Bitcoin’s price has delivered an underwhelming performance in recent sessions, with the crypto entering another consolidation phase between $88,000 and $91,000 – A range it previously broke out of.

Debate over whether the market has entered a broader bearish phase has resurfaced, with data points supporting both sides. Several structural and on-chain factors remain in play and are likely to shape Bitcoin’s next major move.

Investor profitability remains central

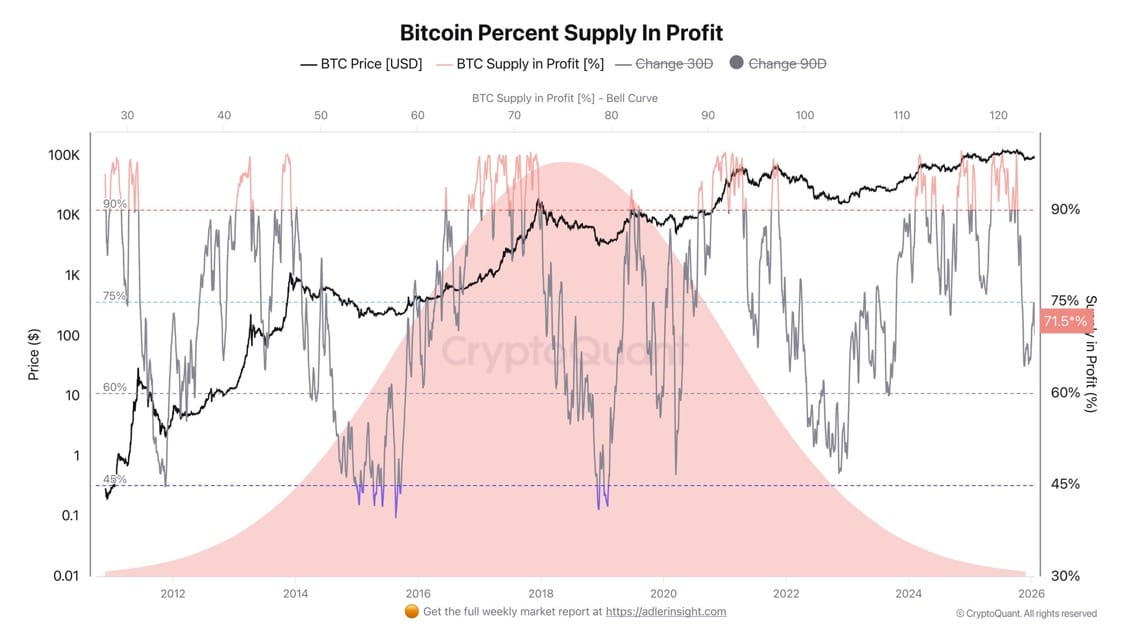

Bitcoin’s [BTC] near-term stability appears increasingly tied to market structure, particularly the share of supply held in profit. Analysts often describe this condition as latent profit – A scenario in which investors are more inclined to hold, rather than sell.

According to CryptoQuant, such an environment typically emerges when at least 75% of Bitcoin’s circulating supply is in profit. At that level, investor sentiment tends to stay constructive, reducing the likelihood of heavy sell pressure.

Source: CryptoQuant

While Bitcoin briefly moved into this zone, the metric has since declined to 71.5% of supply in profit. A sustained drawdown could increase downside risk, potentially pushing the price towards the lower $80,000 range.

That said, the path to a rebound remains intact. A recovery back towards the 75%–80% supply-in-profit range would likely restore relative stability and support a sustained upward trend.

Commenting on the setup, on-chain analyst Darkfost said the market “should be able to stabilize and build a much stronger foundation for a genuine bullish recovery.”

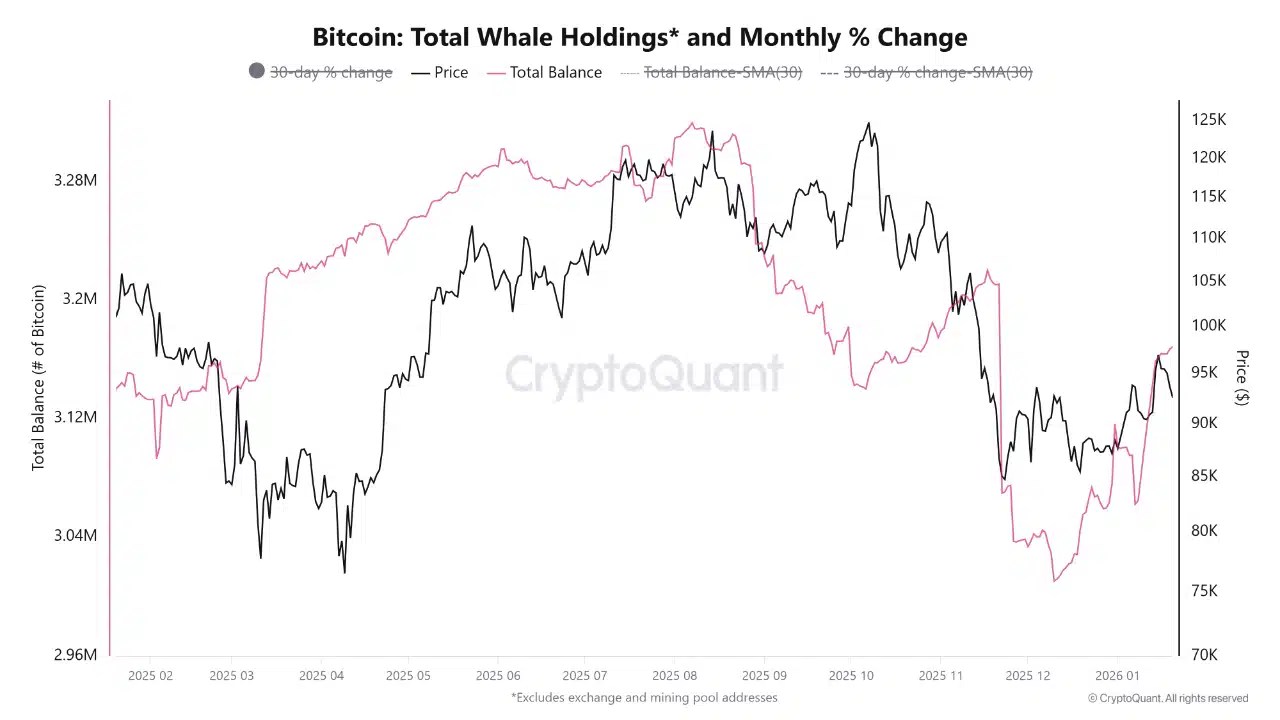

Whales step in as retail exits

Whale conviction has remained strong—and appears to have strengthened—despite heightened volatility so far this January.

Retail investors, who typically hold smaller Bitcoin positions and operate on shorter time horizons, have continued to sell into weakness. Whales, on the contrary, have taken the opposite approach.

These large holders, which control a meaningful share of Bitcoin’s supply, can influence broader market direction. In fact, data revealed that the monthly hike in whale holdings has climbed to its highest level since early January – Underscoring sustained accumulation. At the time of writing, whale balances stood near 3.2 million BTC.

Source: CryptoQuant

This also seemed to align with rising inflows into accumulation addresses, confirming that a segment of these large holders may be active buyers.

Taken together, it can be argued that some investors view current price levels as an opportunity to accumulate Bitcoin at a perceived discount. It can also mean they are positioning for a continuation of the broader uptrend.

Long-term holders remain unfazed

Finally, long-term holders’ actions seemed to be consistent with whale behavior too.

The Binary Coin Days Destroyed (CDD) metric, which ranges from 0 to 1, helps track whether long-held Bitcoin is being moved. Readings closer to 1 typically indicate greater activity, often associated with selling, while a reading near 0 means long-term holdings remain dormant.

Source: CryptoQuant

Right now, the Long-Term Holder Binary CDD remains at 0, signaling that these investors continue to hold their positions and maintain a long-term outlook on the price.

For now, the combined behavior of whales and long-term holders suggests that only an additional 3.5% of Bitcoin’s supply would need to move back into profit to return the market to the 75% threshold. This is a level historically associated with greater stability and stronger price structure.

Final Thoughts

- Bitcoin’s supply in profit remains a critical indicator for assessing whether the market is slipping into a bearish phase or positioning for a renewed bullish move.

- While retail investors have continued to exit, whales have been increasing their exposure.

Source: https://ambcrypto.com/heres-why-bitcoins-bull-market-case-shouldnt-be-dismissed-just-yet/