Solana price remains steady above $127 following a week of consolidation, despite facing recent bearish pressure in the crypto market. The SOL token has undergone steady selling pressure, yet it still attracts robust institutional demand.

Bitcoin price is hovering around $89,000, and Ethereum price is trading around the $2,950, and the market is showing encouraging signs of recovery. Nevertheless, the crypto market is not that certain as the Senate suspends its sessions on Monday to mark up the crypto bill.

Solana ETF Inflows Exceed $11 Million, Outperforming Bitcoin and Ethereum

Solana (SOL) has recently experienced a surge in institutional interest, as shown by the latest ETF data. In the last week, Solana ETFs recorded over $11 million net inflows. This number exceeded the accumulated inflows of Bitcoin (BTC) and Ethereum (ETH) ETFs during the same time.

The biggest sources of this influx are institutional heavy weights such as Fidelity, Grayscale, and Bitwise. The Solana ETF (FSOL) of Fidelity was the first entrant with an inflow of $9.85 million within a day. This increased the cumulative inflows of FSOL to about $148 million.

To date, Solana ETFs have a total net asset value of 1.08 billion. Solana has taken a net asset ratio of 1.50% in such ETFs.

Conversely, Bitcoin ETF recorded an outflow of 38.53 million, whereas Ethereum ETF recorded a decline of 64.86 million. This demonstrates the rising level of interest of institutional investors in Solana.

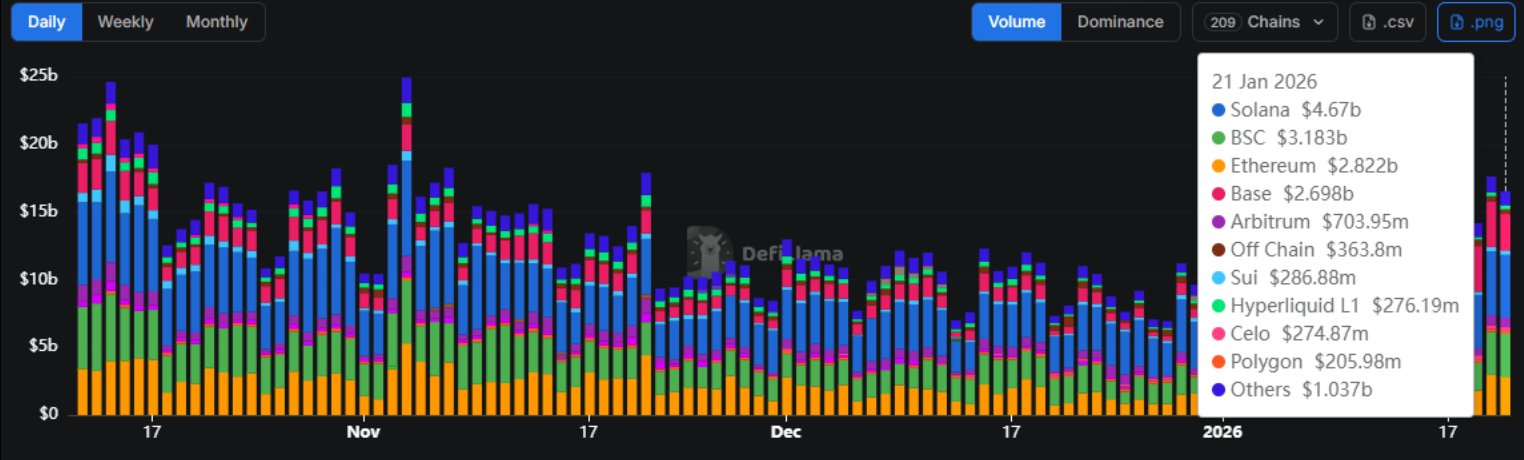

Solana Takes the Lead in DEX Volume, Showing Strong Growth

Solana price has recently demonstrated a massive surge in decentralized exchange (DEX) volume. According to Sosovalue data, Solana recorded the highest DEX volume of 4.4 billion in 24 hours as compared to any other blockchain, which stood at 1.6 billion.

Such an impressive achievement puts Solana at the top of all blockchain networks, which implies that considerable expansion is possible in the future.

The trading activity began to exceed the other leading players, such as Binance Smart Chain (BSC) and Ethereum, which posted $318 billion and $282 billion, respectively. This performance is so high that many professionals think that even more significant progress of Solana is expected.

Solana Price Prediction: Key Levels To Watch

The SOL price crashed to $127, continuing its downtrend from recent highs above $130. The Relative Strength Index (RSI) fell to 39.35, which indicates that it may be weak and is approaching the oversold area.

The overall negative sentiment is also expressed by the Moving Average Convergence Divergence (MACD), which is at 0.30. The traders will be monitoring any form of reversal indicators in case the price can recover out of this range.

Resistance is expected near the $130 and $140 levels. A break above $150 would likely signal a return of bullish momentum for the Solana long-term prediction, but for now, caution is advised as SOL remains under pressure.

In the future, the support is likely to be about the $120, and it may continue to sell, and then the Solana price may reach to $110.