The Federal Reserve’s meeting on January 27-28, 2026, is drawing considerable focus, with a key policy decision expected at 2:00 p.m. ET on January 28. The Chair will hold a press conference at 2:30 p.m. ET to discuss the decision.

The cryptocurrency market surged 1.37% in the last 24 hours following a minor market correction. Although it has fallen by 7.5% in the past week, the market has been on a positive trend in the past 30 days, indicating that investors are optimistic.

Jan 2026 FOMC Meeting: When and How to Watch

The FOMC meeting will span two days, with key events unfolding on January 27 and 28. The public will receive the most important update at 2:00 p.m.

On January 28, at the time that the Federal Reserve issues its official statement, Eastern Time (ET). This will outline the determination by the committee regarding the federal funds rate and give a general guide of the Fed regarding the economy.

In a few minutes, at approximately 2.30 p.m. ET, the Federal Reserve Chair will conduct a press conference. The Chair will provide a detailed description of the decision, covering the major economic considerations and responding to the questions of reporters.

This media conference can help in deciphering the future of the Fed. The wording employed and any minor indications regarding the future policy changes will be a good insight into the intentions of the Fed in 2026.

What to Expect for Crypto Market Ahead of the Fed Meeting

As the FOMC meeting approaches, market participants are focusing on the potential impact of the Fed’s decision on cryptocurrencies. In recent weeks, the crypto market has experienced some consolidation.

Bitcoin price hovered below $90,000, while Ethereum (ETH) remains steady at around $3,000. These other high-performing cryptocurrencies, such as XRP, Solana (SOL), Dogecoin (DOGE), Binance Coin (BNB), and Cardano (ADA), have followed the same pattern of consolidation.

The result of the FOMC session may impact the crypto market greatly. When the Federal Reserve decides to leave interest rates steady, it might indicate that riskier assets such as cryptocurrencies are safe.

Monetary policy stability has been considered to be beneficial to digital assets particularly during economic uncertainties.

Impact of Fed’s Decision on Risk Appetite for Crypto

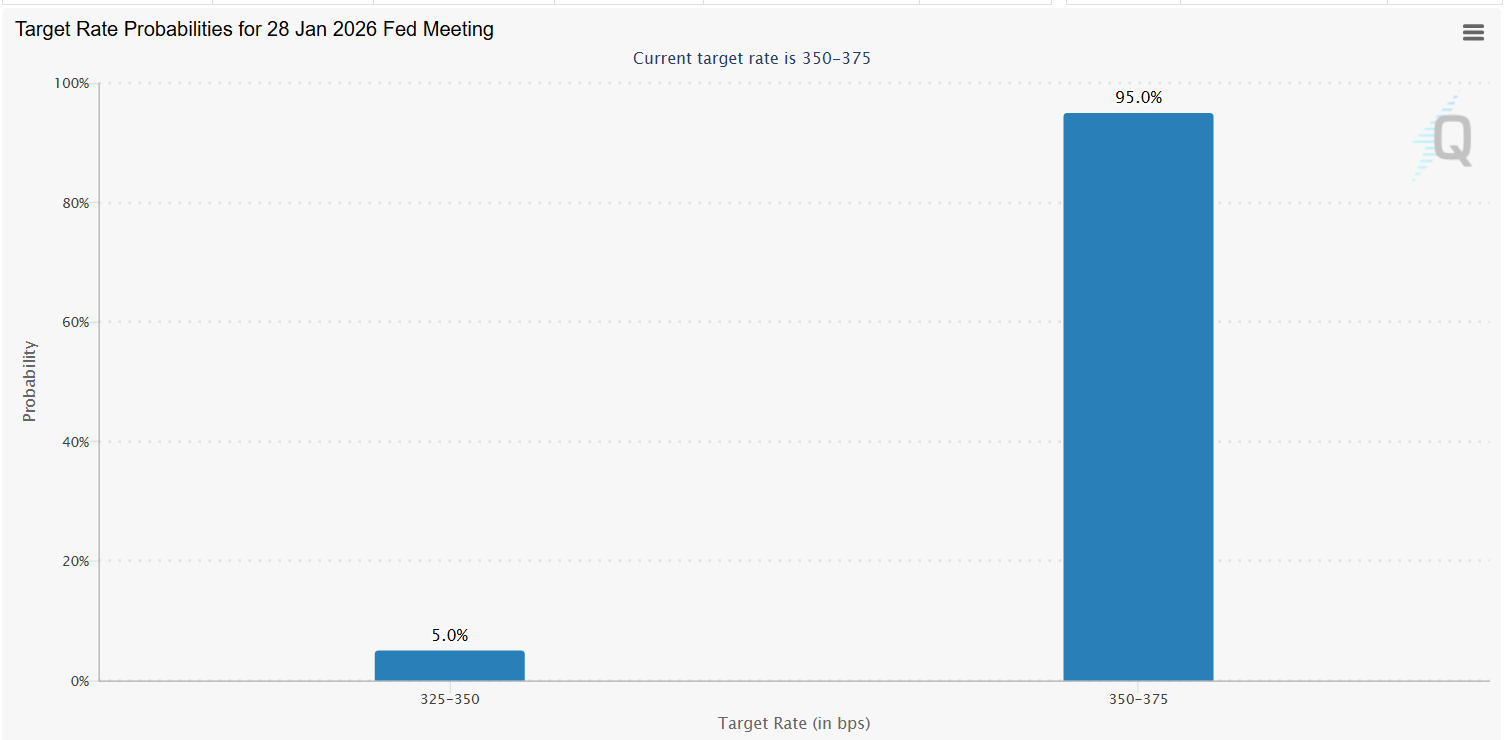

The CME FedWatch Tool currently shows a 95% chance that the Federal Reserve will pause rate cuts in January. This high anticipation of no short-term rate increases or decreases implies that the markets can anticipate a predictable economic climate.

Cryptocurrencies would have increased investor confidence. This would in turn stimulate more investment into the digital currency such as Bitcoin and Ethereum.

Nonetheless, certain future increases in the rates or constriction of policy may be signaled by the Federal Reserve, and it can lower the risk appetite. This may cause a fall in the prices of crypto assets. Increasing the rate of interest will reduce the appeal of speculative money, such as cryptocurrencies. Investors can also prefer common forms of investments like bonds or stocks.