- Gold leading while BTC consolidates signals a bullish setup, Swissblock says.

- Gold extends a 28-month parabolic move, according to Ash Crypto.

- Silver hit a new all-time high of $101 this week.

Gold and silver extended gains this week while Bitcoin traded sideways. Market analysts point to a growing divergence between precious metals and Bitcoin. Historical data shows Bitcoin follows metals with a delay during macro shifts.

Swissblock Identifies Gold as a Leading Indicator

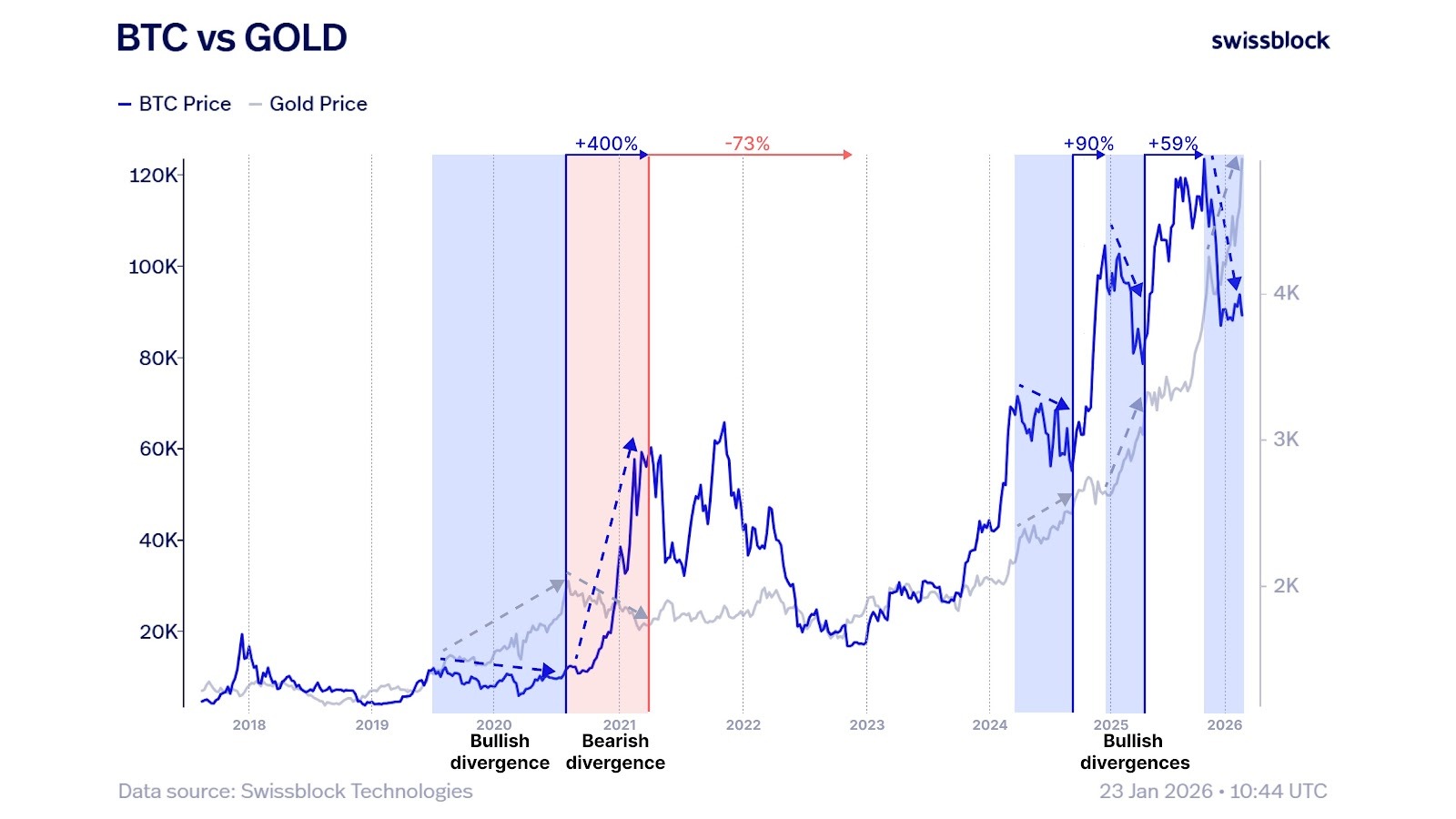

Private wealth manager Swissblock Technologies said gold continues to act as a leading signal for Bitcoin’s price behavior. In a post on X, the firm described gold as a “spoiler alert” for Bitcoin, citing historical patterns in which movements in gold preceded major shifts in the crypto market.

According to Swissblock, a bullish divergence forms when gold rallies while Bitcoin remains suppressed. This lead-lag relationship has often acted as a buildup phase, followed by sharp Bitcoin advances. Swissblock cited the 2020–2021 cycle, when a similar divergence preceded a Bitcoin rally of about 400%.

The firm also highlighted the opposite signal. When Bitcoin continued rising while gold weakened, the divergence often marked liquidity exhaustion. During the 2021 cycle, that decoupling preceded a roughly 73% Bitcoin drawdown after the market peak.

Interestingly, Swissblock mentioned that the current setup remains bullish. Gold continues to push higher, while Bitcoin consolidates rather than breaking away. For context, Bitcoin trades at $89,538, a 6% decline in the past week, reducing its monthly gain to 2.1%.

Earlier analysis from Ash Crypto echoed the broader divergence narrative. The analyst said gold has been in a parabolic move for 28 months, highlighting the metal’s sustained advance during the current cycle. He added that Bitcoin’s delayed response could lead to a sharp catch-up rally.

Silver Surges to Record High

Silver added another signal to the broader macro picture. Prices reached a new all-time high of $101 yesterday, marking months of steady gains followed by a sharp acceleration.

Market data shows silver has outperformed Bitcoin in ROI in the past five years. The move reflects increased demand for defensive assets amid rising global uncertainty.

Geopolitical tensions, including renewed trade disputes and unresolved conflicts in Europe and the Middle East, have driven investors toward traditional stores of value. Concerns over U.S. fiscal sustainability and rising government debt have also weighed on risk appetite.

During periods of heightened uncertainty, capital typically flows first into traditional safe havens. Bitcoin often moves later, once concerns shift from immediate risk toward currency debasement and liquidity expansion.

For now, gold and silver continue to lead. Bitcoin remains range-bound, leaving markets focused on whether history repeats in the months ahead.

Related: Trump’s Tariff Reversal Weighs on Gold, Fuels Bitcoin Volatility

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/why-golds-rally-could-be-setting-up-bitcoins-next-big-move/