U.S. Federal Reserve and its future monetary policy orientation.

The demand of gold has increased, and the market mood has changed toward more dangerous financial resources. According to analysts, the positive trend might persist, and the Gold price could go as high as $5,100 in case the momentum remains bullish.

The gold increase points to the skittishness of investors in the volatile international environment. The Bitcoin prices, on the contrary, have assumed a negative trend, indicating a bearish mood of the market. The trend of gold is also upbeat with the increasing risks in the world.

Bitcoin Price Faces Downturn Amid ETF Outflows, Political Tensions, and Legislative Delays

Bitcoin’s price has taken a hit recently, weighed down by multiple economic and political developments. The biggest trigger was the exit of Coinbase to support the CLARITY Act, a significant crypto regulation bill undergoing discussion in Congress.

The change compromised investor trust and questioned frozen regulatory predictability in the US.

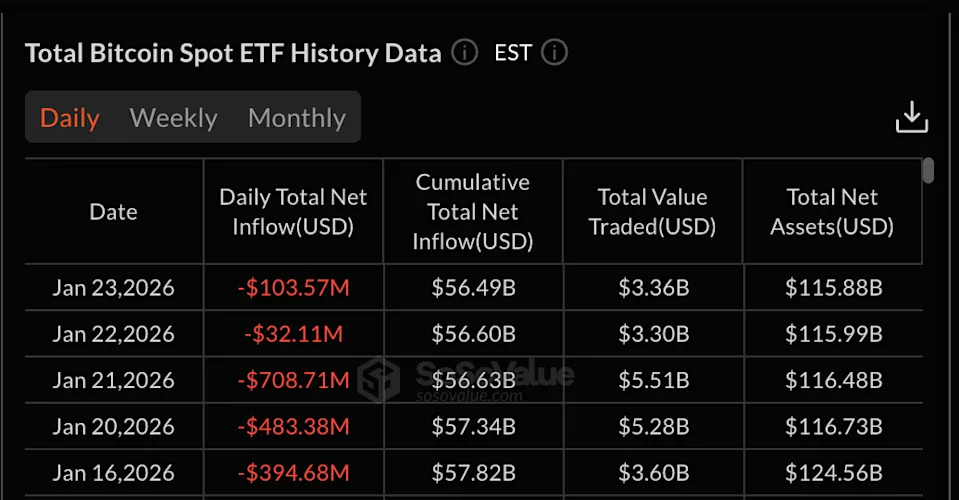

In the meantime, institutional investors appear to be withdrawing. U.S. spot Bitcoin ETFs had net withdrawals of 1.33 billion between January 19 and January 23.

Spot ETFs have not been left behind either, and they lost $611 million in the same period. There was a redemption of $432 million in the ETHA of BlackRock.

To further destabilize market confidence, former President Donald Trump put in place a threat to impose 100% tariffs on Canadian goods.

His remarks associated Canada with a so-called backdoor agreement with China, which caused the geopolitical tensions. Consequently, close to $100 million passed out of the crypto market.

The CLARITY Act remains pending in Congress, and there is uncertainty about it with the fears of another U.S government shutdown on the increase.

All traders are now anticipating a congested economic schedule this week, which features the Fed GDP report, liquidity injections, and interest rate decisions, as well as several speeches. These crypto events to watch are likely to give a strong impact to the market sentiment.

Will BTC Price Recover This Week?

The latest BTC price crashed, sliding under the key $90,000 level, raising concerns about continued bearish control in the short term.

Bitcoin price is now at $87,911, after a consistent fall following its recent high of about $95,500.

The Relative Strength Index (RSI) has marginally recovered to 40.75, with the index still below the neutral. The MACD remains with bearish momentum. The MACD line is lower than the signal line.

In case the BTC price falls below the point of $86,000, the following possible support is at approximately 84,000. On the positive side, the closest resistance is at the immediate $90,000, and then the stronger resistance is at about $92,000. To avoid further decline, bulls have to regain such levels.

Source: https://coingape.com/markets/bitcoin-price-prediction-as-gold-breaks-all-time-high/